Customer Affluence and the Wealth Effect: Strategies for Retail Growth

5 minute read

Click here to view our eBrochure full of information on working with Retail Economics for publishing world class thought leadership research like this.

What can you learn from this report?

The "Customer Affluence and the Wealth Effect" report, developed by Retail Economics in partnership with beBettor, underscores the pivotal role of the Wealth Effect in utilising customer wealth data. This approach is essential for unlocking spending potential and tailoring marketing strategies more effectively to diverse consumer segments. The focus on the Wealth Effect highlights how fluctuations in consumer wealth directly influence purchasing power and behaviour, thereby enabling retailers to optimise their targeting for superior marketing outcomes.

Some key insights:

-

An anticipated £2.4 billion decline in retail expenditure is forecasted for 2024, attributed to the Wealth Effect.

-

A decline of 3.6% in property values from Q4 2022 to Q2 2024 is seen to affect consumer spending habits.

-

Cutting-edge algorithms are proving more efficient than postcode information in ascertaining customer wealth levels, providing accurate insights.

-

Retail enterprises can pinpoint "high affluence, low expenditure" cohorts for bespoke marketing tactics.

-

Hyper-personalisation in marketing coupled with enhancements in Customer Relationship Management (CRM) can markedly increase Average Order Values (AOV).

-

The capability to forecast a customer's Lifetime Value (LTV) from their initial purchase enhances marketing strategies significantly.

This report offers a strategic blueprint for retailers, highlighting the paramount importance of information on customer wealth in revolutionising retail approaches. This enables firms to better navigate economic challenges with greater confidence, striving for retail growth.

This report is divided into five main sections:

• Introduction

• Section 1: The Wealth Effect

• Section 2: Quantifying the Wealth Effect

• Section 3: Why retailers need to understand individual customer affluence

• Section 4: What retailers can do with customer affluence data

• Conclusion

Introduction

We are living in a time where the key to retail success often lies in grasping the complexities of consumer spending and wealth insights to supercharge marketing efforts.

In this dynamic landscape, top-tier brands are forging ahead to gain a deeper understanding of their customers. Using the latest in technology, AI, and growing pools of customer data, these innovators are engaging with consumers instantaneously, aiming to refine their marketing approaches with greater sophistication.

As noted by Harvard Business Review, the synergy of AI and relevant external data significantly amplifies their collective value. Customers, recognising the benefits of personalised interactions, are increasingly open to sharing their data such as age, address, profession, and hobbies etc. Yet, when revealing financial status, a natural hesitancy remains.

Nonetheless, the crucial role of customer wealth insight in elevating business strategy is becoming ever clearer. Grasping how affluence impacts consumer purchasing behavior allows retailers to enhance their marketing initiatives and performance significantly. Tailored interactions, improved product suggestions, and greater relevancy are among the strategic benefits to help companies expand their market presence.

Against the backdrop of an improving yet fragile economy, marked by falling inflation in 2024, retailers face the dual challenge of high interest rates and geopolitical instability. Fortunately, retailers now have unprecedented access to detailed, often localised, data sets.

Despite this, numerous businesses have yet to advance beyond elementary applications of this data, relying on sporadic analyses of basic customer information like birthdays and general postcode areas. Such methods miss the deeper insights found in more specific data points, like exact residential locations. Thus, the potential of blending detailed customer data with established transactional records is a largely untapped opportunity for many within the industry.

This report explores the 'Wealth Effect' and how fluctuating wealth and individual life changes shapes customer spending patterns, presenting a compelling argument for the necessity of individual customer wealth insight today. The report not only provides a guide for retail brands to decipher customer wealth, but also explains how customer wealth insight can be integrated into actionable strategies. With these innovative insights, brands are poised to forge unprecedented connections with their customer base.

The research features four key sections:

1. The Wealth Effect: Introduces the concept of the ‘Wealth Effect’ and associated factors.

2. Quantifying the Wealth Effect: Gives an estimate for the impact of the Wealth Effect in the current UK economic climate.

3. Why retailers need to understand individual customer affluence: Underscores the importance of comprehending consumer wealth in the context of unequally distributed income.

4. What retailers can do with customer affluence data: Offers different use cases of customer affluence insights to help improve business strategies.

Section 1: The Wealth Effect

This section offers an expanded view of consumer affluence and explains the ‘Wealth Effect’. It covers the fundamental economic theory and examines both the associated positive and negative effects.

Understanding first principals

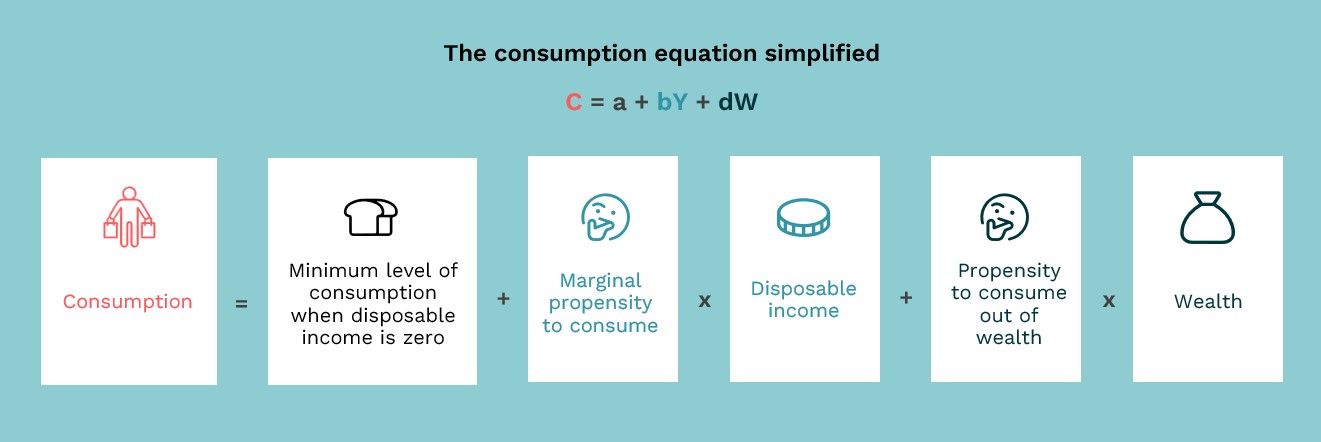

Economic theory suggests that personal expenditure, or consumption, is influenced by five primary factors. This is encapsulated in the ‘Consumption Function’, expressed as “C = a + bY + dW” (Fig. 1). Essentially, this formula posits that your total outlay is a mix of your necessary expenditures, coupled with a proportion of your earnings and your assets. This model is a tool for economists to forecast societal spending trends in response to economic shifts, such as salary hikes or amendments in taxation. Individuals with ample income and assets are likely to increase their spending, whereas those with limited means may confine their purchases to essentials.

Fig 1: Understanding the basics of consumer spending/consumption

Total spending (consumption) is the sum of your essential spending, plus a portion of your income, plus a portion of your wealth

What is the 'Wealth Effect'?

The Wealth Effect is an economic concept that revolves around behaviour, indicating that people are likely to spend more as the value of their assets (e.g. property and savings) increases. This effect is predicated on the idea that asset appreciation boosts consumer confidence and their propensity spend on goods and services.

Wealth Effects can be either positive or negative. Positive Wealth Effects fuel economic growth by increasing consumer spending, which in turn drives demand for products and services, benefiting businesses and the economy at large. On the other hand, negative effects can have the opposite impact. For instance, the economic surge in the UK during the late 1980s, driven by positive Wealth Effects, was followed by a recession in the early 1990s, worsened by negative Wealth Effects.

Understaning this in context of what's happening in today's economic environment is critical for.....

Complete the form at the top of this page now to access the rest of section one!

Section 2: Quantifying the Wealth Effect

In section 2 we estimate the impact of the Wealth Effect in relation to present economic conditions.

Traditional economic models and established practices that guide central bank policies led to an increase in interest rates, a response to the inflation surge of 2022. This adjustment adheres to the widely recognised principle that the effects of monetary policies unfold gradually over time, not instantaneously.

It is estimated that the full impact of such changes permeates the 'real' economy after a delay of about two years. This delay in the effects of monetary policy is partly due to the Wealth Effect. In essence, declining property values (which represent a major asset base for most households) undermine financial security for many, prompting them to increase savings and reduce expenditure while also facing tighter credit conditions.

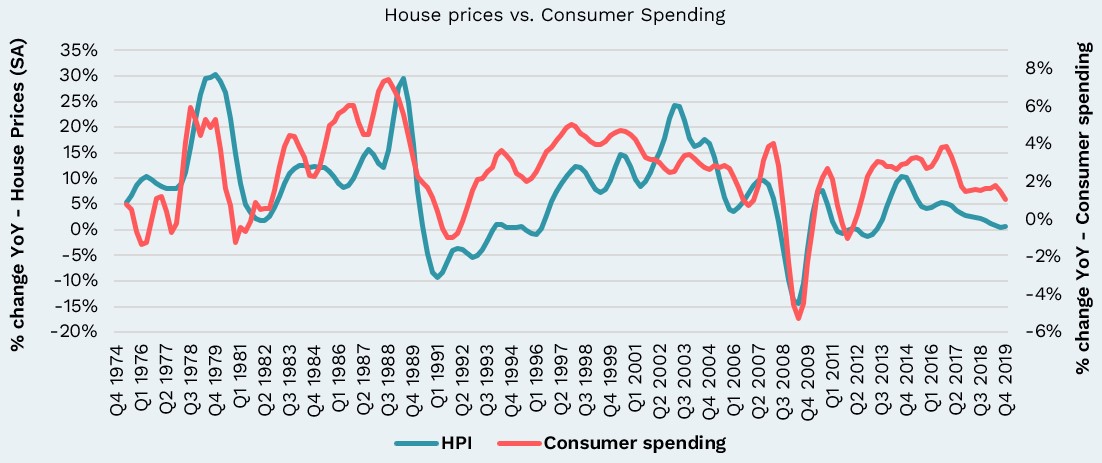

Although interest rate changes take time to impact consumers, historical data demonstrates a close correlation between house price movements and consumer spending over the last half-century (Fig. 3).

Also, the influence of interest rates on the housing market is expected to intensify over time. Even though the cycle of rate hikes may have reached its height, asset valuations and household finances will likely keep adjusting, with the resultant drop in spending persisting into the future. Notably, from Q4 2022 to Q2 2024, average house prices have decreased by 3.6% (Fig. 4), with sharper declines in regions like London (-5.5%) and the South East (-4.5%) (Fig. 5). These reductions have eroded consumer confidence, heightened financial stress, and triggered a negative wealth effect, leading to diminished spending.

Fig 3: History shows that house prices and consumer spending tend to move together

Source: ONS, Nationwide House Price Index – seasonally adjusted.

Due to the impact of the Wealth Effect, we estimate that the retail industry will experience a reduction in spending of around £2.4 billion in 2024 as past rises in interest rates bite.

For comparison £2.4 billion is about the total annual turnover of IKEA in the UK.*

The reduction in spending is likely to land unevenly across households, with the impact of rising interest rates and weaker asset prices capturing a wider pool of middle and high income households. Indeed, many millennials (28-43 years old) have only experienced home ownership during a period of ultralow interest rates and are...

Complete the form at the top of this page now to access the rest of section two!

Section 3: Why retailers need to understand individual customer affluence

In this section, we underscore the critical need for retail brands to deepen their understanding of customer affluence, which is essential for enhancing the sophistication of their marketing strategies and boosting sales growth.

The importance of understanding customer affluence

Businesses that recognise variations in their customers' financial situations can significantly benefit by customising their offerings and marketing strategies. This includes five key considerations:

Customer Profitability

For many retail brands, aiming for customer profitability typically involves concentrating on their most lucrative customer segments. This traditional approach, however, tends to rely solely on historical spending data and fails to consider customer affluence and the latent spending potential of each individual. Adopting innovative methods can significantly enhance this strategy.

Customer Lifetime Value

Typically, the calculation of Customer Lifetime Value (CLV) does not take into account customer affluence when assessing potential customer performance. Rather, these methods predominantly use historical transaction data, which can provide a restricted view. Instead, retailers can...

Complete the form at the top of this page now to discover the other three key issues

Customer affluence scores

Despite a challenging macroeconomic environment, retailers can utilise individual customer affluence scores, such as those provided by beBettor and similar providers, to uncover growth opportunities and enhance resilience. By strategically employing these scores, businesses can customise their products, marketing efforts, and customer interactions to align with the specific financial capacities and preferences of various affluence segments. This focused approach maximises the impact of each customer interaction, boosts sales, fosters loyalty, and secures a competitive edge, even amid potential economic challenges.

Affluence is highly unequally distributed in the UK economy

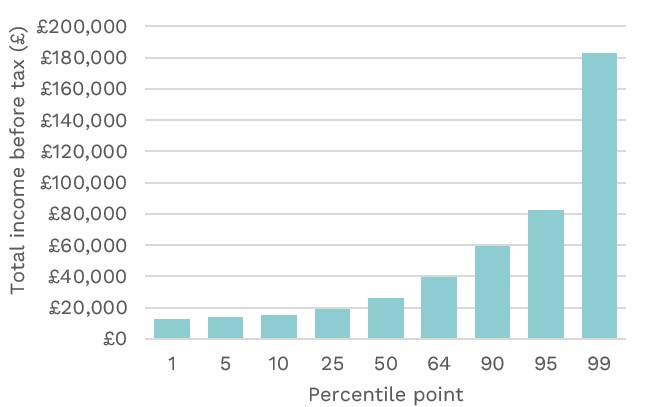

Income and wealth distribution is marked by inequality across global economies, and the UK is no different. His Majesty’s Revenue & Customs provides intricate personal income data for the UK's 32 million taxpayers. This data reveals an average (mean) personal income of £37,300, compared to a median (middle) income of £26,300, illustrating a 42% disparity and underscoring the significant income inequality prevalent within the economy (Fig. 6).

Fig 6: Percentile points of total income before tax

Source: HMRC

Advances in data localisation

The UK's 24.8 million households are distributed across approximately 1.8 million postcodes, a system that was fully established only in 1974. Public access to property prices began in 1995, revealing details such as the owners' names and any mortgages registered against these properties. From the 2001 Census onward—of which there have been only two, with just one fully reported—the Office for National Statistics has implemented a highly detailed system for data classification, which includes:

• England & Wales (2)

• Counties (48)

• Councils (340)

• Parliamentary constituencies (575)

• Middle layer Super Output Areas (7,264)

• Parishes (11,358)

• Lower layer Super Output Areas (35,672)

• Output Areas (188,000)

• Postcodes (1,800,000)

• Households (25,600,000)

• Unique Property Reference Numbers (42,800,000)

These comprehensive measures have, for the first time, enabled the precise personalisation of affluence data on an almost individual basis. This can significantly help retail brands where they can...

Complete the form at the top of this page now to access the rest of section three!

Section 4: What retailers can do with customer affluence data

As the global economy progresses and consumer behaviours evolve, successful retail brands must continually adapt, gaining new insights and facing emerging challenges head-on. Currently, amidst industry upheavals and a rising cost-of-living, the ability to understand individual customer affluence has become vital for crafting effective retail strategies. In this concluding section, we explore the potential applications of customer affluence data.

By considering the following strategic points, retail brands can cultivate an environment that is inclusive, responsive, and attractive to consumers across all wealth levels, thereby promoting growth, building loyalty, and enhancing resilience in a constantly shifting economic landscape. This research outlines six critical areas of focus for retail brands:

1. Identify ‘hidden’ spending power within your existing customer base

Retailers equipped with insights into their customer affluence can strategically identify pockets of ‘hidden’ spending power within their existing customer base (e.g. ‘high affluence, low spend’ customer groups with significant wealth but modest spending habits).

By fusing such customer affluence insights with behavioural data and transaction histories, retailers can better target these ‘golden cohorts’. This identification enables them to...

Complete the form at the top of this page now to access the other five areas for action!

Conclusion

The enhanced granularity of recently available data has now reached a stage where specialist firms, equipped with advanced data science capabilities, are able to precisely estimate individual customer affluence for the first time, enabling retail brands to use this information profitably.

This precision provides a substantial competitive edge, supercharging the customer analytics function and amplifying marketing effectiveness. Coupled with the latest advancements in Generative AI, this synergy unlocks significant revenue opportunities for early adopters—each 1 percent improvement in retail sales effectiveness across the UK could equate to the annual revenue of Next Plc.

Moreover, the ‘Wealth Effect’ remains a formidable influence in consumer spending within the retail sector, poised to exert a negative impact over the coming two years. However, retailers that harness and integrate the newest data sources will be in a prime position to discover and capitalise on hidden affluent segments, potentially outperforming their rivals.

In conclusion, retail brands that effectively utilise affluence insights and integrate this data into their strategies can significantly boost customer satisfaction and more adeptly adjust to evolving economic circumstances. By focusing on personalisation, refining pricing and promotional tactics, fine-tuning inventory management, and adopting data-led decision-making, retailers are well-equipped to navigate the increasingly complex economic environment expected in 2024 and beyond.