UK Health & Beauty Sector Report summary

July 2024

Period covered: 26 May – 29 June 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health and Beauty sales

Health & Beauty sales rose by xx% YoY in June, against a tough comparative rise of xx% in June 2023 according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

The category remains an outperformer in retail and one of only two categories to record growth in June.

Performance was influenced by several key drivers:

Seasonal boost: Health & Beauty sales accelerated in June, driven by summer holiday preparations, gifting for Father’s Day, and major events such as Glastonbury and Taylor Swift’s Eras Tour.

Holidays prioritised: Holidays have become an almost non-negotiable spend for households this year, as consumers seek to escape the lacklustre UK weather and enjoy travel experiences missed during the pandemic. This focus on holidays is supporting Health & Beauty sales, notably for fragrances, suncream, and personal hygiene products.

Cooler weather: June was wetter and cooler compared to last year’s record temperatures, impacting seasonal sales and dragging on footfall. However, Health & Beauty sales are less weather-sensitive than categories like Clothing (xx%) or DIY & Gardening (xx%), which were hit harder in June.

Improving finances: Personal finances are improving as inflation returns to target and real wage growth strengthens. Yet, for luxury and big-ticket items, many households remain cautious, adopting a ‘wait and see’ approach in June as the run-up to a general election created uncertainty.

Social Commerce- £16bn Opportunity:

Long-term trends such as interest in personal wellness and viral makeup and skincare videos continue to positively impact the Health & Beauty market, with social commerce – the integration of social media and e-commerce - becoming an increasingly important sales and marketing channel for brands.

The social commerce industry in the UK is forecast to more than double over the next five years, rising from £7.3 billion to almost £16 billion by 2028, according to research by Retail Economics and TikTok.

This would see social commerce account for xx% of total online sales, up from xx% today, and growing at four times the rate of overall ecommerce sales.

More than xx (xx%) of UK users have made a purchase directly through social media, either by clicking a link on shoppable content, or checking out directly within an app. This rises to almost xx (xx%) for those under 45, with xx (xx%) Millennials purchasing via social media at least once a month.

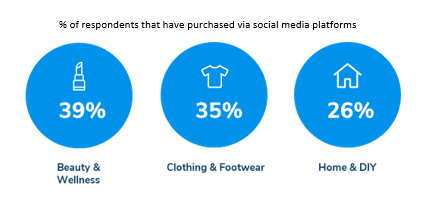

Beauty is the most shopped social commerce category, with more than a xx of UK adults having purchased a beauty product directly on social media.

Take out a FREE 30 day membership trial to read the full report.

Online basket abandonment rate by retail sector

Source: Retail Economics, TikTok

Source: Retail Economics, TikTok