Report Summary

Period covered: 24 November – 28 December 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Retail sales

Retail sales rose by xx% year-on-year in December, according to the Retail Economics Retail Sales Index, following a weak November.

Consumers focused spending on promotional events amid a fragile economic backdrop.

December boost

The later timing of Black Friday in 2024 boosted December non-food sales, with two trading peaks—Black Friday and the days leading up to Christmas. Health & Beauty (+xx% YoY) led performance, driven by gifting, promotions, and seasonal illnesses. Electricals (+xx%) rebounded on demand for AI products.

Bargain hunting remained strong, with xx% of shoppers prioritising discounts (MRI, Retail Economics).

Food sales edged up xx%, supported by premium own-label growth and branded promotions accounting for xx% of grocery sales.

December distortions

Analysing spending over two months across November and December provides a more robust picture of underlying demand during the Christmas trading period.

Wider November-December sales showed a muted xx% increase – behind inflation as shoppers cut back on apparel and big-ticket home-related products.

Shoppers concentrated spending on promotional events, including around Black Friday promotional periods and holding out for last-minute deals before Christmas. This created two peaks in Christmas trading.

Omnichannel outperforms

Shoppers felt more comfortable with ordering online at the last minute and leveraging collections to make use of deals in the run-up to Christmas. This supported stable footfall as online sales increased xx% in December.

Economic climate shifts spending priorities

Consumers are becoming more selective, highlighting a sharp contrast between winners and losers. Inflation eased to xx% in December, but cost-of-living pressures persist, with xx% of households concerned about rising costs over the next six months (MRI, Retail Economics).

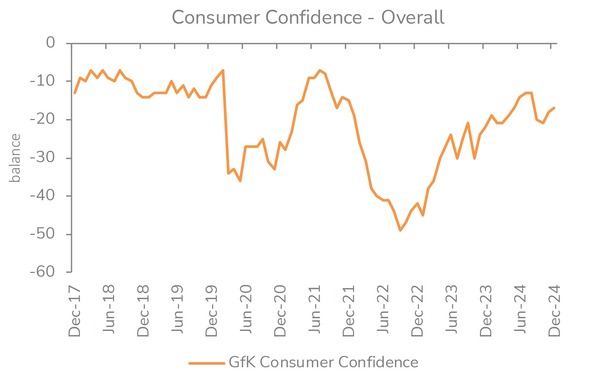

The Bank of England held interest rates at xx% in December. This saw appetite for major purchases unchanged in December at (GfK index ofxx) as consumers think twice about big-ticket purchases.

When households do splash out, they prioritise spending outside of retail that delivers high-value experiences. Entertainment spending surged xx% YoY, bolstered by pantomimes, concerts, and the film Wicked. Additionally, travel spending remained strong (+xx% YoY).

Take out a FREE 30 day membership trial to read the full report.

Consumer confidence lift post-Budget

Source: Retail Economics, GFK

Source: Retail Economics, GFK