UK Homewares Sector Report summary

July 2024

Period covered: 26 May – 29 June 20243 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales grew by xx% YoY in June, according to the Retail Economics Retail Sales Index.

Homewares was once again the top-performing household goods sector in June, compared to figures of -xx% for Furniture & Flooring and xx% for DIY & Gardening.

Rainy day funds: Households continue to perceive now as a good time to save (GfK’s Savings Index rose xx points to xx in July), impacting willingness to splash out on retail goods for homes, following a pandemic boost during lockdowns.

Home moves under pressure: Interest rates held at xx% in June constraining housing market activity, impacted by higher mortgage rates compared to decade lows before the start of the Bank of England’s rate-hiking cycle at the end of 2021.

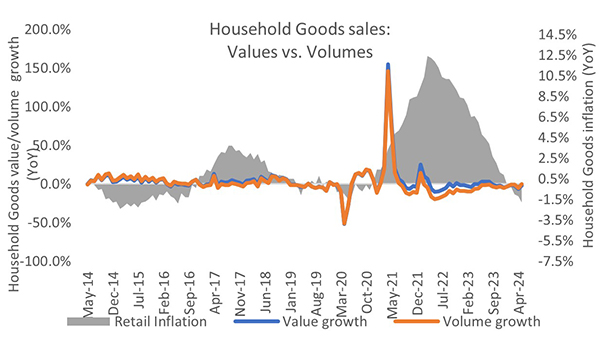

Deflation despite Red Sea disruption: Promotional activities and price cuts have helped to support sales amid a shuffle in spending priorities. Homewares is going through a period of deflation, with lower prices supporting sales (Household Goods prices down xx% YoY in June, ONS).

However, efforts could be undermined by Red Sea challenges, including shipping disruption, putting pressure on home-related retailers producing textiles and accessories in the East.

Improving personal finances: Positively for Homewares into the autumn, take-home pay among typical UK households has been bolstered by recent cuts to National Insurance Contributions and robust earnings growth (real terms annual growth for regular pay was xx% in the quarter to May, ONS). This has seen cash available for non-essential purchases rise by about £xx per month compared to last year (Retail Economics).

Cyber risk

The retail industry continues to face waves of disruption, including from a global pandemic to a cost-of-living crisis.

A concern for retailers going forward is the growing risk of cyber security issues disrupting operations and cash flow – such as ransomware, malware attacks, network security or fraudulent attempts to obtain sensitive information. More than xx (xx%) of retailers consider it a top three risk for the year ahead.

Carpetright filed a notice of intention to appoint administrators in July as it tries to secure extra funding with PwC. The retailer currently has 300 stores and over 3,000 employees. Among weak spending impacting finances, the retailer pointed to restructuring plans being hit by a slump in April trade caused by a cyber-attack.

Attacks remain rare, but the potential for severe disruption is high. Retailers believe it is an area being managed, with xx retailers (xx%) believing they were either “where they needed to be” or “ahead” of the competition regarding cyber security issues.

While retailers feel prepared to tackle the rising threat of cybercrime, they must remain alert and continue to invest to safeguard operations.

Take out a FREE 30 day membership trial to read the full report.

Household Goods faces fifth month of price declines

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis

Need insights from our latest report?

UK Homewares Sector Report: January 2025

Access this report with a FREE 30 day subscription trial!

- Homewares Market Share - Top 10 Homeware retailers

- Homewares Market Size estimates by category (£m)

- Sales Growth by category

- Total Homewares Spending by category (£m)

- Online Household Goods Sales (y-o-y)

- Forecasts for 2024 - 2028

- Footfall by channel and region

- Regional Weather data and more…