UK Homewares Sector Report summary

December 2023

Period covered: Period covered: 29 October – 25 November 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales fell by xx% YoY in November, according to the Retail Economics Retail Sales Index.

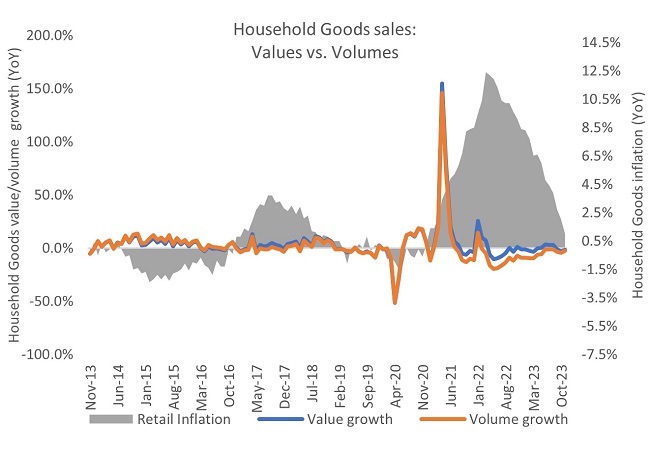

ONS data shows the wider Households Goods category faced xx% YoY shop price inflation in the month, pointing to a decline in sales volumes.

ONS data shows sales volumes in the wider Household Goods category fell by xx% YoY in November.

Tough macroeconomic conditions

Homewares sales volumes remained in decline in November as cost-of-living pressures stopped consumers from spending on non-essential household goods.

Although inflation eased to 3.9%, the Bank of England’s 2% target is unlikely to be reached before 2025.

In addition, the easing in price rises has been driven by falling fuel prices rather than retail prices, while food inflation remains only marginally below double digits.

However, strong earnings growth and a slight easing of mortgage rates came together with easing inflation to push consumer confidence up by eight points over the course of November and December to -22 (GfK)

It should nonetheless be noted that the measure remains firmly in negative territory and will be subject to further volatility in the months to come.

Sales of homewares and smaller household goods were more resilient than big-ticket counterparts such as furniture in November, but were still subject to considerable cut-back.

Housing market cools

House prices fell 1.0% YoY in November (Halifax) but rose by 0.5% on a monthly basis.

The monthly increase can be attributed to falling inventory levels as potential sellers delay putting their properties on the market.

Analysing ONS provisional estimates suggest property transactions fell by xx% YoY in November (non-seasonally adjusted), revealing the extent of the market slowdown.

Although cooling in the property market has traditionally spurred on ‘improve not move’ home purchases, a combination of high living and borrowing costs, as well as a negative wealth effect arising from months of falling property values, is curtailing purchases of household goods as an alternative to moving.

That being said, homewares and smaller household goods, particularly festive and essential winter products saw more resilient sales than big-ticket items in the furniture and home improvements sectors.

Take out a FREE 30 day membership trial to read the full report.

Inflation is easing but volumes remain in decline

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis