UK Furniture & Flooring Sector Report summary

August 2024

Period covered: Period covered: 30 June – 27 July 2024

3 minute read

Furniture & Flooring slipped to the bottom of growth rankings in July, with a year-on-year decrease of xx%. Key factors impacted this performance:

Modest Economic Growth

The UK economy showed modest growth in Q2 2024, with GDP increasing by xx%, following a xx% rise in Q1. Monthly GDP, however, remained flat in June due to wet weather hampering performance.

Consumer Confidence and Spending Priorities

Consumer confidence showed a slight improvement in July but remained in negative territory at -13 (GFK). The Major Purchase Index at -16 highlights continued consumer hesitancy towards making large purchases amid ongoing economic and political uncertainties.

Subdued housing activity

Mortgage rates remained elevated at 5.25% in July, keeping pressure on borrowing costs, and impacting the affordability of making large Furniture & Flooring purchases.

More households are being engulfed by a step up in mortgage and rental costs. About one-third of mortgage holders are still on rates below xx%, but most deals are set to expire by 2026, pushing them to higher interest payments (Bank of England).

Delayed home projects

A harsh economic backdrop is discouraging consumers to undertake large home improvement projects that may otherwise entice Furniture & Flooring spending. Across the wider home improvements and DIY category, spending was down by xx% in July compared to the previous year (Barclays).

Steady footfall

Retail footfall across destinations edged up 0.5% YoY in July. However, retail parks – the home of Furniture & Flooring retailers – faced weaker footfall, down xx% (MRI Software).

Prioritisation of experiences

Post-pandemic, there’s been a marked preference for spending on experiences such as travel and hospitality rather than non-food retail. Spending on non-essential items declined further in July, dropping by 0.7% compared to a 0.5% decrease in June (Barclays), as 48% of consumers looked to reduce discretionary spending, up from 46% the previous month.

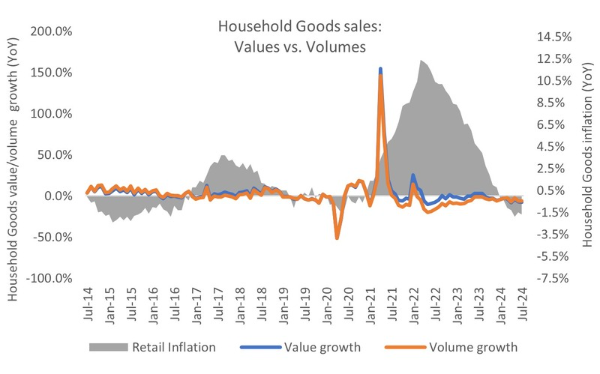

Deflation and competitive pricing

The Furniture & Flooring category continued to experience deflation, with shop prices at Household Goods stores down 1.7% YoY in July (ONS). It means Household Goods retailers have been experiencing deflation for the past seven months. Cautiousness and price sensitivity are leading consumers to increasingly seek discounts and deals for big-ticket purchases..Take out a FREE 30 day membership trial to read the full report.

Take out a FREE 30 day membership trial to read the full report.

Deflation throughout 2024 amid weak demand

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis