UK Retail Sales Report summary

March 2024

Period covered: Period covered: 28 January – 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retail sales

Retail sales growth softened to xx YoY in February according to the Retail Economics Retail Sales Index.

Key factors impacting sales in the month include:

Record wet weather: The wettest February on Met Office records in Southern England brought stagnant non-food growth, particularly for DIY, furniture and apparel.

Nights in: Despite half term for schools, footfall declined xx YoY in February, impacting categories reliant on stores for conversion. Spending over Valentine’s Day shifted to dining in.

Seasonal sales: Consumers swapping big ticket expenses for small indulgences benefited beauty around Valentine’s Day.

Softening inflation but rates held: Finances remain under pressure despite inflation softening to its lowest level since xxxx. At the start of February, interest rates were held at the highest level for xxx xxx at xx. This has seen confidence stagnate as mortgages and rents come up for renewal.

Macroeconomic backdrop shaping sentiment

Retail sales in the UK xxxx in February, affected by high inflation, elevated interest rates, and weak real earnings impacting households of varying affluences.

Consumer confidence dropped in February, with GfK’s index falling to xx, indicating a deterioration in personal financial outlooks despite previous improvements.

Forecasts suggest real household disposable income will return to pre-pandemic levels by xxxx, earlier than expected, due to a significant decrease in energy prices.

Retail Economics and NatWest analysis highlights pessimism among those facing mortgage or rent renewals, especially younger, middle-income households, affecting consumer spending.

Residential rents surged by a record xx in February, with higher borrowing costs affecting tenants due to landlords passing on increased mortgage payments or reducing rental property availability.

The Bank of England maintained the base rate at xx, a xxx xxx high, through February and March. Future interest rate decisions are crucial for consumer confidence and spending, with markets expecting rate cuts this year.

Inflation eased to its xxxx since xxxx, with the CPI inflation rate at xx in February, indicating xxx xxx for consumers.

Take out a FREE 30 day membership trial to read the full report.

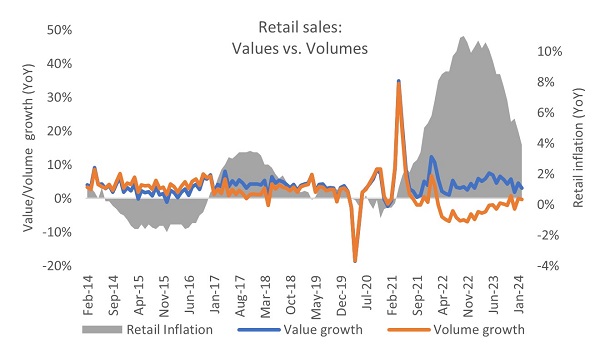

Sales volumes dip in February

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis