UK Health & Beauty Sector Report summary

August 2024

Period covered: Period covered: 30 June – 27 July 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health and Beauty sales

Health & Beauty sales rose by xx% YoY in July, compared to xx% growth in July 2023, according to the Retail Economics Retail Sales Index.

The Health & Beauty sector remains the fastest-growing in UK retail, and one of only three sectors to see year-on-year growth in July.

Several key factors influenced this performance:

Holidays abroad: Holidays remain a key spending priority for households, as consumers look to escape the unpredictable UK weather and enjoy overseas experiences missed during the pandemic. Strong travel demand is boosting Health & Beauty sales, particularly in fragrances, suncream, and personal hygiene products.

COVID-19 cases: An uptick in COVID-19 cases and summer colds has supported spending on health-related products. Sales of cough lozenges were up xx% YoY in July, as increased social gatherings and cooler-than-average temperatures fuelled a rise in cases.

Summer sales: As they look to stimulate spend, many retailers are passing on softer input prices to consumers via promotions, resulting in deflation across some areas of non-food retail. Amazon’s UK Prime Day (July 16-17) was its busiest ever, with beauty and grooming among the top-selling categories during the sales event.

Improving personal finances: As inflation returns to ‘normal’ levels, earnings growth is now outpacing price rises, supporting a recovery in discretionary incomes for many households.

Gen Alpha spend big on beauty

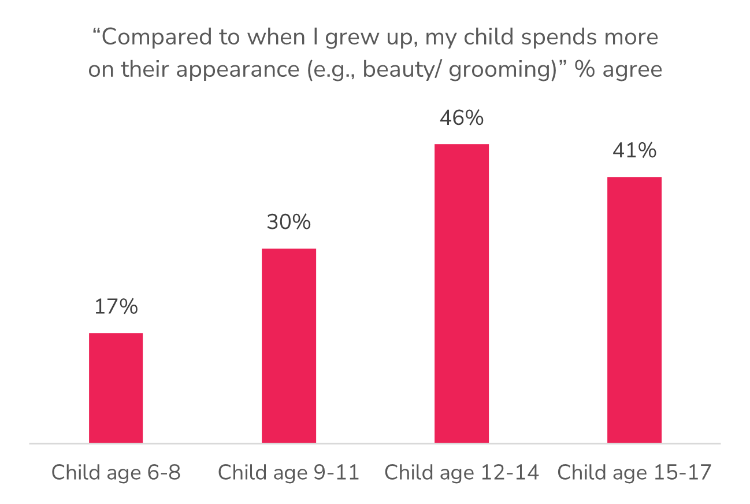

Our latest report, "Tomorrow’s Consumer," explores UK children's spending habits, based on insights from 8 million card transactions by children aged 6-17, provided by HyperJar—the popular prepaid debit card and money management app.

The findings reveal the significant contribution of Generation Alpha to the current beauty boom in UK retail, with Boots and Superdrug both among the top 15 UK retailers by child spending.

After accounting for new customers, HyperJar’s transaction data shows substantial increases in children's spending at leading beauty retailers over the past 12 months: Boots up by xx%, Superdrug by xx%, and Sephora by an impressive xx%.

Take out a FREE 30 day membership trial to read the full report.

Our latest research shows evidence of youth-driven beauty boom

Source: Retail Economics, HyperJar

Source: Retail Economics, HyperJar