Retail at Inflection Point: A New age of Digital Transformation

5 minute read

We conducted qualitative research on over 100 listed companies to discover the level of their digital transformation strategies. We then measured the impact of digital sophistication on various financial indicators including sales growth, profitability and valuation.

This report is produced by Retail Economics in partnership with Alvarez & Marsal and it confirms that businesses that have continually driven digital transformation have reaped the fruits of their investments, achieving substantial financial rewards and competitive advantage over time.

If you're interested in teaming up with Retail Economics to create engaging thought leadership research like this, click here.

What can you get from this report?

• A better understanding of how digital sophistication can impact various financial indicators

• Digital transformation strategies

• Areas to focus on for leveraging digital technologies

• Examples of retailer's use cases of digital technologies

• Oppurtunities for growth

Report Contents

• Executive Summary

• Introduction

• Methodology

• Key Findings

• Conclusion

• Key Contacts

Introduction

The shape of retail continues to evolve with digital technology a critical enabler for retail brands. The sector has been deeply impacted by the pandemic, overcoming disruption brought by the rise of e-commerce, shifting consumer behaviour, and supply chains issues among other challenges. More recently, persistent inflation and the worst cost-of-living crisis in a generation have placed additional pressure on sales and profitability.

Our research reveals that businesses that have continually driven digital transformation have largely outperformed their peers, including during the tough business environment of the last few years. They have achieved greater efficiencies and stronger sales growth, resulting in increased market share, profitability and strengthened business models.

This advantage has been particularly strong for those players that invested in an omnichannel digital strategy, rather than a pure player one, especially given the rebalancing of online and physical sales that has been unfolding since the pandemic.

Methodology

In order to identify successful transformation programmes, our research measured a range of data points covering four digital transformation pillars for over 100 listed European retailers. Specifically, we look at online performance presence and metrics, social media activity and engagement, proportion of digital job roles, usage of software tools across various business

functions and digital partnerships, among other metrics.

A scorecard was then created to measure digital sophistication across each of the pillars before normalising the data to create an index used to segment companies into three cohorts:

• Digital Leaders

• Digital Followers

• Digital Latecomers

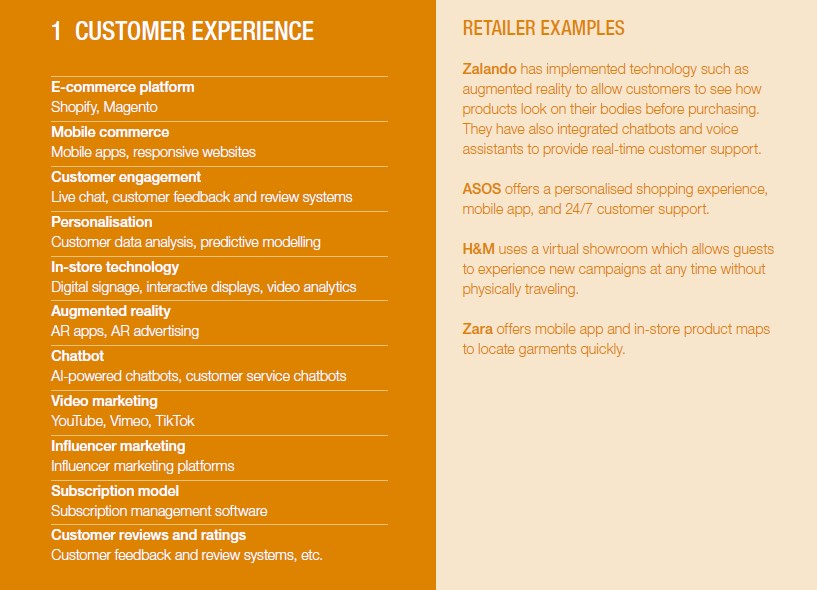

The following table summarises three critical areas of focus for retailers leveraging the benefits of digital technologies.

(Download the full report to access the rest of the table)

Key Findings

Key Finding 1: Investing in digital transformation has clearly paid off for retailers

Our research shows that Digital Leaders have seen higher levels of growth across sales, profitability and market share since 2015. In fact, they saw average sales growth of 00% over the last eight years; this is considerably higher than Digital Followers (00%) and Digital Latecomers (00%), in part driven by a superior omnichannel proposition using technology to create a consistent, relevant and blended customer journey across all channels.

While ‘Digital leaders’ are disproportionately comprised of large retailers, they continued to grow their market share during the pandemic.

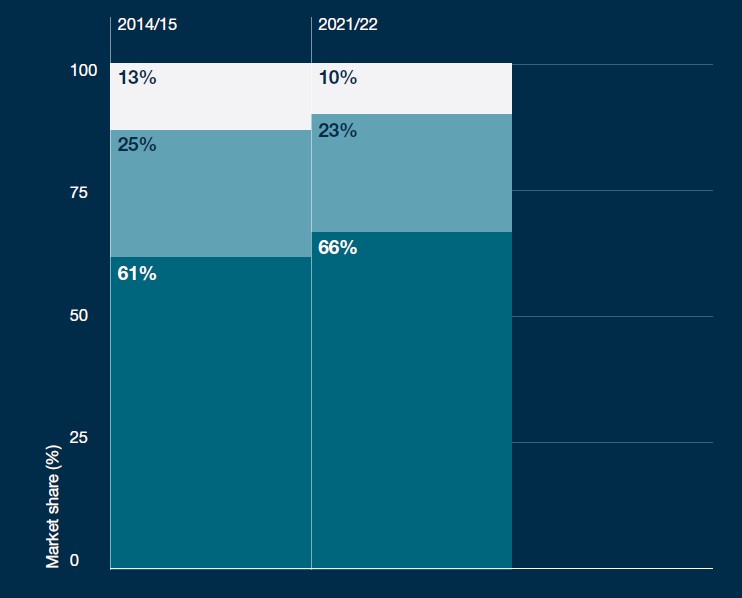

Fig 3: Market share by cohort (%)

Their investment in a strong digital proposition was shown to be crucial throughout the pandemic, particularly during lockdown. The ability to pivot sales through e-commerce platforms (particularly within non-food) ensured continued growth throughout the disruption as retailers were able to quickly scale online operations. Both Digital Followers and Latecomers experienced weaker sales, constrained by capacity, or were simply unable to switch to an online channel that was fit for purpose.

Digital Leaders also managed to increase their market share over the period, increasing from 61.4% of combined sales in 2014–15 to 66.5% in 2021–22. This market share increase did not come at the expense of profit margins. Our analysis shows that Digital Leaders experienced consistently higher margins and higher average return on assets (ROA), implying that Leaders leveraged assets to boost profitability more effectively than Followers or Latecomers.

Digital transformation within these businesses was also recognised by investors in terms of valuation, with Digital Leaders reporting multiples (EV/EBITDA) consistently higher than the other two groups. However, average valuation multiples have declined for all groups since 2015, with the largest drop seen across Digital Leaders. This has led to the valuation gap between the Leaders and Latecomers narrowing from 00 to just 00.

Indeed, some of the most digitally advanced retailers experiencing rapid growth over the last decade have operated a pure online model. Being ‘first-movers’ in some parts of the market, competition was low, capital was cheap, hence they experienced rapid growth in the online space as consumer adoption accelerated.

These dynamics suggest that some level of digital capabilities is, by now, somewhat a hygiene factor in the retail environment. In other words, digital engagement with consumers is potentially no longer the differentiator factor that it once was, especially when the cost of deploying basic digital retail capability has come down so much. Retailers will therefore need to work harder and be much smarter at building their competitive differentiation through digital; many are already doing that.