UK Retail Sales Report summary

February 2024

Period covered: Period covered: 31 December 2023 – 27 January 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales

Retail sales growth rose by a soft xx% YoY in January according to the Retail Economics Retail Sales Index.

Key factors impacting sales in the month include:

Evolving financial pressures: On the downside the Ofgem energy price cap stepped up at the start of the year, but major lenders began cutting mortgage rates leading to a rise in house buyer demand from weak levels.

January promotions: Retailers used January promotions to discount heavily, supporting shop price inflation softening to its weakest level since xxxxx.

Mixed weather: Warnings of icy conditions, followed by various storms bringing 80-mph winds and heavy rain disrupted sales throughout the month. But temperatures were above average.

Focus on wellbeing: New Year resolutions brought renewed focus on wellbeing, including Dry January and Veganuary supporting certain Food categories and Health & Beauty.

Evolving financial pressures

Retail sales in January showed signs of improvement compared to the weak levels observed in December, which were affected by households bringing forward their Christmas spending into November. However, overall sales remained lacklustre, with several factors influencing consumer behaviour and purchasing decisions during the month.

Households faced a mixed economic backdrop in January. On one hand, the Ofgem energy price cap increased at the beginning of the year.

This saw the typical annual household energy bill go up by 5% or £94 to £1,928. It contributed to inflation persisting at 4.0% in January (Office for National Statistics) – double the Bank of England’s 2% target.

Wages continued to outpace inflation at the end of last year, albeit at a weaker pace than in recent months. Vacancies, although declining, remain significantly higher than pre-pandemic levels, leading to robust wage growth. But the Bank of England expects pay growth to soften to around 5.75% in Q1 2024 before easing to 4.75% in Q2, ending the year at a similar rate.

Major lenders began cutting mortgage rates at the start of 2024 following lofty rises in H2 2023. This has seen an improvement in buyer enquiries, with a net balance of +7% of estate agents seeing rises in January, which marks the most positive reading since February 2022 (RICS).

However, the harsh reality remains for around 1.6 million households exiting fixed-rate mortgage deals in 2024 at average rates of 2%.

If their mortgage rate rises by 3.25 percentage points to over 5%, repayments will rise by an average of £220 per month (Bank of England), putting pressure on discretionary spending among these households.

Take out a FREE 30 day membership trial to read the full report.

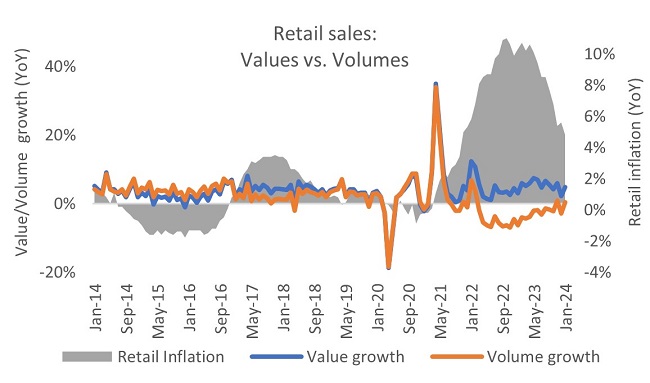

Sales volumes broadly flat in January

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis