UK Homewares Sector Report summary

August 2024

Period covered: Period covered: 30 June – 27 July 2024

3 minute read

Homewares sales

Homewares sales grew by xx YoY in July amid a deflationary environment, according to the Retail Economics Retail Sales Index.

Incomes up amid low confidence

Homewares sales have improved over the past three months, driven by a gradual recovery of discretionary incomes among typical households. This has been driven by a combination of strong wage increases and recent adjustments to National Insurance Contributions.

Consumer confidence improved by just one point from mid-June’s -14 to -13 in mid-July (GfK). Cautiousness is having an acute impact on big-ticket retail spending. Households are prioritising saving over spending on major purchases (GfK’s Savings Index rose five points to +27 in July versus the Major Purchase Index at -16).

Housing impact

Non-essential budgets are being impacted by a step-up in mortgage and rental costs. About a third of households with mortgages (c.3 million mortgage holders) are still paying rates of less than 3%, with most of these deals expected to end by 2026, shifting mortgagors to higher rates (Bank of England).

Price cuts

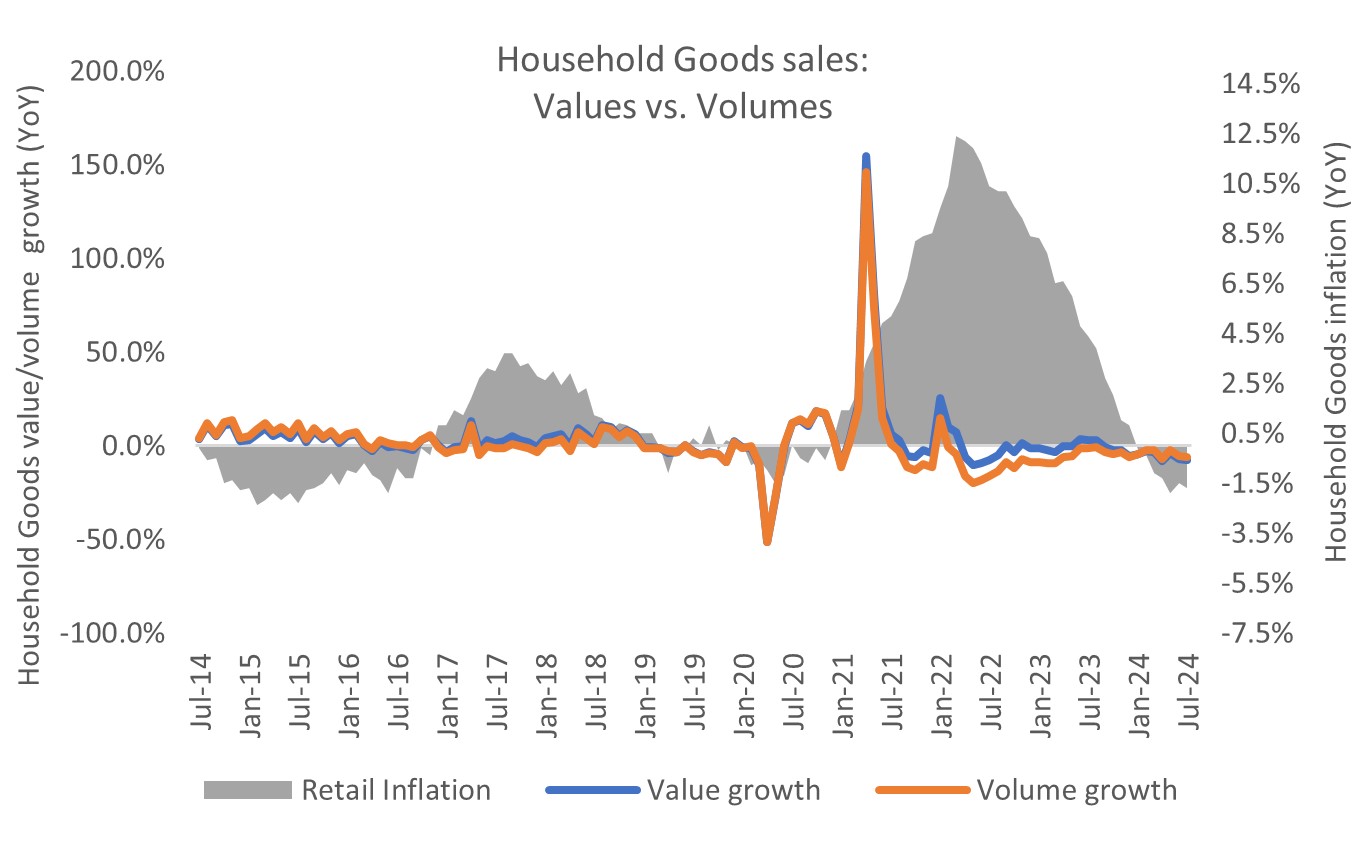

When consumers are spending on Homewares, they’re typically sprucing existing homes as prices decline. The retail sales deflator (a measure of inflation specific to retail) among Household Goods has experienced deflation throughout 2024, with prices down xx% YoY in July. This includes Homewares giant Ikea promoting price reductions this year.

Sporting support

Declining prices supported sales among households sprucing up homes ahead of gatherings, with July dominated by major sporting events. The Euro 2024 final on 14 July, where England faced a narrow defeat to Spain, captured the attention of xx million viewers, marking a record for this year.

Steady footfall as online under pressure

However, sports supported gatherings outside of the home too. Pubs and bars saw a xx% YoY increase in spending, the highest since January (Barclays). This concentrated footfall to high streets (+2.4% YoY in July) during sporting events in early July and warmer weather later in the month (MRI Software). But retail parks, where many Homewares retailers set up shop, faced weaker footfall, down by 0.2% in July.

Summer priorities

A reprioritisation of non-essential spending towards travel and experiences this summer has weakened intentions to spend on home-related categories in the short term. Spending on travel grew by xx% YoY, with travel agents up 6.6% (Barclays), reflecting a strong demand for international getaways.

Household Goods faces seventh month of price declines

Source: Retail Economics, ONS, seasonally adjusted

Source: Retail Economics, ONS, seasonally adjusted