From Brexit to Breakthrough: UK Brands Embrace Marketplaces for Global Success

5 Minute Read

Our report, 'From Brexit to Breakthrough: UK Brands Embrace Marketplaces', developed in partnership with Tradebyte, offers essential insights into UK retail transformations, digital marketplace strategies, and global expansion post-Brexit.

Below are some exerts from the report, download the full report to access even more insights and data.

Click here to explore working with Retail Economics for creating thought leadership papers like this.

What can you get from this report?

-

Explore innovative strategies for leveraging digital marketplaces for UK retail success in a post-Brexit world.

-

Understand the critical disruptions in UK-EU trade flows and evolving export dynamics impacting UK brands.

-

Access strategic insights for navigating future retail challenges, emphasising digital channels and marketplace integrations.

-

Discover how UK brands can turn post-Brexit challenges into opportunities through strategic use of digital marketplaces.

Contents:

-

Introduction

-

Evolution of Online Marketplaces and Expectations

-

Export Distruption and Evolving Trade Flows

-

The Future of Marketplaces

-

Conclusion

Introduction

In a post Brexit world, the UK retail industry has undergone significant transformation. For UK sellers wanting to leverage the EU’s lucrative market, the competitive dynamics have now evolved considerably. With Brexit reshaping many rules of international trade, the path to expansion has become fraught with challenges, including heightened export costs and intensified competition. Amidst these challenges, digital marketplaces have risen as crucial enablers of growth, providing a platform for innovation and access to wider markets. Platforms like Asos Marketplace, About You and Zalando have become essential in this new reality, serving as growth beacons in a competitive global arena.

The significance of digital marketplaces has been magnified by key trends, these include: (1) the accelerated digital transformation within retail; (2) the integration of AI to enhance customer experience and personalisation; (3) the adoption of circular economic principles such as re-commerce; and (4) consumer demands for better value amidst financial pressures. These developments have carved out a critical role for online marketplaces in ensuring competitiveness, streamlining operations, and fostering consumer engagement in more sophisticated ways.

Today, demand for technology-driven shopping experiences that merge the physical and digital worlds is higher than ever, with personalisation and community engagement at the core of marketplace strategies. Also, consumer expectations have soared, partially due to instant access to online information and smartphone use.

As brands navigate through a dual crisis of heightened living and operational costs, with consumers growing increasingly price-sensitive, digital marketplaces have emerged as the new giants of the retail world. Capturing nearly half of Europe's online sales, they provide a critical nexus for brands and retailers to explore new territories and forge paths to revenue diversification and growth.

This report looks at UK retail trade flows since Brexit and the pandemic. The analysis not only serves as a great resource for understanding current trends, but also sets the stage for identifying new growth potential overseas. By leveraging digital channels, particularly marketplaces, UK brands and retailers can navigate and overcome these emerging challenges, turning them into opportunities for expansion and success.

The report features three main sections:

-

The backdrop for UK marketplaces: The evolution of marketplaces in the UK, marking their rise from simple transactional platforms to complex ecosystems that cater to a diverse range of seller and consumer needs.

-

Export disruption and evolving trade flows: Proprietary analysis on the shifts in UK-EU retail trade patterns, highlighting the integral role of marketplaces in this new trade landscape.

-

The future of marketplaces: A forward-looking perspective on three key areas where marketplaces play a fundamental role in the future of retail.

Evolution of Online Marketplaces and Expectations

Put simply, online marketplaces are dynamic digital platforms that connect buyers and sellers. They offer a range of new and second-hand merchandise across various categories and can be considered the digital equivalent of department stores. Depending on sophistication, marketplaces can facilitate online transactions, help track orders, and offer feedback opportunities amongst many other features to enhance the shopping experience.

Historically, marketplaces provided a route to market to enable brands to tap into larger, international audiences. They played a key role in providing payment services and marketed via traditional media to attract buyers and sellers. However, online marketplaces today are considerably more sophisticated, even a decade on, with much more functionality.

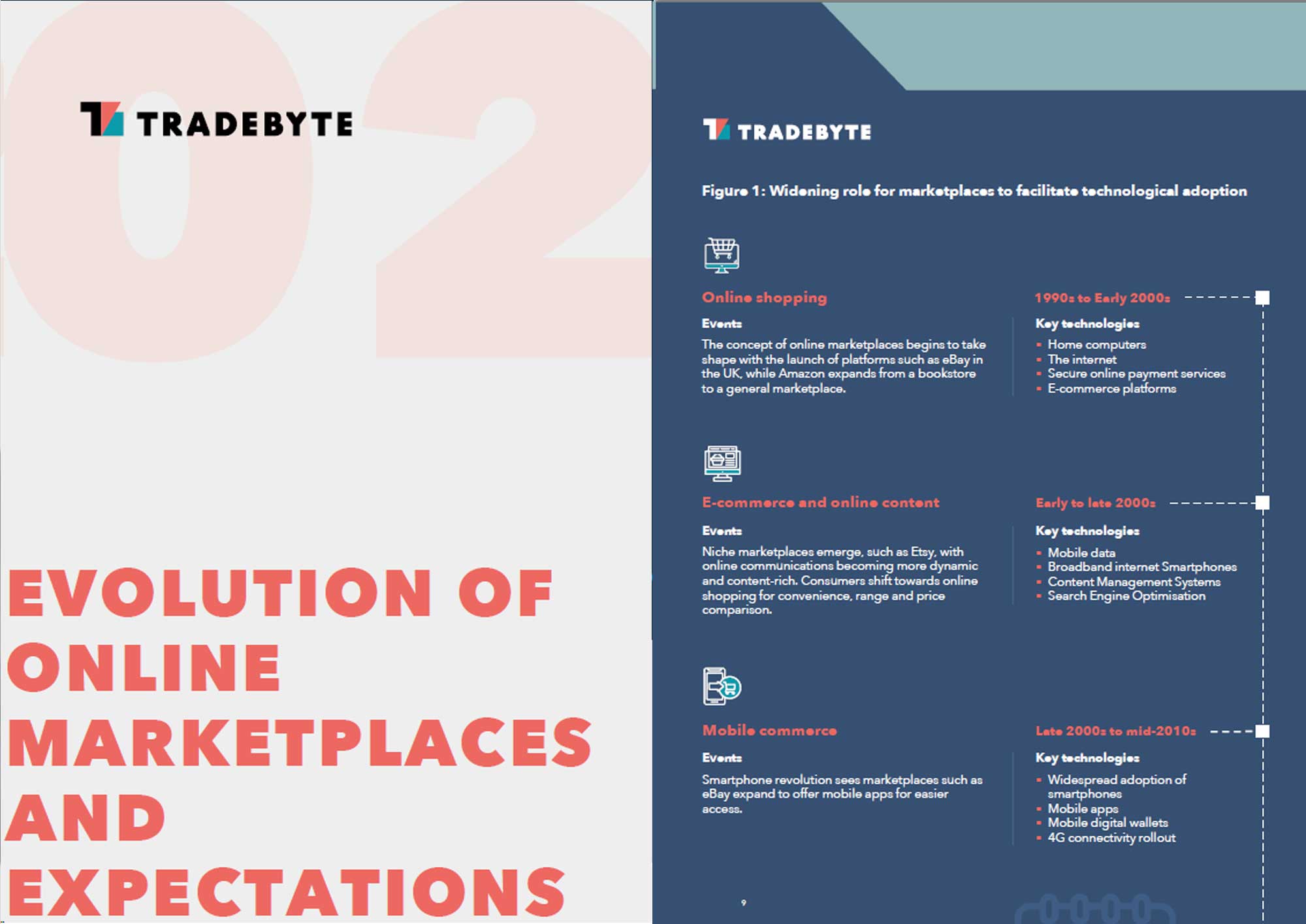

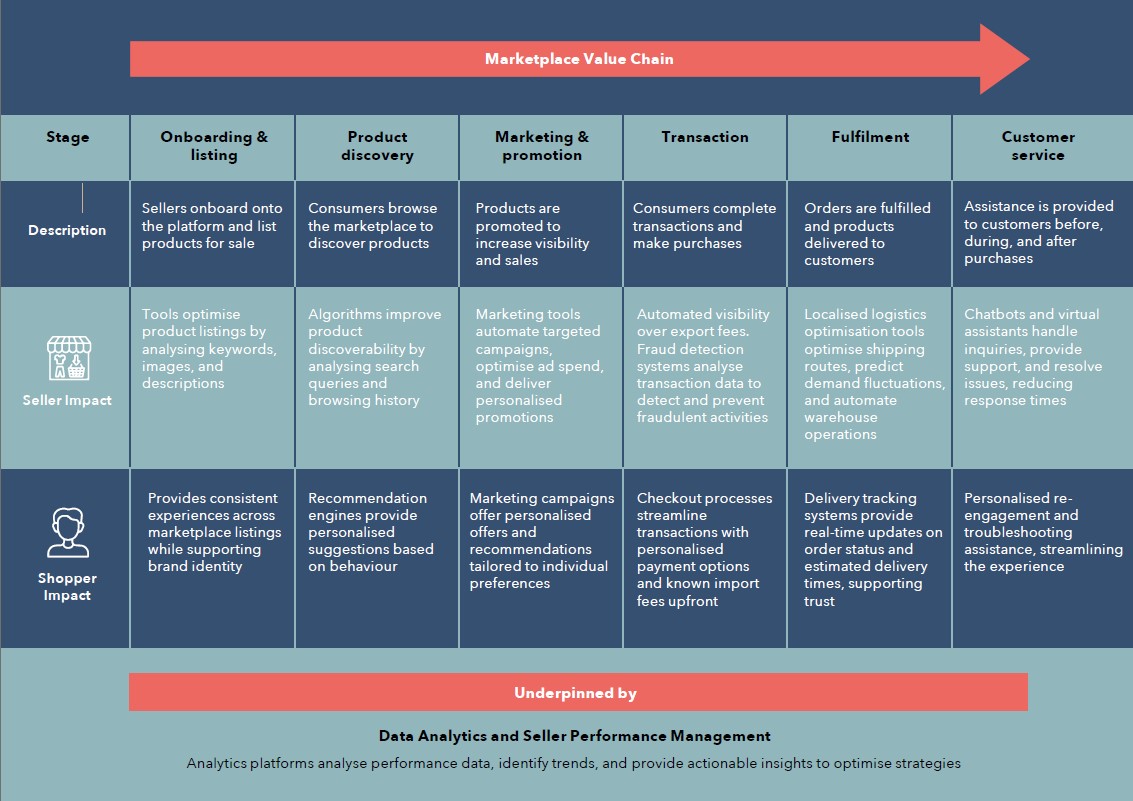

Naturally, much of this development is down to technological advancements as shown in Figure 1. Throughout this time, marketplaces have continuously shaped the way consumers discover, interact, and purchase products online; with each phase offering new tools to attract and retain customers, optimise operations, and differentiate in a competitive market.

Evolving Customer Expectations

Marketplaces not only sell products, but also offer services to help sellers of all sizes, from major brands and retailers to individuals. This comes amid technological development and rising consumer expectations where ‘anything, anytime, anywhere’ is a mindset which often underpins behaviour.

Today, shoppers unconsciously bounce between digital and physical channels throughout the entire customer journey (particularly younger digital natives). This can involve discovering new products on social media while browsing in-store, purchasing online for click-and-collect delivery, while seeking returns through drop-off points close to home. As such, customer journeys are now more complex with diverse customer expectations across different demographics.

In this context, marketplaces play a key role in meeting consumer expectations. They provide convenient and personalised experiences, offer shoppers extended ranges, give them the ability to quickly compare products on a single platform, and serve relevant messaging which helps conversion.

Shoppers are typically attracted to marketplaces in three key ways:

-

Convenience: Many marketplaces are essentially a one-stop shop (category dependent) offering a vast product range on a single platform, as well as fulfilment and returns options. This eliminates the need to visit multiple websites, reducing browsing and checkout friction.

-

Validation: Trusted marketplaces provide assurance of authenticity, quality and value to validate the credibility of brands when shoppers look to discover new products.

-

Personalised experiences: Marketplaces leverage consumer data to deliver targeted and personalised product recommendations and promotions that supports the discovery of new products, conversion and loyalty.

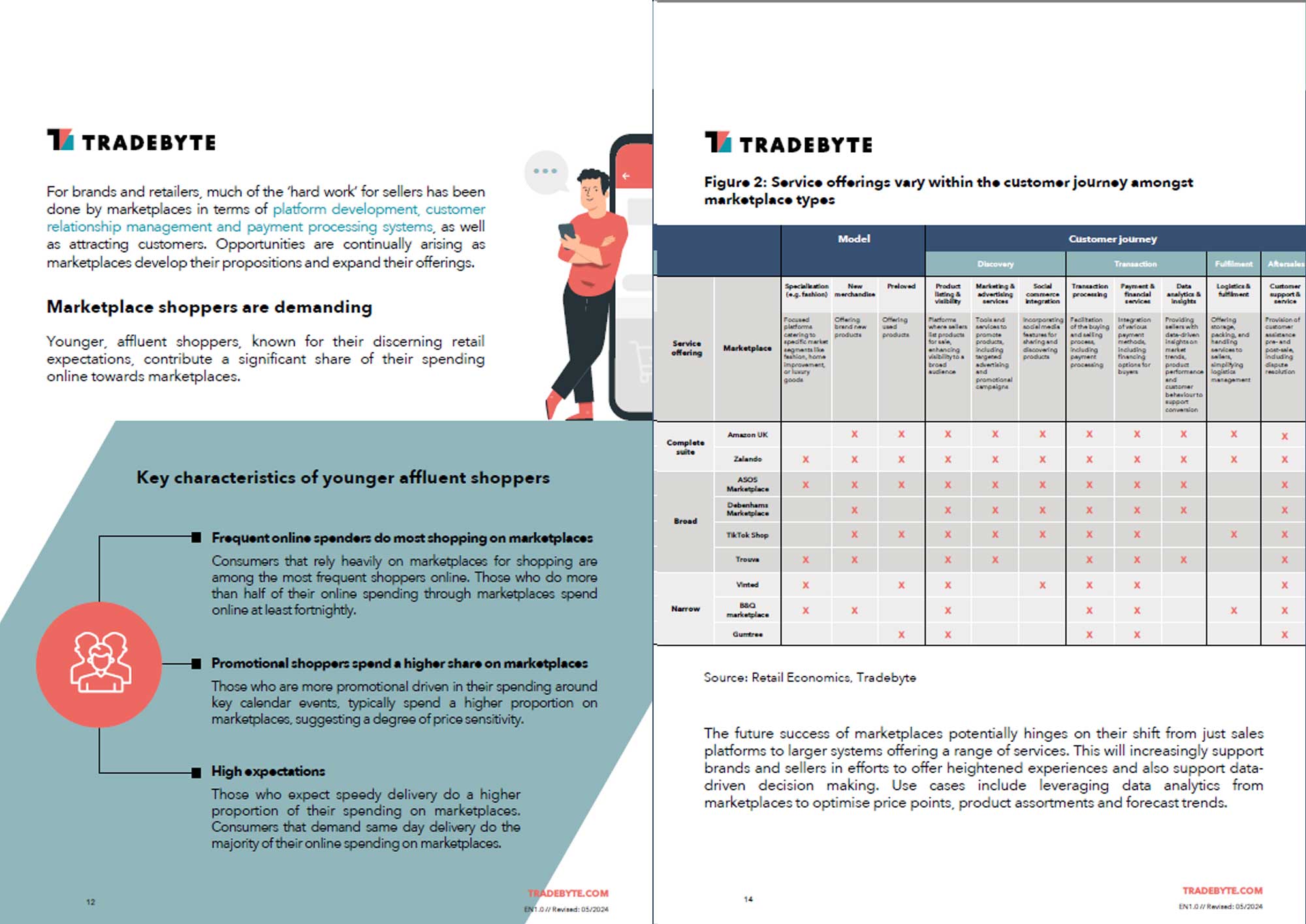

For brands and retailers, much of the ‘hard work’ for sellers has been done by marketplaces in terms of platform development, customer relationship management and payment processing systems, as well as attracting customers. Opportunities are continually arising as marketplaces develop their propositions and expand their offerings.

Marketplace shoppers are demanding

Younger, affluent shoppers, known for their discerning retail expectations, contribute a significant share of their spending online towards marketplaces.

Marketplace Models

Online marketplaces have developed beyond traditional 'pure' platforms to a point currently where three other distinct models dominate. These include:

-

Hybrid marketplaces: Combine wholesale or own-label sales with third-party offerings, competing directly in the same marketplace and known for quick adaptation to market trends at scale (e.g. Amazon, Shein). These are typically ‘open marketplaces’, allowing any business to sell on its platform providing registration requirements are met.

-

Retailer-operated marketplaces: Managed by a single retailer offering third-party brands access to their platform and logistics support such as warehousing and fulfilment (e.g. Next Plc’s Total Platform (TP)). These are ‘closed marketplaces’, restricted to third-party sellers curated and onboarded by the retailer.

-

Social commerce: Operated by social media giants with e-commerce integration, providing immersive shopping via content and in-app purchases, while expanding into logistical support like inventory and shipping management (e.g. TikTok Shop).

Broadening Service Offer

Marketplaces are not just venues for transactions but have matured into ‘mini ecosystems’ in themselves. Figure 2 features a sample of online marketplaces (not an exhaustive list). They range from generalists like Amazon, which offer a full suite of services, to niche players like Vinted, which provide more targeted offerings. These platforms have become the bedrock for many retail journeys, increasing product awareness, streamlining transactions, and offering logistical support (3PL). Collectively, they present a comprehensive mix of platforms aimed at optimising the retail experience for both sellers and consumers.

Fig 2: Service offerings vary within the customer journey amongst marketplace types

Source: Retail Economics, Tradebyte

The future success of marketplaces potentially hinges on their shift from just sales platforms to larger systems offering a range of services. This will increasingly support brands and sellers in efforts to offer heightened experiences and also support data-driven decision making. Use cases include leveraging data analytics from marketplaces to optimise price points, product assortments and forecast trends.

(Download the full report for the rest of this section)

Export Distruption and Evolving Trade Flows

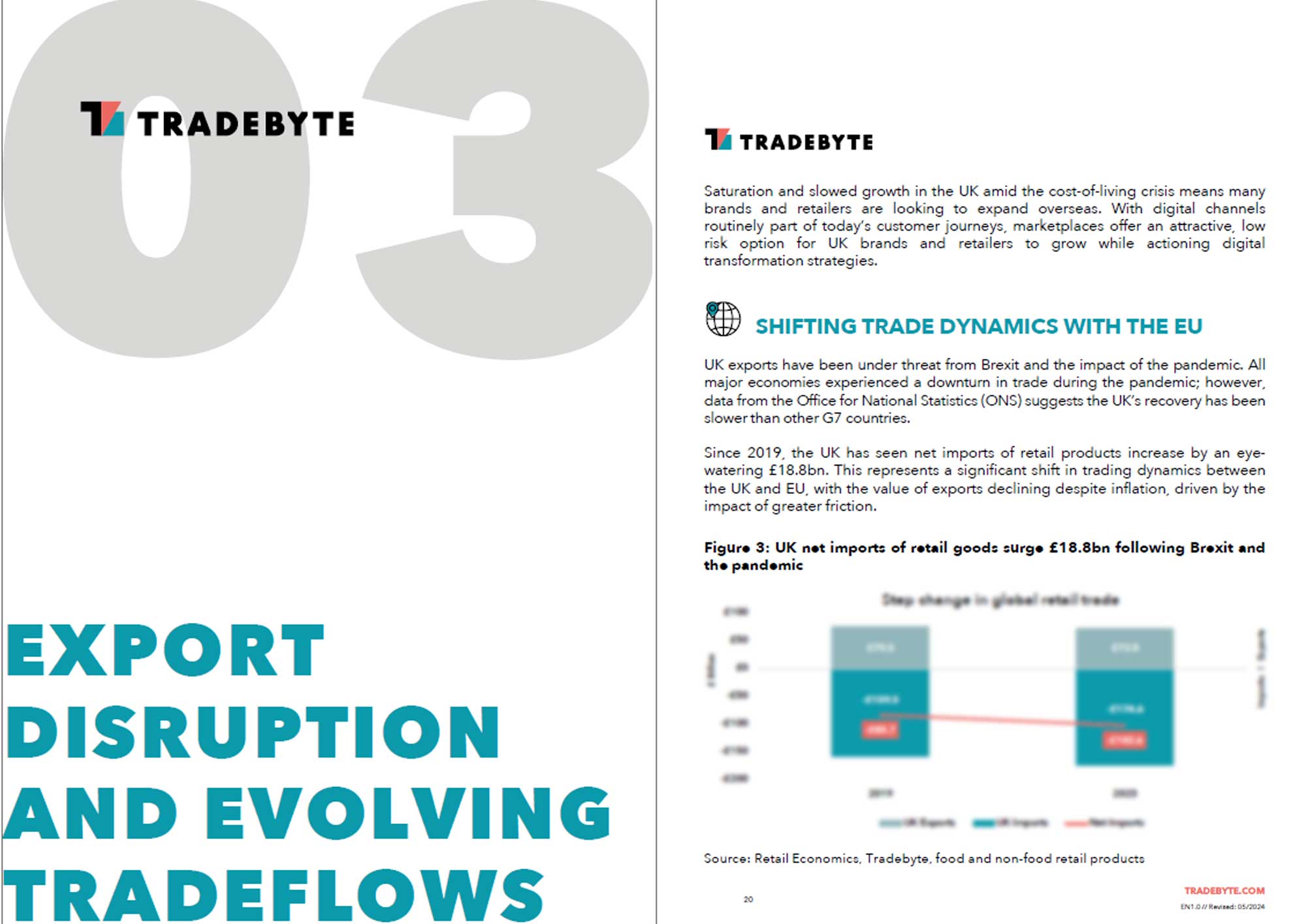

Saturation and slowed growth in the UK amid the cost-of-living crisis means many brands and retailers are looking to expand overseas. With digital channels routinely part of today’s customer journeys, marketplaces offer an attractive, low risk option for UK brands and retailers to grow while actioning digital transformation strategies.

Shifting Trade Dynamics with the EU

UK exports have been under threat from Brexit and the impact of the pandemic. All major economies experienced a downturn in trade during the pandemic; however, data from the Office for National Statistics (ONS) suggests the UK’s recovery has been slower than other G7 countries.

Since 2019, the UK has seen net imports of retail products increase by an eye-watering £18.8bn.

This represents a significant shift in trading dynamics between the UK and EU, with the value of exports declining despite inflation, driven by the impact of greater friction.

Fig 3: UK net imports of retail goods surge £18.8bn following Brexit and

the pandemic

Source: Retail Economics, Tradebyte food and non-food retail products

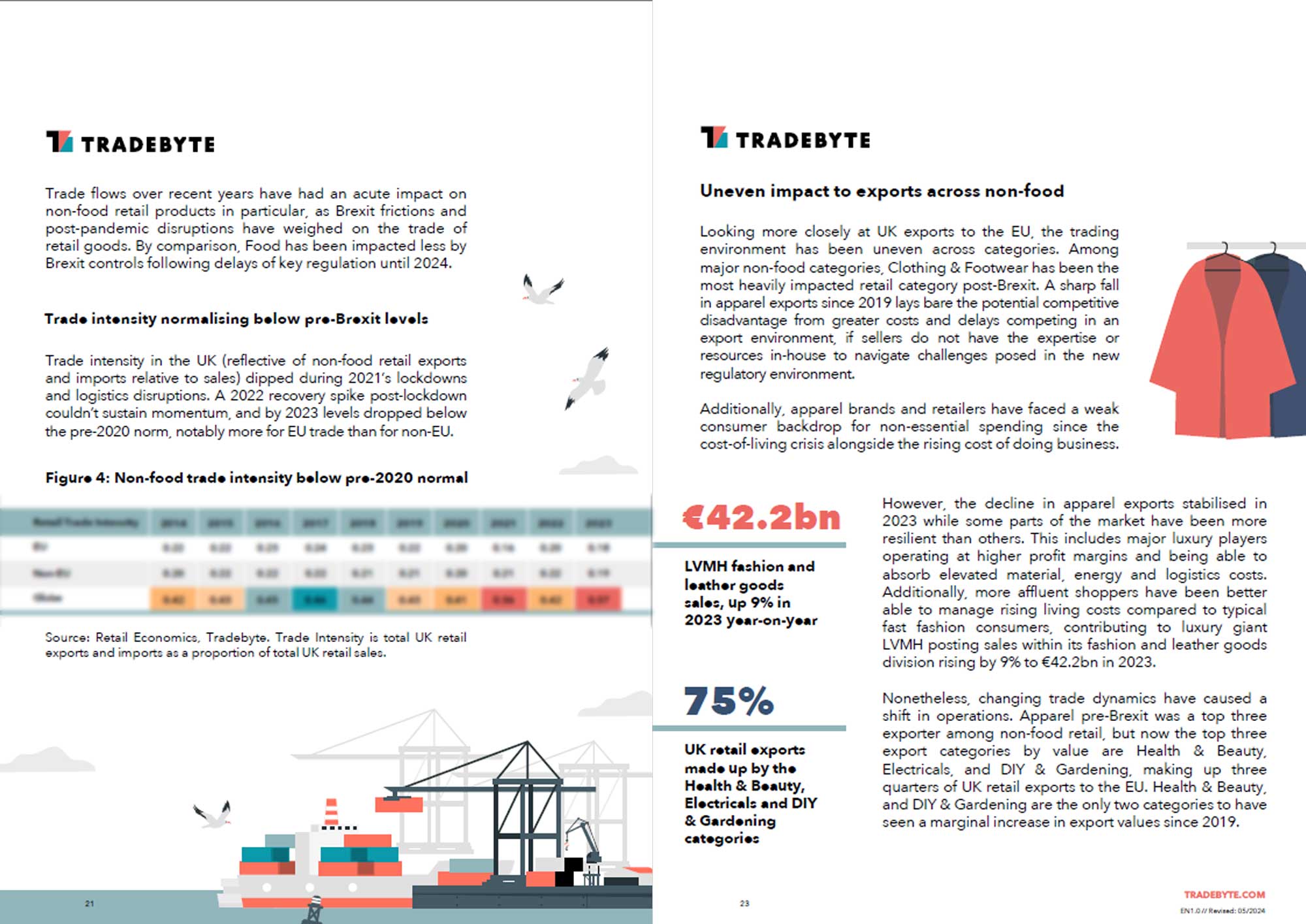

Trade flows over recent years have had an acute impact on non-food retail products in particular, as Brexit frictions and post-pandemic disruptions have weighed on the trade of retail goods. By comparison, Food has been impacted less by Brexit controls following delays of key regulation until 2024.

Trade intensity normalising below pre-Brexit levels

Trade intensity in the UK (reflective of non-food retail exports and imports relative to sales) dipped during 2021’s lockdowns and logistics disruptions. A 2022 recovery spike post-lockdown couldn’t sustain momentum, and by 2023 levels dropped below the pre-2020 norm, notably more for EU trade than for non-EU.

Fig 4: Non-food trade intensity below pre-2020 normal

Source: Retail Economics, Tradebyte. Trade Intensity is total UK retail exports and imports as a proportion of total UK retail sales

Changing dynamics with EU impacting exports

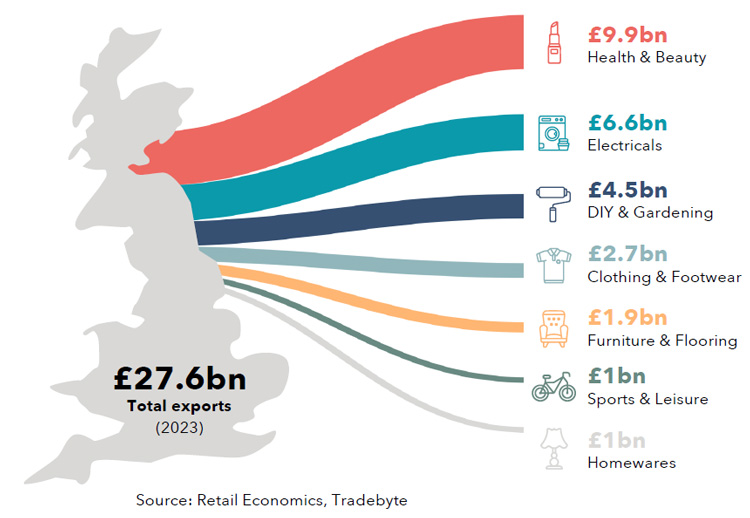

The UK is importing non-food products at a broadly similar rate to pre-pandemic levels, but is essentially exporting less to the EU since 2019. As pandemic impacts subside and Brexit policies ‘settle’, UK exports for non-food to the EU shrunk in 2023, compared to 2019 from £33.6bn to £27.6bn. This means that the UK remains a net importer from the EU. Key impacts include:

-

Market exit: Additional paperwork and costs following Brexit may not be viable for small businesses on both sides, including UK firms looking to export to the EU and EU firms looking to sell to the UK.

-

Pandemic supply chain challenges: Global supply bottlenecks are likely to have contributed to the weakness in some EU demand for UK exports, with new relationships forming in other markets.

-

Preparation pre-Brexit: Stockpiling likely to have supported EU demand in 2019 before the UK’s departure from the EU.

(Download the full report for the rest of this section)

Download: From Brexit to Breakthrough: UK Brands Embrace Marketplaces for Global Success report

NOTE: We will never sell, rent or pass on your details to a third party.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)