Report Summary

Period covered: 24 November – 28 December 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales fell by xx% YoY in November, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted) against a xx% decline a year ago. This was the sharpest decline since November 2019 following two consecutive months of growth.

Factors impacting performance this month include:

Black Friday Timing: Black Friday’s late November date shifted much of its impact into December’s trading period.

As the most online-reliant category, electricals was disproportionately impacted by the later timing of the predominantly online promotional event.

Early Festive Spending: Some retailers launched early promotions, patricianly online, captured in November’s period.

However, many shoppers waited for traditional Black Friday discounts, leaving November’s figures underwhelming across non-food categories.

Weather Impact: November presented a split weather pattern, with a mild, dry start that delayed seasonal purchases like winterwear.

This shifted mid-month with an arctic blast and storms, including Storm Bert, which disrupted footfall across high streets and retail parks pushing many consumers to shop online.

Economic Pressures: Rising energy bills and weak (but improving) consumer confidence constrained discretionary spending.

Inflation reached xx%, an eight-month high, with clothing and recreational categories seeing notable price increases.

While wage growth outpaced inflation at xx%, real earnings gains remained modest, leading households to delay non-essential purchases.

Half-Term Timing: The later timing of the school half-term positively impacted November spending, having fallen in October a year ago.

Festive spending intentions

The electricals sector enters the final stretch of the festive season with mixed signals. Retailers extended promotional strategies appear to have broadened engagement, but financial pressures have kept many shoppers cautious, highlighted in our recent consumer research with MRI. Key insights include:

Christmas Gifts: xx% of shoppers expect to spend more on gifts compared to last year, while xx% anticipate spending less.

Generational Differences: Spending intentions are strongest among younger shoppers, with xx% of under-35s planning to spend more this Christmas.

Big-Ticket Items: Intentions for big-ticket purchases, such as electronics, are evenly divided: xx% plan to spend more, xx% plan to spend less, and xx% expect to spend about the same.

Notably, xx% of shoppers have no plans for big-ticket purchases in the next three months, reflecting persistent economic uncertainty.

Success in capturing seasonal demand will depend on balancing attractive offers with maintaining profitability in a tight market.

Take out a FREE 30 day membership trial to read the full report.

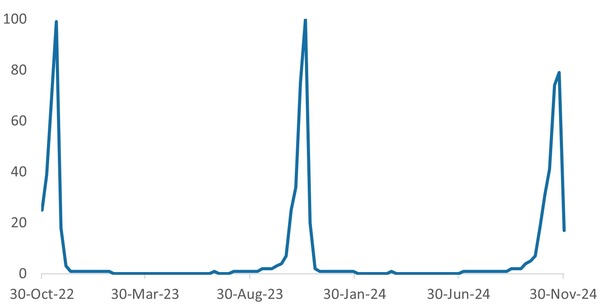

Google search trends for term ”Black Friday”

Source: Google trends, Retail Economics analysis

Source: Google trends, Retail Economics analysis