UK Retail Inflation Report summary

April 2024

Period covered: Period covered: March 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Inflation

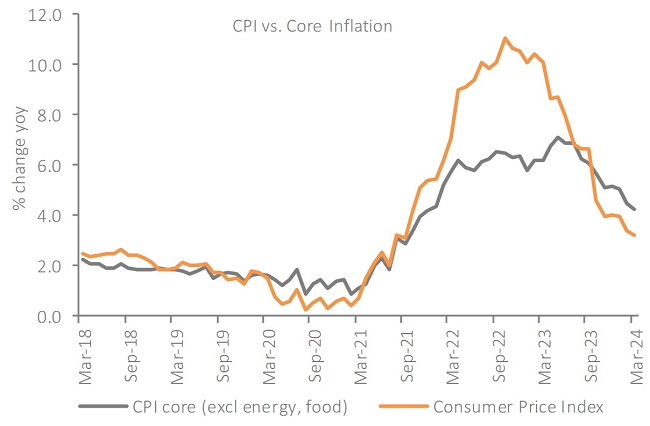

The headline Consumer Price Index (CPI) rose by xx% YoY in March, down from xx% last month, but above expectations of a xx% rise. The annual core inflation rate (excl. food & energy prices) also eased to xx% from xx% last month.

Core inflation decline: Core inflation, which excludes volatile energy and food prices, declined to xx% in March from xx% in February, slightly higher than analysts' expectations.

Services inflation sticky: Goods inflation dropped to xx% from xx% in February, while services inflation eased to xx% from xx%. This was ahead of the Bank of England’s estimate of a fall to xx%. While the driver of the stickiness is widespread, there was a notable surge in rental inflation which reached its xxxx rate for at least xxxx.

Food inflation eases: Food inflation slowed to xx% in the year to March 2024, down from xx% in February, marking the xxxx annual rate since xxxx. Downward pressure came from the xxxx categories.

Markets were caught off guard with the inflation release, prompting a delay in the expected first cut in the Bank rate to September. Prior to the release of the inflation figures, there was a full anticipation of a cut in August. Additionally, the likelihood of multiple rate cuts this year has notably diminished.

This delay prolongs the pressure on borrowers, who are anticipating lower interest payments, and on mortgage markets, although there was no immediate impact on mortgage rates.

The Bank chief, Andrew Bailey. reiterated this week that the timing of any interest rate adjustment hinges on evidence of easing price pressures, particularly a sustained slowdown in services inflation, which has yet to materialise.

However, there is some optimism for consumers as inflation is expected to xxxx next month to around xx%, driven by a xxxx in household energy bills and a continued xxxx in food inflation. Nevertheless, pressure on household budgets appears to persist in the near term.

Take out a FREE 30 day membership trial to read the full report.

Inflation eases

Source: ONS

Source: ONS