Customer acquisition costs

As in-store footfall metrics become less relevant to overall performance, apparel retailers need to invest to entice shoppers through their ‘virtual doors’. The average UK consumer spends 3 hours 37 mins per day online (on multiple devices), outside of work environments. This rises to 4 hours 34 mins for Gen Zs, which was boosted by the impact of the pandemic (Comscore, 2020).

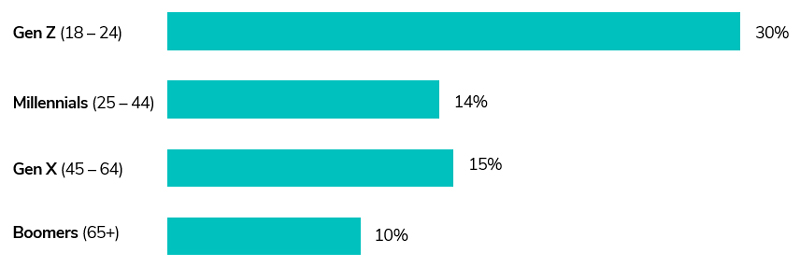

Social media is becoming an increasingly important part of the customer journey, especially for younger generations. 30% of Gen Z’s in the UK have purchased apparel online having first seen or discovered the product on social media (Fig. 5).

The average UK consumer spends 3 hours 37 mins per day online (on multiple devices), outside of work environments.

Consequently, the battle for consumer attention is increasingly being fought online, with ‘big tech’ (Google, Facebook, Snapchat, Instagram, Pinterest and TikTok) emerging as the ‘landlords’ of the digital environment.

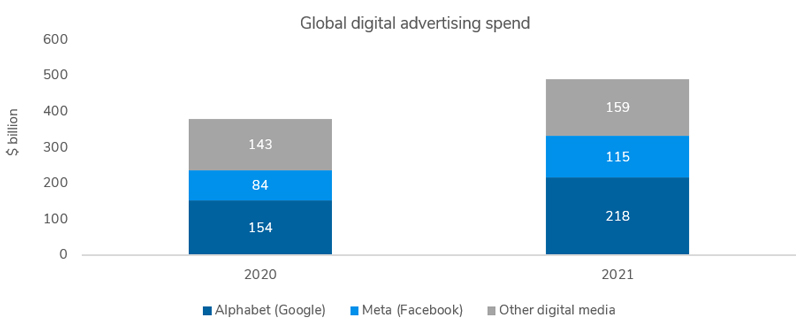

Alphabet (Google) and Meta (formerly Facebook) own nine of the top ten most popular mobile applications.Alphabet and Meta also accounted for 68% of global digital advertising revenues in 2021, and almost half of all expenditure on advertising that year (Fig. 6).

Figure 5. Social media is a key discovery tool for younger apparel shoppers

Source: Retail Economics

Customer acquisition costs are being driven higher as a result. As brands and retailers compete within the ‘attention economy’, full-scale bidding wars often ensue for online keyword search terms for SEO strategies. A decade ago, key search terms that apparel retailers were bidding on cost less than £0.50 – now they are upwards of £5 – a ten-fold increase.

Figure 6. Google & Facebook dominate global advertising market

Source: Retail Economics

Retailers excelling at customer retention enjoy the reduced cost burden of customer acquisition. With intense focus on ‘paid for’ web searches and social advertising, retailers can often pay multiple times to attract the same customer. Instead, placing similar levels of energy on re-engaging existing customers and driving lifetime value can be a more cost-effective strategy. Nevertheless, battling for customer attention online has become the new reality for most retailers, adding costs and further degrading profits.

Trend 2 - Reimagining stores: showrooms, micro-fulfilment & personalisation

The pandemic-induced shift to online and subsequent impact on store-based sales has magnified the urgency for retailers to adapt.

Physical stores can be of comparable value to digital channels – if they co-exist in a seamless, symbiotic relationship. As industry restructuring continues, the purpose of stores will evolve. As such, there will be a renewed focus on reimagining and repurposing physical stores to improve customer experiences.

Sensory showrooms

Online apparel purchases can be extremely convenient, but stores inject physical touchpoints and emotional dynamics that add considerable value to shopping experiences.

Online apparel purchases can be extremely convenient, but stores inject physical touchpoints and emotional dynamics that add considerable value to shopping experiences.

Our research shows that almost half (48%) of consumers said that the ability to touch, feel and try on products are the most important aspects of shopping in-store. The tactile experience of stores holds appeal to consumers of all ages, but particularly older generations (e.g. Gen X, Boomers) of whom over two thirds still prefer to ‘try before they buy’.

By honing in on high-touch, sensory-driven experiences, physical stores can better complement digital channels, fuelling online sales instead of competing against them.

Many concept stores function more like ‘retail showrooms’; they are designed to enable customers to try and test products, but actual purchases take place online or on the move. Simultaneously, retailers can educate consumers on products and services while supporting online sales via the ‘halo effect’.

Most online spend involves a physical store touch point during the customer journey (e.g. click and collect or ‘try before you buy’). Indeed, research shows that online sales at fashion retailers are 124% higher on average within the catchment area of a physical store than outside it.

Our research shows 30% of UK consumers regularly buy clothing online having first seen the product in store.

Showrooms can also be effective in building a brand and developing customer trust. The recent push of online retailers such as Amazon and Gymshark in opening physical stores reinforces the growing appreciation of bricks-and-mortar as an effective way to strengthen brand loyalty and secure lifetime value. But they can also be useful for retailers looking to pivot online and reduce their store footprint as they require less space to hold inventory.

Fulfilment hubs

By leveraging stores as micro-distribution centres, retailers and brands can implement faster and more convenient delivery solutions for customers, while simultaneously relieving supply chain pressures and utilise in-store stock more efficiently.

Levi’s was among several retailers that used its closed stores to fulfil online orders during the pandemic, helping speed up delivery times and preventing overcrowding in its distribution centres.

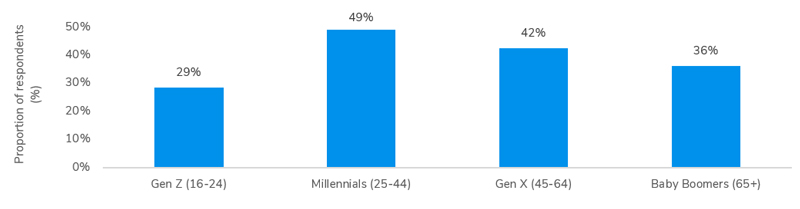

Almost half (49%) of UK millennials are more likely to visit an apparel store if they offer free click-and-collect.

The pandemic will accelerate the rise of ‘grey’ or ‘dark’ stores that mimic normal store operations but are more akin to a walk-in fulfilment hub, geared up for collection and returns.

Figure 8 – Physical touchpoints valued by all ages, but particularly older consumers

Source: Retail Economics

Click-and-collect services surged during 2020/21 with our research showing that consumers expect to increasingly use this service going forward. Click-and-collect is most popular amongst Millennials. This age group finds it convenient to collect an order as part of a work commute or school run, rather than risk being out and missing a home delivery.

Almost half (49%) of UK millennials are more likely to visit an apparel store if they offer free click-and-collect.

Personalised experiences

Today’s consumers crave unique and personalised shopping experiences. In a crowded marketplace, personalisation is a key differentiator which retailers and brands can develop to gain a competitive advantage.

Personalisation is particularly important for apparel where customer journeys are often complex and rarely linear. Each shopper has their own individual style and preferences, and the path to purchase often spans multiple devices and channels – online and offline. Personalisation is a potent sales tool, offering superior leverage for conversion.

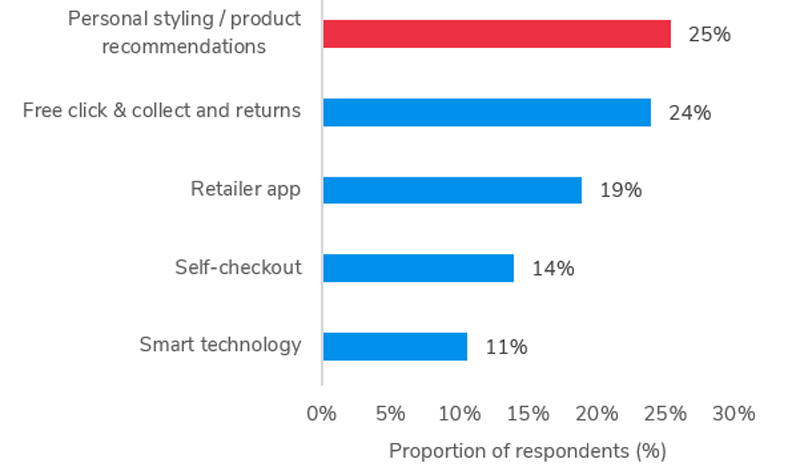

Our research shows that highly personalised services are a key pull factor for physical stores. One in four shoppers said they would be more likely to visit an apparel store if they offer personal styling and bespoke product recommendations (Fig 9).

One in four shoppers said they would be more likely to visit an apparel store if they offer personal styling and bespoke product recommendations.

Personalisation is valued most by Gen Z consumers who enjoy being able to customise products. Personalised offerings, such as Spotify playlists and Netflix recommendations, already play a key role in their everyday consumption; and they increasingly seek a similar personalised experience from retailers and their stores.

Figure 9 – Personalised service valued by consumers

Source: Retail Economics

Physical stores can also act as ‘playgrounds’ for consumers by generating interest and creating brand buzz. The fusion of entertainment and retail is likely to...

Download this free report for all the insights > complete the form at top of page...

Trend 3 - Digital innovation: Social commerce & the metaverse

As digital uptake soars, so does the need for apparel retailers to innovate and embrace new technologies.

During the pandemic, digital innovation focused on the need to quickly upscale online capacity and help bridge the gap between physical and digital. Many retailers invested significantly in more sophisticated digital marketing campaigns, automated fulfilment systems and innovative shopping features (e.g. livestreaming, customer service video chat). In many cases, the pace of digital transformation accelerated plans by years, in just a matter of months.

In a post-pandemic world, retailers will need to elevate their digital propositions even further. As shoppers increasingly demand more sophisticated digital interaction, apparel retailers must optimise online capabilities while continually discovering new ways to entice customers. Examples include using augmented reality (AR) and building next-generation mobile apps that check stock availability and support self-checkout.

Social commerce

Around one in five UK shoppers have used their smartphone while shopping in an apparel store to help with their purchasing decision, including for price comparison, checking social media, or to use a retailers’ mobile app.

This will continue to rise over the coming years as retailers better integrate mobile into the store experience to meet growing expectations from younger generations in the future.

Social commerce in particular presents huge opportunities for the apparel industry, leading to creative solutions for marketing, design and new revenue streams.

Many aspects of social commerce (e.g. checking out using apps, purchasing products within the social media ecosystem) allow apparel retailers to lessen friction within the customer journey while also offering creative marketing solutions. China is arguably leading in this field where super-apps like WeChat offer users a wide range of functions – beyond social networking.

Instagram, Pinterest and TikTok are all enhancing their... [excerpt]

The metaverse

Although it is still immature and conceptual for the most part, certain fashion brands have moved early to explore possibilities with virtual stores and merchandise.

For example, Nike partnered with Roblox in 2021 to develop ‘Nikeland’, a virtual world featuring sports fields, arenas and showrooms to offer Nike gear, alongside the opportunity to unlock ‘superpowers’ and explore the future of virtual sports.

Gucci also partnered with Roblox during the pandemic to create Gucci Gardens, a virtual version of the Gucci Garden in Florence that includes a Gucci Store, Gucci Museum and Gucci restaurant. During this virtual event, Gucci allowed user to buy a Queen Bee Dionysus bag for 475 Robux, or $5. The bag was only on sale for 1 hour, creating scarcity for the limited digital product. One of these virtual bags was later sold for over $4,000 – more than the actual bag in real life.

In time, it is possible that apparel brands and marketers will realise that the metaverse is another ‘place’ – not just another channel.

If the metaverse is widely embraced, retailers and brands will need a radical rethink when considering the types of products and services they will offer. It is likely that they will need to consider a shift in brand positioning and proposition to remain relevant in a new digital age defined by more immersive experiences. Retailers will need to think carefully about how... [excerpt]

Data analytics

Data analytics generated through social commerce and digital integration more broadly can give retailers powerful insights into their operations

Using data science, apparel retailers can identify their most profitable customer base from customer segmentation and profiling. It also allows a deeper understanding of their customer’s needs and requirements to help predict future behaviour.

Looking forward, with advanced data analytics and capabilities, retailers will be able to segment customer cohorts into ‘groups’ of one – the individual. Here, hyper-targeted promotions, bespoke pricing, and meaningful messaging offering genuine advice and guidance will be the marketing ‘gold standard’ many retailers will... [excerpt]

What's in the rest of this report?

Retail insight still to explore...

The full content from the first three sections

Trend 4: Supply chains: Mitigating disruption & cost pressures

Trend 5: ESG & the circular economy: From fast fashion to resale

Conclusion

Download your free pdf report for all the insights > complete the form at top of page...

We hope you found this article interesting. For more insights and industry analysis be sure to connect with us.

About this report

This thought leadership report was produced by Retail Economics and identifies five key industry trends that will shape the apparel market (clothing & footwear) towards 2025. It forms the second report in a series which looks at category-specific trends to 2025 (explore our Grocery Trends report here). These insights are critical for retailers and brands in order to enhance their performance by using data-driven research to underpin more sophisticated strategies.

View All THOUGHT LEADERSHIP REPORTS