The Cost of Serial Returners in 2024

5 Minute Read

£27 billion in online returns are reshaping the economics of UK retail

We surveyed 2,000 UK households to better understand online returns behaviors across all major retail categories. This is what we found...

What can you learn from this report?

-

Discover how £27 billion in online returns are reshaping the economics of UK retail

-

Understand the four key returner profiles and their impact on your bottom line

-

Learn how 15.5% of delayed returns are putting £9.8 billion of stock value at risk

-

Access data-driven strategies to combat costly return behaviors while maintaining customer satisfaction

-

Get actionable insights on technologies and policies that can help reduce return rates

Key findings

-

Online returns will reach a staggering £27 billion in 2024

-

Serial returners (11% of customers) generate nearly a quarter of all returns

-

66% of shoppers prioritize convenience over environmental impact when returning items

-

Generation Z takes 7 days longer to return items compared to Baby Boomers

Contents

- Introduction

- Section 1: Online and the evolution of returns

- Section 2: Quantifying the returns issue

- Section 3: The future of returns

- Conclusions

The Cost of Serial Returners in 2024: Annual Returns Benchmark Report

Introduction

As ecommerce thrives, a silent crisis of serial returns is eroding retail profit margins like never before. Beyond financial losses, online returns create both operational and sustainability challenges for retailers. Through detailed insights, this Annual Returns Benchmark Report 2024 quantifies the magnitude of this problem and provides critical insights into how to approach the issue as consumer expectations soar. It provides those operating in retail (and related services) with actionable strategies to better manage the rising tide of returns to help protect profitability while strengthening customer relationships.

As customer journeys become more complex and macroeconomic conditions increasingly challenging, ‘opportunistic’ shopping behaviours have plagued brands whereby shoppers show little hesitation in returning large volumes of goods. These behaviours have partially reshaped the economics of ecommerce, adding margin pressure and operational inefficiencies to retail businesses models.

Serial returners, though representing a minority of all customers, contribute disproportionately to overall return volumes. Their tendency to overorder, coupled with slow return habits, means that a significant number of items are returned past peak sales periods, lowering the chances of resale at full value. This is highly problematic for sectors like fashion where product lifecycles are short.

As a result, retailers are now experimenting with measures such as charging for returns to mitigate costs. These new paid returns policies are designed not only to protect margins, but also to discourage ‘irresponsible’ purchasing behaviour.

Furthermore, there are clear generational divides when it comes to return habits. Younger consumers tend to return items more frequently and are often more concerned with convenience than cost. Conversely, Baby Boomers and Gen X prioritise simplicity in the returns process but may return less frequently. This generational divergence, coupled with differences by product category, leaves a single solution unfit for purpose. A delicate balance lies in minimising losses while maintaining customer satisfaction. As such, retailers must consider tailoring returns policies based on customer segmentation.

The importance of effective returns management cannot be overstated. With profit margins already strained, understanding which customers are the most profitable – and which drive excessive returns costs – has become crucial.

This report also sheds light on the broader industry trend of embedding sustainability into the returns process. Paid returns, for instance, not only help retailers recover some costs, but also align with consumer awareness about environmental impacts.

Our report is divided into three key sections:

1. Online and the evolution of returns: An overview of the impact of ecommerce on returns, generational shifts in consumer expectations, and the rise of returners.

2. Quantifying the returns issue: A data-driven analysis of return values, the relationship between order value and return rates across different product categories, and returner cohorts and their characteristics.

3. The future of returns: Strategies for addressing returns, including the use of technology, data, and tailored policies to balance customer satisfaction with profitability and sustainability.

Section 1: Online and the evolution of returns

n recent years, retail has experienced a step change in the way consumers shop. Today, many customer journeys are highly complex. They blend both digital and physical touchpoints at every stage, particularly for non-food products. Total online retail sales in the UK have more than doubled from a little over 10% a decade ago to over 25% today (Fig. 1). For non-food categories like clothing, footwear and homewares, the role of online in conversion is far greater, with the proportion of retail sales made online now accounting for over a half of total non-food sales.

Convenience matters in the digital revolution

The rise of digital technology has provided new opportunities for non-food retailers, especially for those able to adapt to the rapid pace of change. However, it has also introduced significant operational challenges as retailers face unprecedented volumes of returns—volumes that were never a concern in single-store operations.

Over the past decade, technology has enabled seamless channel integration with innovative and exciting ways of interacting with consumers across the entire retail ecosystem. Conversely, it has also encouraged ‘opportunistic’ behaviours among many consumers. purchases now being returned. This significantly impacts both profitability and customer satisfaction.

Our research shows that convenience is the top priority for online shoppers, with two-thirds (66.3%) of respondents rating it as highly important when selecting a return method. The most preferred return method is via Post Offices (28.1%), followed closely by courier collections (27.1%), then returns via convenience stores (16.1%) (Fig. 2).

In 2023, we allowed respondents to select multiple carrier options for their returns, as opposed to just selecting their ultimate favourite this year. But the results showed an eerily similar trend. The order of preference remained exactly the same as last year, with the Post Office being used by 57.7% in first place and Return to a Locker the least (but still significantly) used at 24.1%.

Fig 2: Shoppers now expect a range of return options

Environmental considerations

At the heart of returns behaviour is inefficiency. It leads to waste and environmental impacts. As the UK transitions to net zero over the next decade, retailers are coming under scrutiny from governments, investors, and consumers to act sustainably. This is particularly evident in the fast fashion industry, where cheap imports and returned items that cannot be resold often go to waste as they fall out of season or trend.

Despite sustainability concerns, only 30.0% of consumers prioritise environmental factors when selecting a returns method, with cost and convenience being dominant factors. In fact, half (49.8%) of shoppers would be discouraged from making environmentally friendly returns if it incurred additional costs, and over a third (34.6%) would avoid it if it required more effort or was less convenient.

Fig 3: Convenience and cost of returns matters most to online shoppers

Q: How important, if at all, are the following factors when choosing a return method for online orders?

Source: Retail Economics, ZigZag

Section 2: Quantifying the returns issue

As online shopping continues to grow, UK retailers face unprecedented financial and operational challenges that are only compounded by a new wave of serial and slow returners. These ‘returners’ expect low-cost, long return periods and often return a high proportion of their purchases with minimal consequences. Such behaviours are reshaping the economics of ecommerce, though the true cost of returns is rarely disclosed by retailers.

In this section, we quantify the value of UK returns across non-food retail, using economic modelling and consumer behaviour insights. We examine the relationship between return rates, order values, and consumer segments, as well as how returns vary across product categories.

2.1 Returns values across non-food retail

Online returns have reached a tipping point where retailers are compelled to take action to mitigate impacts. We forecast that online UK returns will tip £27bn in 2024, with online sales across nonfood retail climbing to £102bn after returns are accounted for (Fig. 4).

Fig 4: Proportion of online returns forecast to hit £27.3 billion in 2024

Forecast for 2024 Source: Retail Economics, ONS

The four returner profiles

Our research identifies four distinct returner profiles, each requiring different management strategies:

-

Serial Returners (11%): Frequently over-order with intention to return

-

Slow Returners (11%): Delay returns, often missing peak resale periods

-

Efficient Returners (31%): Return promptly, typically with valid reasons

-

Occasional Returners (43%): Rarely return items unless seriously dissatisfied

The returns crisis

As ecommerce continues to thrive, retailers face unprecedented challenges from a new wave of return behaviors. Our research reveals concerning trends:

-

'Bracketing' - 27% of shoppers deliberately over-order sizes and colors

-

'Wardrobing' - 15.6% buy clothing just for short-term use

-

'Staging' - 14.5% purchase items solely for social media content

Section 3: The future of returns

The research reveals critical opportunities for retailers to transform their returns management, but success requires a strategic approach:

-

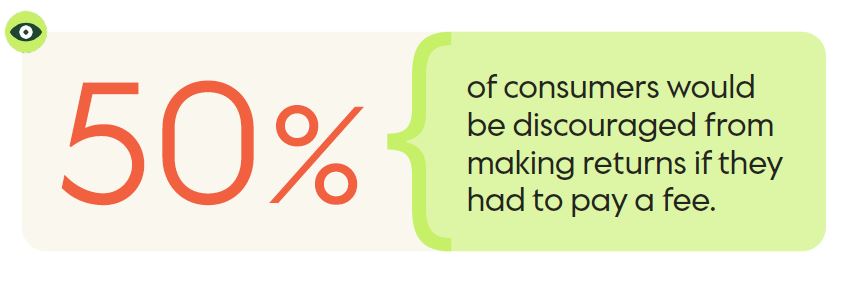

50% of consumers would be discouraged from returns by fees - but only 33.9% of serial returners

-

Two-thirds prioritize convenience over sustainability in returns choices

-

Gen Z and Millennials are most likely to exploit returns policies for profit

Download the full report to get more insights about the future of returns...