Christmas 2022 Retail Prospects: Holiday Shopping Trends Report

5 minute read

Click here to explore collaborating with Retail Economics for publishing outstanding thought leadership research like this.

What you can discover in this report

This report produced by Retail Economics in partnership with Metapack looks at prospects for Christmas 2022 and New Year, to assess retail sales performance across peak trading in the context of intensifying cost-of-living pressures going into the fourth quarter of the year.

The report is divided into 5 main sections:

• Introduction

• Part 1: The Big Squeeze

• Part 2: The Cutback Landscape

• Part 3: Adapting & Thriving

• Conclusion

Introduction

For many, 2022 has framed an uncomfortable transition of crises which has left dark clouds of uncertainty lingering over the golden quarter for the retail industry. As retailers face spiralling costs and consumers experience the tightest squeeze on discretionary income in recent memory, what will peak trading look like this year?

Hopes for 2022 included a return to more normal times. However, high inflation and increasing interest rates across markets prompted consumers to ask themselves whether now is a good time to spend. Similarly, retailers are pondering just how much additional cost can be passed onto their core customer base in order to remain profitable, or even to stay afloat.

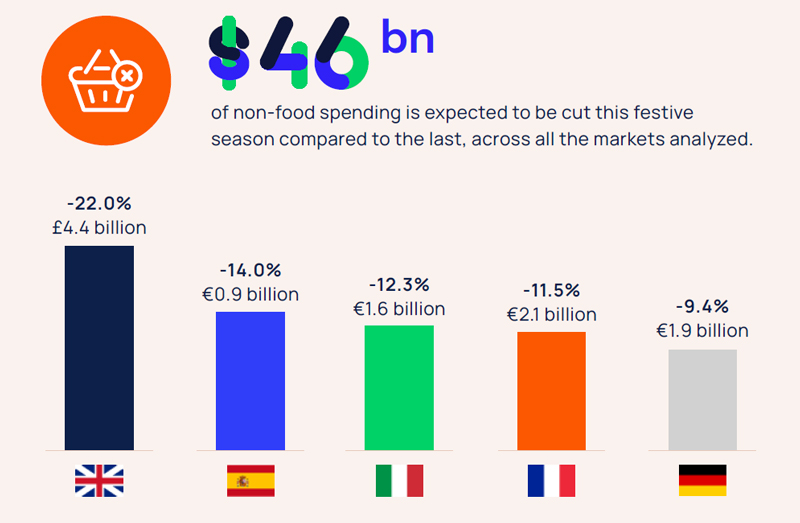

Ongoing industry disruption, financial anxiety and elevated uncertainty is contributing to reduced confidence, which in turn is leading to diminishing spending intentions for Black Friday and Christmas. As such, the golden quarter is set to be more muted, with some US$46 billion of spending expected to be wiped off this year, as consumers look to cut back non-food expenses across eight international markets covered in this research (UK, US, Canada, Australia, Germany, France, Italy and Spain). Apparel and electricals are among the unfortunate categories set to bear the brunt.

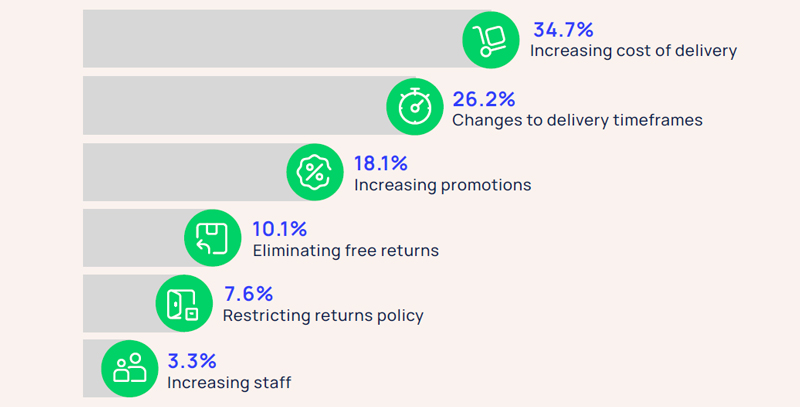

Worryingly, most retailers surveyed in this research are not expecting such a decline. This means their ‘winning strategies’ of passing on heightened fulfilment costs to consumers are at odds with current shopper sentiment — and indeed their ability, and even willingness, to pay.

As financial storms brew for retailers and headwinds strengthen for households, recessionary behaviours are surfacing. Consumers will reconsider familiar channels, brand loyalties will be tested, and price and value will quickly become key drivers of change.

The golden quarter is set to be more muted, with some US$46 billion of spending expected to be wiped off this year.

It has never been more important for retailers to understand the reprioritizations at play, and how each of their target audience groups will be impacted. This is why our research explores and identifies four types of consumers, based on attitudes towards finance as well as financial security. It shows how market characteristics play an influencing role in shaping changes in behaviour, together with category-related factors. The insights presented here are intended to inform, and hopefully help improve, retail strategies to address current trading conditions for peak trading and beyond.

Indeed, the report investigates which categories are likely to suffer most from consumer intentions to cut back spending, and how different consumer types will impact sales performances over peak season. More broadly, it aims to assess retail sales performance across peak trading in the context of intensifying ‘cost of living’ pressures going into the fourth quarter of the year.

The research explores three key themes:

1. The big squeeze - looks at the macroeconomic backdrop and how consumer sentiment is being impacted by the ‘cost of living’ crisis

2. The cut back landscape: forecasts how much consumers are looking to cut back spending this year – including analysis by category, household and channel – and how this contrasts with retailer expectations

3. Adapting and thriving: highlights strategies for retailers to remain relevant and profitable during a challenging fourth quarter

The insights presented here are intended to inform, and hopefully help improve, retail strategies to address current trading conditions for peak trading and beyond.

Key stats

$46bn of non-food spending is expected to be cut this festive season compared to the last, across all the markets analysed.

1: The big squeeze

Retail industries across the world are approaching an extraordinary peak season. Inflation has surged to decade highs across key consumer markets as escalating energy, fuel and food costs continually squeeze consumer living standards.

Set against a softer consumer backdrop, retail profitability has come under intense strain. Labour shortages, ongoing supply chain disruption, and rising operating costs are testing business models — some to breaking point.

Nine in 10 (91.9%) businesses surveyed in our research expect to be negatively impacted by rising costs over peak season; while on the consumer side, three in five (58.0%) shoppers expect to cut back non-food spend amid rising living costs.

It comes as households face deteriorating discretionary budgets for nonessential purchases. Families are having to make tough choices regarding where to shop, what to buy, and how frequently. This is leading to consumers trading down to cheaper alternatives, delaying ‘nice-to-haves’ and canceling certain purchases altogether.

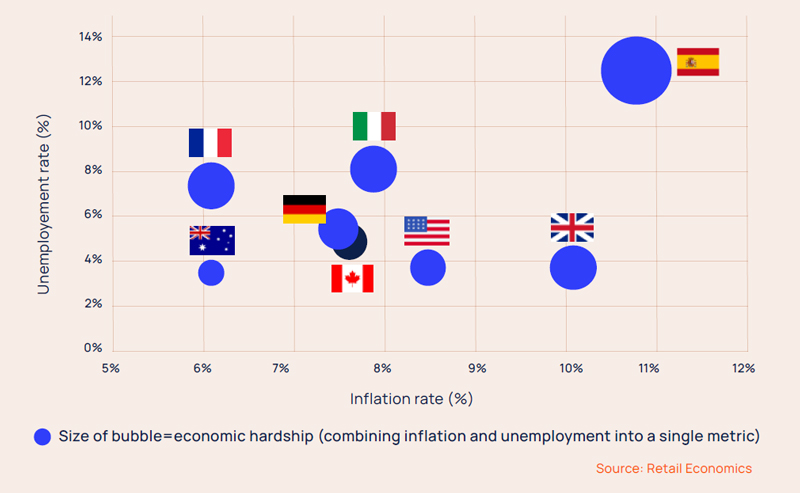

Fig 1: Inflation across key markets is at uncomfortable levels heading into the final quarter

Source: Retail Economics

Economic hardship varies considerably by country depending on many factors such as government policy, regional market dynamics (e.g. supply of energy) and domestic interest rates. For instance, the UK has been exposed to rising wholesale gas prices, significantly impacting the price of staple goods, with the least affluent households affected the most. Compare this to France, which has shielded its consumers due to the Government’s stake in major energy supplier EDF, as well as greater access to alternative sources of energy such as nuclear power.

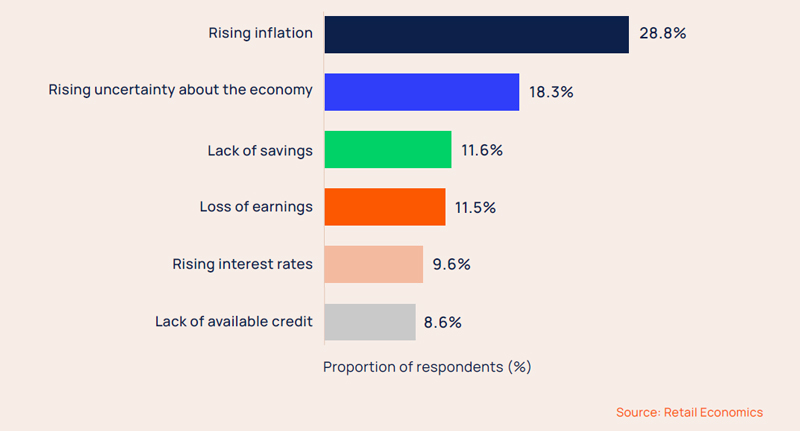

Nonetheless, inflation remains uncomfortably high across all countries analysed, and this is harming consumer confidence. Our research shows that inflation remains the biggest concern for consumers (28.8%) across all markets, followed by uncertainty about the economy (18.3%), and lack of savings (11.6%) - all of which is likely to undermine end-of-year spending.

Fig 2: Inflation is having the biggest impact on spending intentions over the golden quarter

Many consumers will be forced to adopt recessionary behaviours such as trading down, cutting back spending and canceling purchases as inflation persists over the golden quarter.

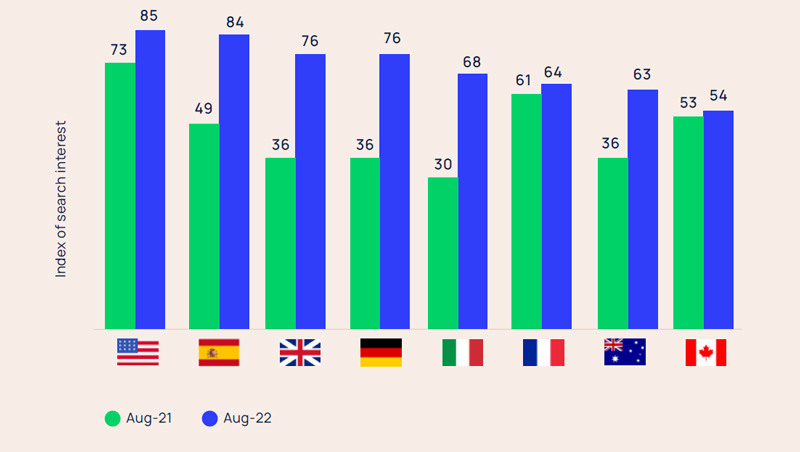

Online searches for ‘save money’ have hit a five-year high

Seeking ways to stretch budgets through increased savviness is already on the rise. Online searches for the term ‘save money’ have increased in all of the markets covered in the research. These searches hit a five-year high, with countries facing higher rates of inflation such as Spain, USA and the UK, recording the greatest interest.

Fig 3: Interest in ways to save money has stepped up significantly in the last year

Source: Retail Economics

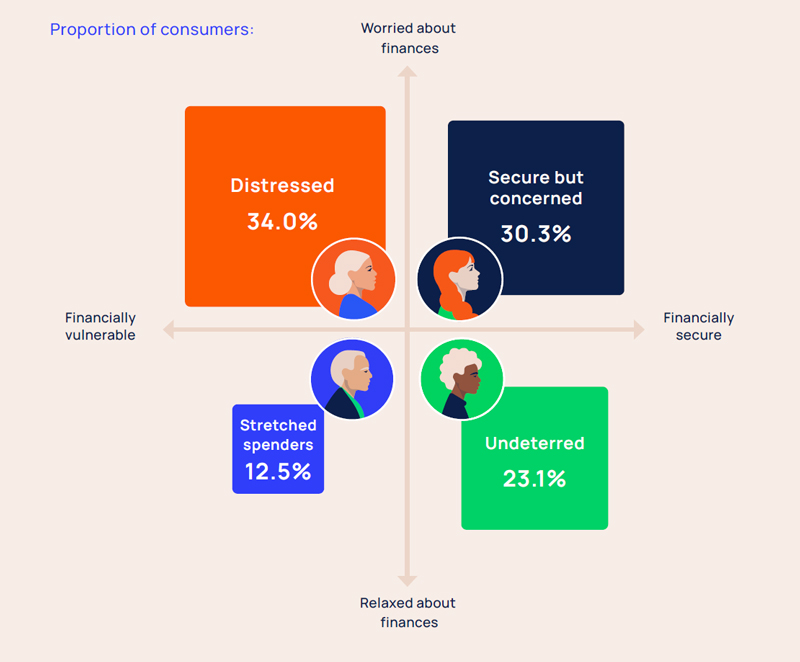

Our research identifies four key types of consumer (Fig. 4), mapped against a quadrant which measures attitudes towards personal finances(vertical-axis) and underlying financial security (horizontal-axis).

“We see [this holiday season] being slower than the past two seasons. Selling outdoor products during the pandemic was really busy. [We] have seen substantially slower sales this year so far.” 35TH AVE SKATEBOARDS

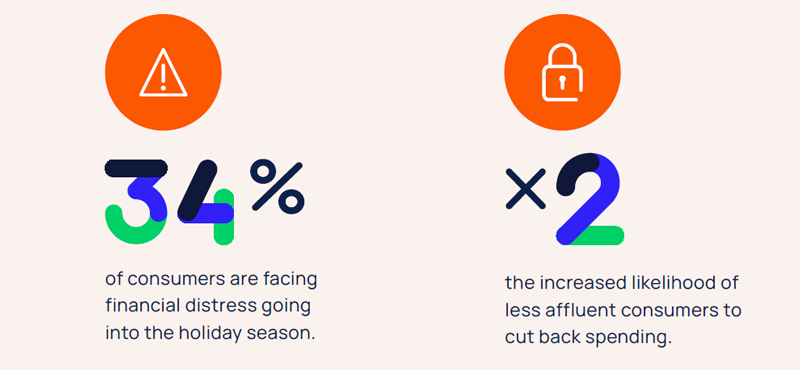

Fig 4: A significant proportion of consumers are financially distressed as living costs rise

‘Undeterred’ (23%) - The ‘cost of living’ has a lesser impact on shopping behaviour compared to

other cohorts as they have the greatest financial freedom and are the least concerned about inflation. However, they worry about the economy, spending is at risk from a deteriorating economic outlook, and they have increased saving intentions. These consumers are typically at established points in their careers aged between 35-54 years old and skewed toward males (56%).

‘Stretched spenders’ (13%) - Consumers that are attempting to maintain a resilient attitude toward spending (particularly after years of COVID-related restrictions), despite finances coming under pressure from rising living costs. Given consumers in this cohort like to spend but are on tight budgets, they are the most concerned about inflation going forward. They are typically older consumers approaching retirement, with a slight bias towards women (51%).

‘Secure but concerned’ (30% - Financially strong consumers, but their attitudes towards spending are being influenced by ‘cost of living’ concerns. They display risk-averse attitudes towards spending as inflation and interest rates rise, and are often savvy, looking to switch shopping channels to save money. This group represents a broad mix of ages (including 18-24 year olds) and is roughly even split between men and women

‘Distressed’ (34%) - Consumers at high risk from rising living costs; financially vulnerable with significant concerns. They are most likely to be worried about lack of earnings, savings and credit availability going into peak season and next year, and therefore most likely to cut back spending. They are also considering switching preferred shopping channels to save money. These consumers are typically

middle-aged or older, facing prospects of weak earnings growth and pension funds being eroded by inflation. Just over half (54%) are women.

As expected, consumer sentiment varies by market. British and Spanish shoppers suffer the highest levels of financial distress, while German and Australian shoppers have relatively greater financial freedom.

40% of Spanish shoppers are distressed about their finances

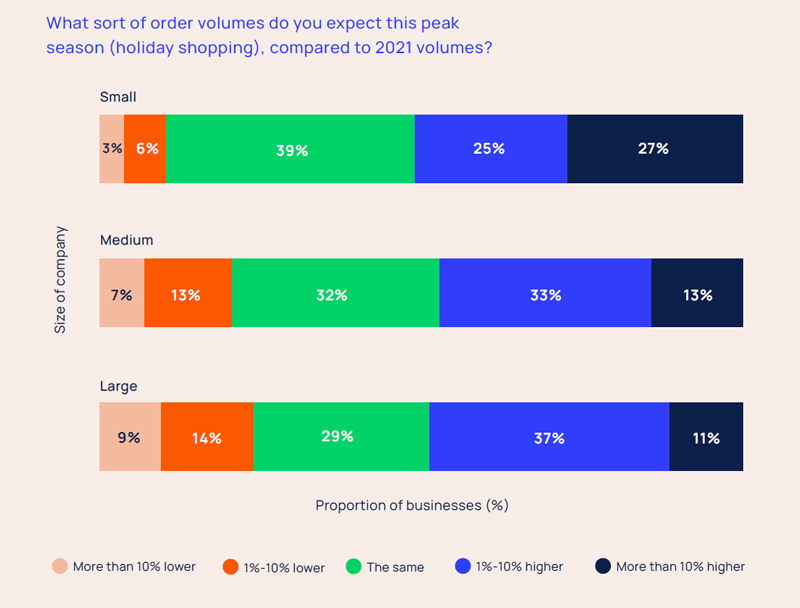

Consumer sentiment versus retailers’ expectations Despite growing concerns over the state of the global economy, retail businesses surveyed appear significantly more optimistic, and are generally planning for order volumes to increase this year compared to last. From these retailers (predominantly small and medium-sized enterprises), smaller companies are most confident. Over a quarter (27%) of small companies expect order volumes over the golden quarter to be more than 10% higher than last year.

Fig 6: Firms are optimistic about a volume uplift this year

Source: Retail Economics

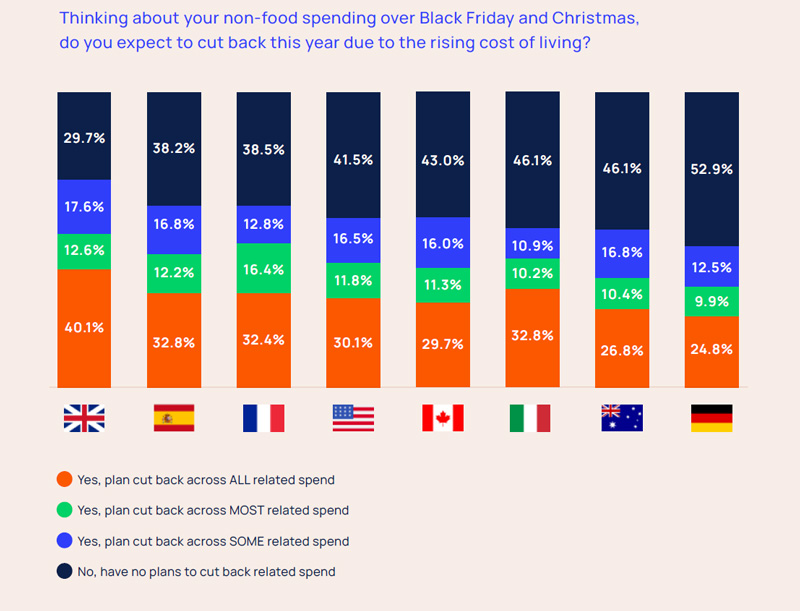

Interestingly, this particular finding contradicts current consumer sentiment. Well over half of shoppers expect to cut back non-food spending to some degree over Black Friday and Christmas. UK consumers expect to cut back the most over peak trading, which is likely to lead to a sharp reduction in spending this year. Conversely, German consumers appear much more resilient than other European countries, with the United States and Canada more closely aligned to the average across all countries.

Fig 7: The majority of consumers expect to cut back over Black Friday and Christmas

Source: Retail Economics

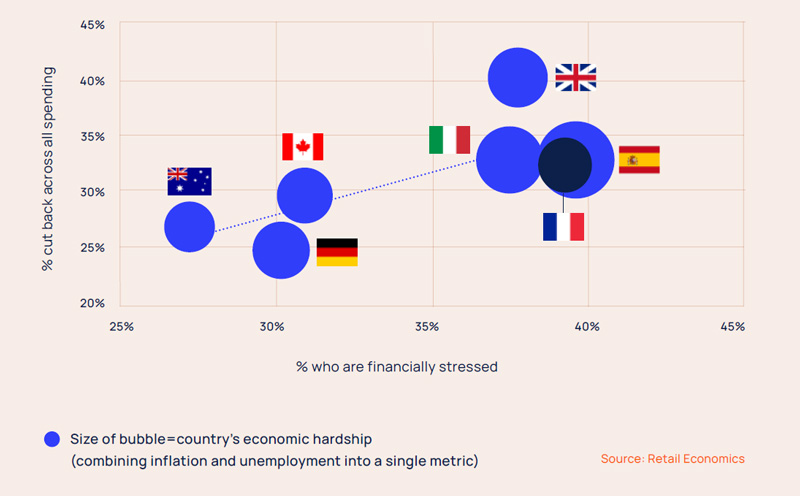

The research confirms that the extent to which consumers intend to cut back is correlated with the degree of economic hardship each country faces (measured by adding inflation and unemployment rates together). Similarly, consumers in countries facing the greatest economic hardship are more likely to be those looking to cut back their spending over peak season.

Fig 8: Financially distressed consumers are those cutting back the most

Source: Retail Economics

Post-purchase experience a critical lever to winning and retaining customers

In a peak retail season marred by slower consumer spending and rising costs, retention is a crucial lever

to protect investment in customer acquisition, and ensure a share of that reduced consumer spend.

Every stage of the online shopping journey is make-or-break, but none more so than post purchase, or the experience from clicking ‘buy’ to receiving the order. A lot can go wrong at this point: late deliveries, lost parcels, incomprehensible tracking… the list goes on.

In today’s socially-networked world, the impact of experiences – both good and bad – has the potential to multiply exponentially. For example, 67.1% would be less likely to shop with a retailer after hearing someone they knew had a bad experience with them.

Tracking - the most important factor

One factor looming large behind experiences both good and bad is tracking. As consumers wait for their online order to arrive, being able to follow its progress in real-time leaves them feeling informed and in control. 94.5% of shoppers say the ability to track their order is important, of which 54.7% say it’s very important.

Ongoing appetite for free returns

As soaring fuel prices translate into increased final mile costs, many retailers are considering bandoning free returns as a way to eke out cost efficiencies. However, according to our research, free returns is the number one driver of a good post-purchase experience. It is important for 93% of consumers, and very important for 60%, ranking even higher than factors like delivery speed.

2: The cutback landscape

The harsh economic backdrop cloaking the golden quarter is expected to impact peak trading this year. Households facing financial pressure will cut back on non-essentials.

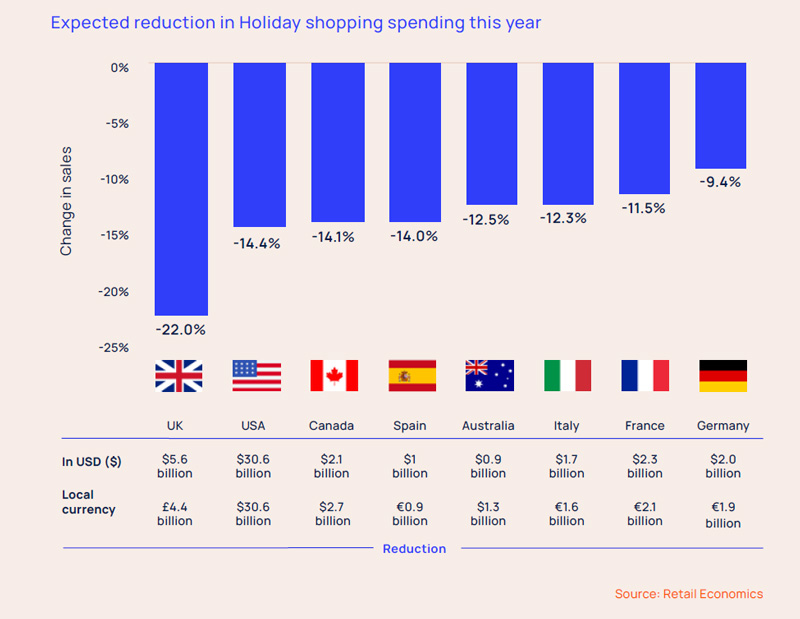

For most, Christmas is likely to be a more muted affair in 2022. Non-food spending over the holiday period is expected to decline by US$46 billion this year compared to the previous year, with consumers (across all the markets analysed) set to cut back.

Fig 9: US$46 billion hit to Holiday shopping this year

Source: Retail Economics

This research shows that the UK is expected to face the sharpest decline in spending. Here, consumers are already facing double digit inflation, with the squeeze on personal finances expected to intensify in Q4. Consumer confidence is at a record low as recession looms, expected to hit commencing 2023, and to persist into 2024 as rising interest rates hamper growth.

These conditions present a bitter reality for retailers to swallow. By comparison, German consumers are cutting back to a lesser extent, reflecting a stronger economic backdrop going into the final quarter of the year. The impact will vary significantly by category, channel and retailer, which is... [extract]

What else can you learn from this report...

What categories are under pressure

Importance of the channel switch

How economics is impacting retail propositions

How businesses can adapt & thrive:

1. Defining a strong value proposition

2. Redefining customer experiences

3. Data, insights and personalization

4. Evolving operating models

5. Flexible supply chains

Download your FREE copy of this report by completing the form at top of page...