UK Health & Beauty Sector Report summary

November 2023

Period covered: Period covered: 01 - 28 October 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty Sales

Health & Beauty sales rose by xx% YoY in October, against a xx% rise a year ago, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Despite a slight slowdown in growth, it remained the strongest non-food category, underscoring the sector's robustness and sustained consumer interest amid the weak consumer backdrop.

Performance was influenced by several key drivers:

Easing inflation (+/-): Annual inflation fell to xx% in October from 6.7% in the previous month, surprising both the Bank of England (BoE) and economists who had predicted a 4.8% reading. This marked the sharpest drop since xxxx xxxx.

However, some Health and Beauty products continued to experience higher inflation levels than the headline rate including liquid soap (xx%), deodorant (xx%), liquid foundation (xx%) and mascara (xx%), according to the ONS.

Weather disruptions (-): The first half of October featured a stark north-south weather divide in the UK. While England and Wales enjoyed unusually warm and sunny conditions, with the 7-10th the warmest October spell since 2011, Scotland faced heavy rain (6-7 October), marking its wettest two-day period on record.

The latter half of the month saw widespread flooding and record-breaking rainfall in eastern Scotland, with England and Wales also experiencing their third-wettest 3-day period on record from storm Babet.

In-store performance weakened, with footfall across retail destinations falling by xx% YoY in October, the first annual decline since xxxx xxxx (MRI Software).

Travel (+): Spending on travel remained elevated in October, rising by 10.5% YoY (Barclaycard), as consumers looked to book winter holidays as temperatures cooled closer to home. While this may be impacting spending in some parts of the retail sector, increased travel spend supports the health and beauty segment.

Record pay growth (+): Latest data on earnings growth showed regular pay rose at 7.7% between July and September, compared to a year earlier, still close to record pace.

However, official figures showed that wage rises are starting to slow in some industries, notably construction and hospitality which are particularly sensitive to an economic slowdown.

'Fragrance effect'

Retailers in the category continue to see ‘the fragrance effect’ as customers want small indulgences during tough economic times – akin to ‘the lipstick effect’ during the financial crisis, shunning big-ticket items amid squeezed household budgets.

Take out a FREE 30 day membership trial to read the full report.

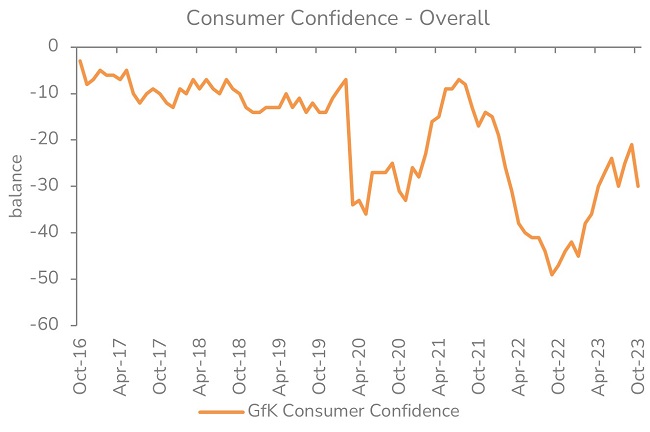

Consumers cautious at start of golden quarter

Source: GFK

Source: GFK