Top 5 strategies for retailers & brands to combat rising inflation & operating costs

10 Minute Read

To explore the option of teaming up with Retail Economics for the creation of high-quality thought leadership research similar to this, please click here.

This report highlights our top five operating strategies for retailers and brands to better understand what they can do to combat rising inflation and operating costs (and squeezed household incomes) in order to survive another wave of significant disruption. Also, with current economic conditions, sales and marketing strategies require increased sophistication. The insights in our report are critical for businessess seeking cyclical improvement of strategies to address these emerging challenges.

The report is divided into 7 main sections:

Introduction

Strategy 1: Define a strong value proposition

Strategy 2: Evolving operating models

Strategy 3: Leverage data science

Strategy 4: Develop resilient supply chains

Stragegy 5: Redefining customer experiences

Conclusion

Introduction

More change has occurred within the retail industry in the last decade than in the previous century. Successive waves of disruption have permanently altered much of the landscape, with the rise of digital, the shift to online, evolving consumer values, a global pandemic, and geopolitical tensions all forcing changes in ways that were once unimaginable.

Supply chains have been dislocated, business models have been stress-tested, and public health and wellbeing have suffered tremendously. Today, as the world begins to slowly recover from Covid-19, anxieties swiftly move towards the Russia-Ukraine conflict. This is putting further pressure on supply chains due to escalating energy costs with rising inflation compounding matters. As such, the public health crisis has morphed into an economic one, plunging Europe into a cost-of-living crisis not seen in over 50 years.

A combination of rising costs for global commodities (e.g. oil, natural gas, grain), transport (e.g. shipping, containers), labour shortages and ongoing disruptions from the pandemic have caused significant cost pressures which continue to filter through the supply chain. The speed and magnitude of these pressures differ widely by country and industry, based on factors such as the length of supply chain, hedging strategies, margins and supplier contracts.

Nevertheless, consumer prices remain on an upward trajectory. Some forecasts predict double digit inflation by the end of 2022 for major economies across Europe, urging central banks to carefully balance tightening monetary policy with economic growth. Indeed, the Bank of England raised interest rates for the fourth consecutive time in May 2022, reaching the highest level since the 2008 global financial crisis. Meanwhile, the European Central Bank (ECB) has confirmed it will end its net asset purchases in the third quarter of 2022, opening up the possibility of a rates hike.

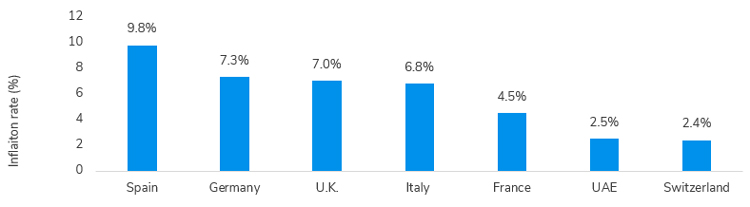

Figure 1. Inflation the top concern for household finances in 2022

Source: Refinitiv – Harmonised Consumer Price Index (March 2022). Note – UAE latest data available is Dec 2021.

With this backdrop, retailers and brands face yet another challenge. They now need to adapt their propositions to meet an increasing number of cost-conscious consumers with squeezed finances, whilst battling rising inflation and operating costs as well as ongoing supply chain disruption. This will be tough for many.

The five key strategies and insights contained within this report are essential for businesses to better understand what they can do to combat these mounting challenges in order to survive another wave of significant disruption.

Strategy 1: Define a strong value proposition

A more cost-conscious consumer will emerge from the cost-of-living crisis. They will consciously (and unconsciously) reshape how they perceive value, sacrificing quality, convenience and the shopping experience for lower prices.

It will be more critical than ever for consumer facing businesses to align their proposition to shifts in how consumers perceive value. They will need to offer a convincing and authentic value message that is sufficiently differentiated from their competitors. As recessionary behaviours, such as trading down, shifting to own brands and shopping around become more common place, businesses must ensure they anchor their proposition around value for money while offering relevant ranges across channels in a fiercely competitive market. Key strategies will include:

Investing in Price

Currently, the emergence of a more cost-conscious consumer requires a strong value proposition built around value for money. Our research suggests that consumers were willing to sacrifice quality over convenience in some markets, and sacrifice the shopping experience for other markets.

Striking a careful balance between using the right tone with a core customer base, while simultaneously reaching out to new consumer cohorts who are willing to try new brands will be key in protecting market share. Using authentic communication can help achieve a competitive advantage here.

Customer segmentation

Businesses must develop more tailored messaging, pulling value levers that really resonate with targeted customer cohorts. For customers under intense financial pressure, offering compelling entry level price points across relevant ranges with price matching may be the most effective approach. But for more affluent customers, it might be...

Download this free report for all the insights > complete the form at top of page...

ESG (Environmental, Social, Governance)

Our research shows that maintaining high ethical standards are ‘non-negotiable’ for most consumers, regardless of country. Paying a fair wage, ethical sourcing and telling a compelling sustainability story are critical components within the consumer value set. The growth of clothing and furniture rentals (e.g. Zalando, My Wardrobe; Selfridges Rental, IKEA), online marketplaces (e.g. Depop, Vinted), and the wider circular economy are prime examples of how these trends are bringing about new commercial opportunities.

Regional sensitivity

The impact of the cost-of-living crisis will be felt unevenly across countries (and country regions) due to factors such as income level, digital maturity, government support and culture. As such, businesses will need to vary their value strategies by region. For example, our research shows some consumers will be more willing to sacrifice quality for price in some markets, while in others, consumers will be more willing to forgo convenience. Focusing on how these differences translate to the value proposition and adapting it by market will be key.

Strategy 2: Evolving operating models

Unlike previous periods of disruption, significant cost pressures from supply chain issues, labour shortages and rising global commodity costs now often sit within a more mature digital landscape due to the pandemic. This has brought about a new layer of operational complexity.

Although the appropriate operating model depends on type (e.g. pure online, bricks and mortar, omnichannel or direct to consumers), most businesses will have to initiate a thorough review of operations to identify areas for cost savings and improved efficiencies. They will also need to continue focusing on digital transformation to ensure short-term challenges do not derail longer term ambitions. As cost control is prioritised, thorough reviews will be required regarding: supply chains, supplier contracts, logistics, warehouse, distribution, store estates, personnel, lease flexibility, marketing, digital infrastructure and the purpose of stores. Key strategies will include:

Partnerships

New and innovative partnerships will need to be explored whereby businesses can strike mutually beneficial strategic alliances. This could involve partnerships between pure online and store-based retailers, to tie ups with logistics experts to manage online returns more efficiently. With profitability under intense pressure, many retailers are likely to accelerate the migration towards online aggregators and platforms. This allows retail brands to leverage existing infrastructure and expertise to drive down marginal cost. Partnerships with agile third-party suppliers (e.g. Amazon) and returns management companies (e.g. Clipper Logistics) will... [extract].

Omnichannel first

An omnichannel first approach is becoming increasingly important for many reasons. The windows of opportunity to capture consumers’ attentions online are exceptionally brief. Dwindling attention spans and increasing user experience (UX) standards by big players provides no mercy for ‘clunky’ websites or an inconsistent cross-channel experience. Huge opportunities lie in meeting... Download this free report for all the insights > complete the form at top of page...

Agility

Businesses need to respond quickly and function with agility to changing market conditions, consumer sentiment, and monitor a range of metrics relevant to their operations (e.g. basket size, average transaction value (ATV), online penetration and shift to private label). The ability to adapt promotional messaging and explore innovative tactics related to social media marketing, in-store digital signage and dynamic pricing (where applicable), can dramatically boost customer engagement and satisfaction. For example, ensuring products are only promoted where inventory levels allow to avoid customer disappointment, or reacting quickly to competitor promotions to protect market share.

Digital investment

Digital investment could come in many forms including supply chain optimisation, leveraging data science, using dynamic pricing, demand forecasting and appropriate automation (e.g. robotic process automation [RPA]). Process automation is broad. It can be applied to tasks such as accounts payable/receivable, but also with administrating purchasing or promotions that are largely manual for many retailers. Workflow management software can also... [extract].

Strategy 3: Leveraging data science

Digital transformation will become an urgent priority for retailers operating with antiquated systems that are unable to provide actionable and near real-time customer insights.

Maximising opportunities from shifting consumer values requires advanced data analytics to convert ‘big data’ into actionable insight. Data harvesting (e.g. social media ‘listening’ or AI-driven insights through customer data or message boards) will be critical for retailers to gain a competitive advantage from evolving consumer values. Key strategies will include:

Personalisation

The use of data science (AI, data mining and analytics) to mine behavioural insights that can be applied to personalised marketing strategies will be critical in the future as competition increases. The use of relevant, personalised messaging for product offering can quickly forge deep customer relationships that are more meaningful and enduring. If done authentically, businesses can connect with customers intimately to effectively communicate their value proposition.

Increased personalisation across marketing channels is also another key concept to get right, especially in a hyper competitive environment. Using big data allows businesses to connect with customers in more targeted and creative ways, helping customers feel more valued.

Customer acquisition

Battling for consumer attention is exceptionally challenging and is increasingly being fought online. As such, using big data to drive sophisticated marketing strategies that engage customers by serving them relevant content at the right moment, in the right channel, will be vital.

Of course, winning new customers cannot come at any cost with limited budgets. A detailed understanding of the cost-attribution and revenue allocation model will... Download this free report for all the insights > complete the form at top of page...

Enhancing loyalty

The use of data science (AI, data mining and analytics) to mine behavioural insights that can be applied to personalised marketing strategies will be critical in the future as competition increases. The use of relevant, personalised messaging for product offering can quickly forge deep customer relationships that are more meaningful and enduring. If done authentically, businesses can connect with customers intimately to effectively communicate their ... [extract].

Strategy 4: Develop resilient supply chains

The ongoing impact from the pandemic continues to disrupt global supply chains, adding significant cost to shipping processes. It has also forced many businesses to prioritise agile planning, digitalisation, and to ensure they have more specific international trade policy expertise to address future supply disruptions.

Strategies are likely to involve using shorter, more flexible and resilient supply chains that are better equipped to deal with supply shocks; they will also need to address rapid changes on occasion in consumer behaviour as witnessed in recent months (e.g. Russia Ukraine conflict). In order to navigate supply chain disruptions more effectively, our research highlights the following strategies:

Simplification & diversification

Explore simplification of supply chains by making them shorter, often involving more on-shoring, near-shoring and re-shoring. Supply chains can also include more sources, and reduced overreliance on single countries (e.g. China +1/+2 models).

Rethinking inventory

Establish alternative supply sources to enable fast-tracked volume delivery capability. Adopt better, more agile inventory policies to maintain ‘just-in-time’ strategies with established mitigation.

Understanding cost to serve

Any move to near-shoring will have an impact on margin due to local cost differences. Businesses will need to gain an understanding of these differences to build mitigation options and pricing scenarios. There is a clear trade-off between agility and inventory write-offs.

Contingency planning

As costs continue to rise and continuity of supply becomes more uncertain, contingency planning across businesses will be vital to reduce risks and identify ways to mitigate the impact of supply chain bottlenecks and disruptions. A continuous review of... Download this free report for all the insights > complete the form at top of page...

Final mile

The final stages of the supply chain has seen consumer expectations for speedy delivery become normalised. Consistently achieving these objectives will increasingly require investment towards more automated distribution centres and micro-fulfilment hubs (and potentially ship from store) to meet this shift in demand at scale. Partnerships with logistics providers for final mile deliveries (and for efficient handling of returns back into the supply chain) will be key.

Stockpiling

Building up strategic stockpiles where appropriate to mitigate against potential supply shortages can prove effective, given elevated levels of uncertainty. However, key considerations will require diligent assessments, such as demand forecasting, impact on cashflow, product seasonality, storage costs and shelf-life..

Digital-first

The imperative for businesses to adopt a ‘digital-first’ approach to their supply chains has never been more pressing. The increase in efficiency and predictability will help optimise product mix and range, pricing power, and waste reduction – all critical components in protecting profitability. Optimising data flows, from point of sale to predictive ordering (and digital supply chain transparency), can help improve assortment, tailored merchandise for regional variations, and adapt pricing, with impacts on both customer satisfaction and bottom-line.

Strategy 5: Redefining customer experiences

Creating positive customer experiences has become an increasingly important way for businesses to connect with customers in a hyper-competitive environment; with many opportunities to use the customer experience to their advantage.

With the purpose of stores having evolved to fulfil a multitude of functions, an important role is in the effective acquisition of customers that value experiences. However, creating beautiful retail spaces that offer entertainment, education and escapism often demands considerable investment. For many retailers, this shift in the purpose of stores runs parallel to a strategy to reduce the overall number of outlets in their estate as online continues to account for a larger proportion of overall sales.

Furthermore, the value and role of experiences has changed since the start of the pandemic. For example, for many shoppers, the importance of being entertained by a fashion show in a flagship Paris store was marred by the need for safety from the pandemic, and now product affordability amidst rising levels of inflation.

This is just one instance in which many businesses will face a conundrum over how they should adapt and communicate their offer, highlighted by our research showing that consumers are willing to sacrifice experiences for lower prices. Key strategies for businesses looking to leverage customer experiences includes:

Instant product access

Our research shows that cost-conscious consumers disproportionately value immediate access to products in-store. Better visibility of stock availability, and managing consumers’ expectations around promotions, particularly where inventory levels are important, will be critical for generating positive customer experiences.

Improved communication

As consumers take greater control of their personal finances, research and price comparison will become a more considered part of the journey. Businesses must ensure they communicate their value proposition clearly and consistently in-store and across the digital platforms, where their consumers pay more attention. Leveraging the value of stores to support a seamless omnichannel experience will be key, particularly when it comes to fulfilment and returns. Using stores as distribution and returns hubs helps reduce costly online returns while enhancing the customer experience.

Enhancing the delivery experience

Where possible, consumer businesses should attempt to enhance the delivery experience by offering timed delivery slots (dynamic pricing), accepting returns, removing old products for disposal, and offer additional services that consumers are willing to pay for. At scale and operated efficiently (although category specific), delivery service revenue can be achieved with... Download this free report for all the insights > complete the form at top of page...