UK Homewares Sector Report summary

February 2024

Period covered: Period covered: 31 December 2023 – 27 January 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales fell by xx% YoY in January, according to the Retail Economics Retail Sales Index.

ONS data shows the wider Households Goods category faced flat YoY shop price inflation in the month, with sales volumes falling by xx% YoY in January.

Tough macroeconomic conditions

Homewares sales volumes fell in January as the sector found itself in competition with several other sectors for households’ discretionary spending.

Homewares nonetheless performed the best out of the three home-related categories in January, as consumers were able to commit more easily to purchases of smaller and cheaper products.

Consumer confidence improved in January, with GfK’s overall measure rising three points to -19. This reflects easing price rises, with consumer price inflation remaining at 4.0% in the month, below economists’ expectations.

However, consumers remained cautious with their discretionary spending, which they chose to spread out across areas beyond retail.

Housing market is a mixed picture

UK house prices rose on both an annual (xx%) and a monthly (xx%) basis in January, according to Halifax.

This reflects growing buyer confidence, with indicators for buyer enquiries, agreed sales and new instructions all improving in the month.

However, market activity is still soft, with confidence among buyers continuing to be tempered by macroeconomic uncertainty, and low inventory levels as homeowners hold off from selling.

Market conditions are particularly tough for younger, aspiring classes, including mortgagors ladened with debt and private renters.

Households renewing fixed-rate mortgages this year are expected to face an average increase in repayments of £xx per month.

Private renters continue to face steep price rises, with market conditions at risk of further deteriorating as owners of rental properties on mortgages either pass costs on to tenants or sell properties to reduce exposure.

With mortgagors and private renters making up around xxxx of UK households, room for spending on discretionary household goods is tight.

Take out a FREE 30 day membership trial to read the full report.

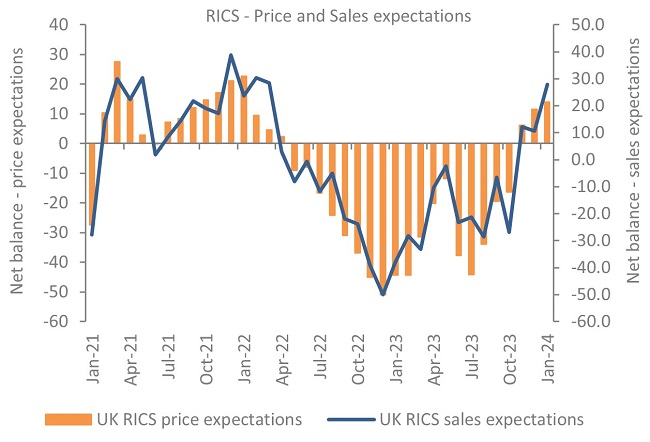

Prices and sales expectations improve

Source: RICS

Source: RICS