UK Online Retail Sales Report summary

November 2024

Period covered: Period covered: 29 September – 26 October 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online performance

Online sales growth rose by xx% year-on-year (value, non-seasonally adjusted) in October, compared with a xx% rise in the same month last year.

Average weekly online sales totalled £xx, the highest since December 2023, as consumers increasingly turned to online shopping to make purchases.

This shift was reflected in the online penetration rate, which rose to xx%, surpassing the xx% recorded a year ago and marking the highest penetration rate since December.

Key factors impacting performance this month include, budget concerns, rising costs, mild and stormy weather, later timing of half term, promotional activity and Black Friday anticipation:

Budget Concerns: Speculation around the Budget’s content created uncertainty throughout the month with discussions about income tax band freezes contributing to a cautious consumer sentiment.

Rising Costs: Energy price increases and the cost-of-living crisis weighed heavily on consumer confidence. Compared to October 2020, prices of goods and services are xx% higher, placing significant pressure on household budgets.

Promotional activity: Promotional activity played a crucial role in driving sales across both food and non-food categories. However, with Black Friday promotions anticipated in November, there was an element of consumers holding back, particularly for big-ticket purchases.

Serial returners: trends and challenges

As the peak trading season nears, efficient stock management is essential. Online retailers are facing difficulties with both frequent and slow returners, which could hinder their ability to resell items quickly enough to meet seasonal demand.

In 2024, online returns in the UK are forecast to reach £xx, with clothing, footwear, and health & beauty seeing the highest return rates.

Across non-food categories, reasons for returns vary widely. While clothing and footwear returns often stem from sizing or style issues, other categories like electronics are more likely to face returns due to defects or unmet expectations.

Take out a FREE 30 day membership trial to read the full report.

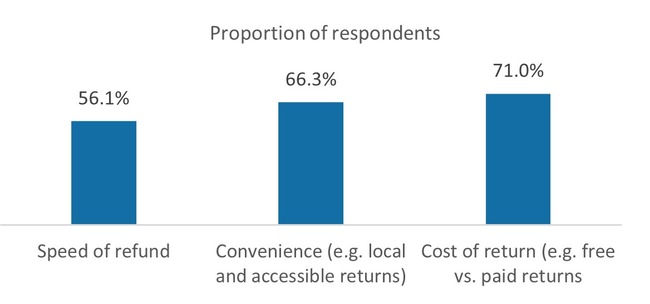

Convenience and cost of returns matters most to online shoppers

Source: Retail Economics, ZigZag

Source: Retail Economics, ZigZag