The Cut Back Economy 2023: A Widening Crisis

10 minute read

We surveyed over 2000 UK consumers and asked them about their spending behaviour, how they are planning to cut back and where. We also take a look at what the immediate future holds for the retail industry.

This is the second report in our 'Cut Back Economy' series, produced in partnership with Grant Thornton. Part one was published in 2022 and can be found here.

This work essentially looks at the impact of the cost of living crisis on UK retail, leisure and consumer sectors, and unearths new insights into how UK consumers are reacting to the current economic environment.

The research identifies the opportunities and risks that retail brands need to understand in order to better navigate current industry challenges in order to maintain a competitive advantage in 2023 and beyond.

Discover how you can partner with Retail Economics to publish thought leadership research similar to this by clicking here.

What you can get from this report?

-

Insights on the widening cost of living crisis impact

-

Consumer cut back behaviours

-

Changing customer journeys

-

Insights about retailers' financial resilience

-

Retailer strategies for tackling the current retail environment

Watch Richard Lim (CEO, Retail Economics) respond to some key questions arising from the research.

Watch our panel discussion which highlights various critical issues covered in the report.

Watch the Grant Thornton & Retail Eocnomics launch webinar where presenters share findings from this research, as well as speaking with industry experts about the impact across consumer organisations.

Report Contents:

• Foreward

• Findings at a glance

• Executive summary

• Methodology

• A widening crisis: more households to feel the pinch

• Uncomfortable inflation lasting longer than expected

• Inflation erodes £65 billion from household incomes

• Understanding cut back behaviours and changing customer journeys

• Consumer cut back intentions

• Shifting consumer values

• Blurring channels and creating unified customer journeys

• Financial resilience and strategies for success

• Cost management and efficient business models

• Digital skills and transformation

• M&A, strategic partnerships and investing in growth

• ESG, brand trust and reputation

• Enhancing value from internal audit

• Conclusion

• Authors and contacts

Forward

This research shows a widening crisis that businesses need to handle through a multi-stage strategy.

The news cycle has been dominated by headline inflation figures that are proving difficult to shift. Our report estimates that inflation will erode £65 billion of household income, with the average household £2,300 worse off by the end of this financial year.

The difference between now and last year? More middle and higher-income households are being drawn into this widening crisis as savings dwindle and mortgage rate rises bite.

Findings at a glance

Below are three of the key research findings from the work. Download the full report using the form at the top of this page to access many other critical insights.

A widening crisis: more households to feel the pinch

The UK’s cost of living crunch is far from over. What initially began as an energy-driven price shock disproportionately affecting the least affluent, has now shifted into its second phase.

It’s a phase punctuated by sharp rises in interest rates, persistent inflation and protracted financial pain to more households – including those in middle and higher-income brackets.

Uncomfortable inflation lasting longer than expected

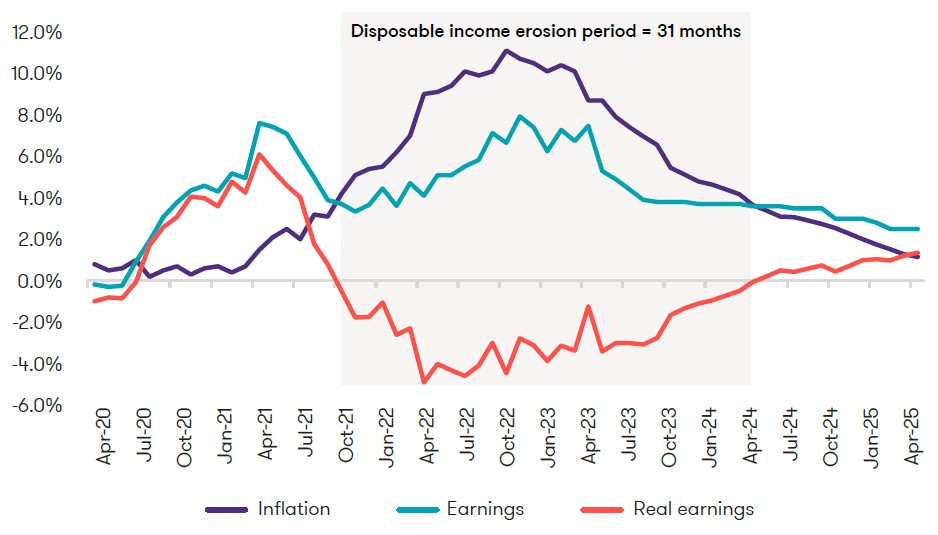

Although inflation peaked at the end of 2022, the path back towards more palatable levels is likely to be a long one. There are some signs that energy and other input cost pressures are beginning to ease – for instance, the official energy price cap from Ofgem has been reduced to £2,074 per annum for a typical household.

However, these benefits are taking longer than expected to filter through to households, with prices ‘stickier’ than many economists had forecast. Core inflation (which strips out the more volatile components such as food and energy) is at the highest level in three decades.

This raises concerns that a wage-price spiral has emerged, as higher wage demands lead to higher costs for businesses, causing inflation, which necessitates further wage rises.

Subsequently, this sets the stage for more aggressive interest rate hikes and tighter credit conditions which could prolong the financial pinch on households.

For more insights on this section download the report at the top of this page.

Inflation erodes £65 billion from household incomes

Regardless of whether the UK economy manages to avoid a technical recession, many households have embraced recessionary behaviours as they operate with diminished spending power.

UK households have already endured the sharpest squeeze on disposable incomes in generations. The spiralling cost of food, energy and other daily expenses – and the failure of wages to keep pace – has already cost UK households £50 billion in lost income.

Unfortunately, there is further pain to come. UK households face an additional £15 billion erosion of disposable incomes this financial year, with real earnings not expected to return to

growth until May 2024. A typical household will then be over £2,300 worse off.

Fig 2: The average household will be £2,300 worse off by the end of this financial year

Source: Retail Economics, Grant Thornton

Dwindling pandemic savings

UK households were able to set aside savings worth almost £200 billion during lockdown from cancelled holidays, less commuting and socialising. This helped cushion the blow of higher inflation for many households despite falling real incomes, particularly in the middleincome bracket.

However, excess savings consumers amassed during lockdowns have now been significantly eroded, both in terms of value (due to higher prices) and from withdrawals to support increased household costs and sustained discretionary spending.

As pandemic savings continue to unwind, many households will be forced to modify spending habits to make ends meet.

Mortgage wake-up call for households

The surge in mortgage rates reaching levels unseen in over a decade, presents a significant hurdle for homeowners – particularly those in the middle-income bracket, typically with young families and burdened with higher debt levels relative to their income.

This creates a ‘mortgage lottery’ scenario where timing is everything, and in combination with uncertainty surrounding fixed-rate expirations and the likelihood of higher repayment costs, this is creating financial instability.

For more insights from this section download the full report today.

Understanding cut back behaviours and changing customer journeys

Having a deep understanding of how consumer behaviour is changing in context of more complex customer journeys is now an imperative for retail, leisure and hospitality

businesses.

This section explains consumer cut back intentions, identifies various cut back personas, and explores shifts in consumer values within the all-important omnichannel environment.

Consumer cut back intentions

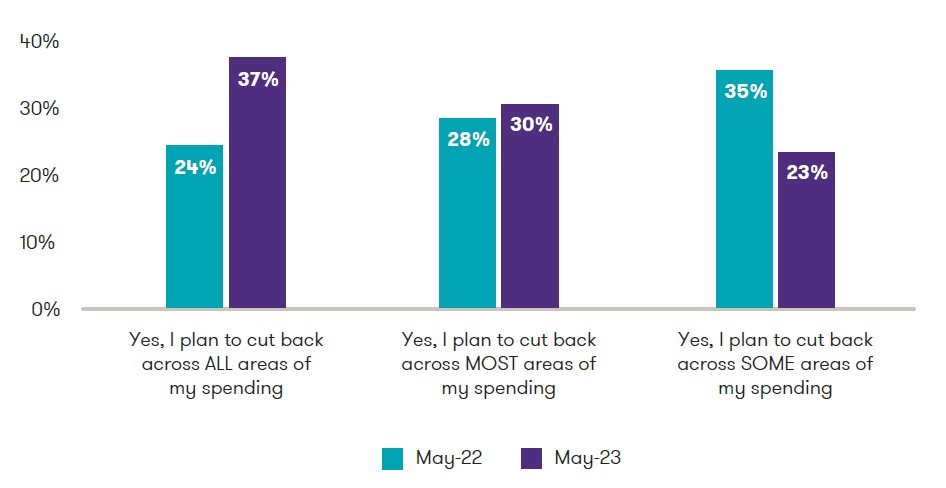

Consumers’ cut back intentions remain high. This reflects weak confidence and continued financial pressure experienced by households.

Our research shows almost nine in ten (88%) shoppers plan to cut back their spending over the twelve months to April 2024 (i.e. spend less, delay or cancel purchases), virtually unchanged from last year (86%).

However, the scale of cut back appears to be intensifying. Nearly two thirds of consumers intend to cut back across most, if not all, areas of spending, up from a little over half a year ago.

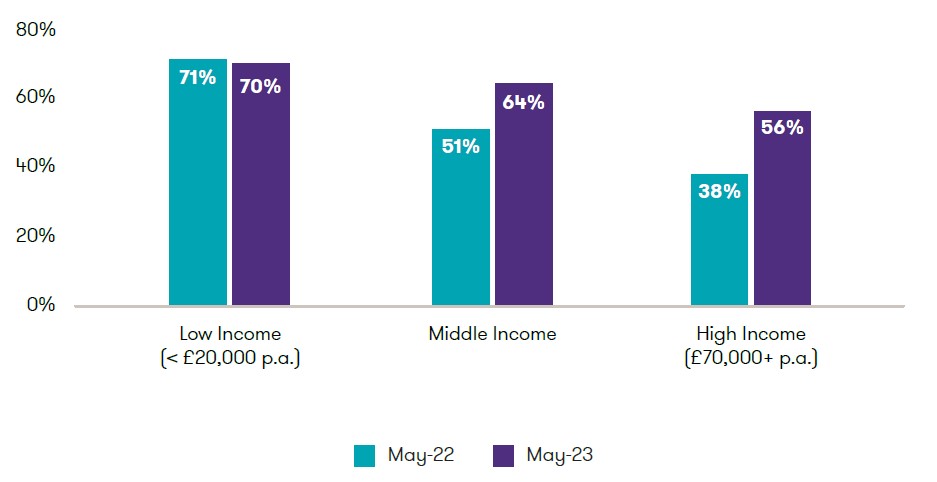

The increase on last year is being driven by a step change in the proportion of middle and higher income households planning to cut back. It reflects consumers’ concerns about the impact of higher interest rates on their personal finances, alongside lower levels of savings compared to a year ago (Fig. 6).

Fig 5: Consumers' cut back intentions remain elevated

Source: Retail Economics, Grant Thornton

Fig 6: Consumers' cut back intentions by income

Source: Retail Economics, Grant Thornton

Cut back cohorts:

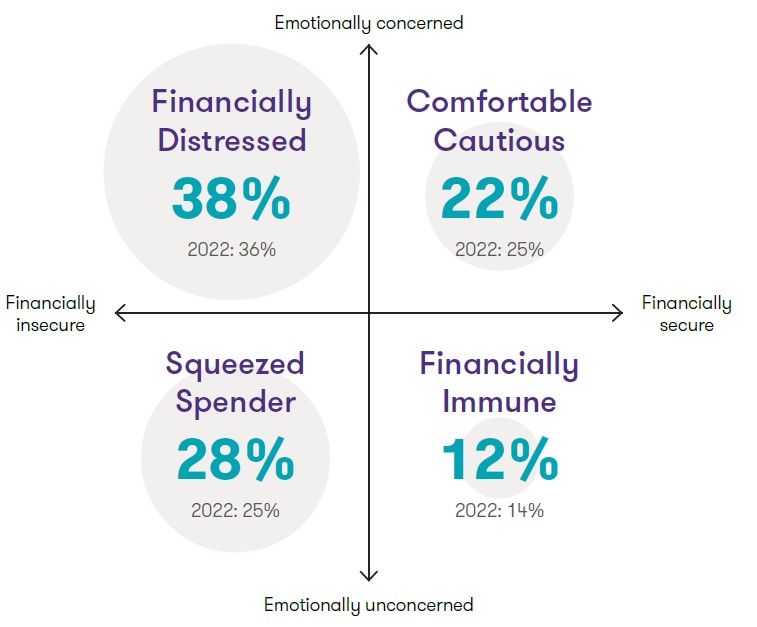

Our 2022 Cut Back Economy report revealed four distinct consumer cut back cohorts, based on how UK households perceive the cost of living crisis and how their spending behaviour has changed as a result.

One year on, our research reveals how these cohorts have evolved, with a marked increase in the proportion of consumers defined/characterised as ‘Financially Distressed’ and ‘Squeezed Spenders’ (Fig. 7).

Fig 7: Four consumer cut back cohorts

Recessionary behaviours:

Facing financial pressures and uncertainty, consumers are adapting by cutting back on non-essential purchases, re-evaluating leisure activities, seeking alternative financial solutions, and making trade-offs in their daily routines.

These behavioural adaptations highlight the continued influence of rising costs on consumers’ decision-making and the proactive measures adopted to navigate current economic challenges.

Understanding these shifts in consumer behaviour presents opportunities for retail, leisure and hospitality operators to deliver effective strategies.

Two track spending:

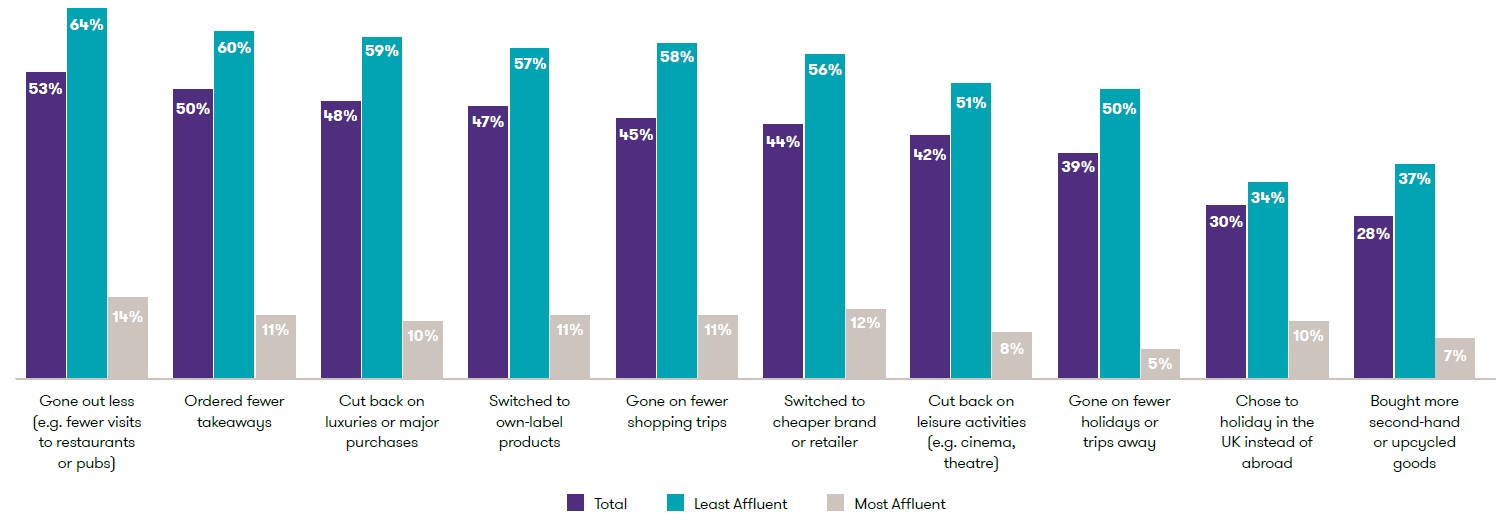

Our research shows a clear polarisation between the least affluent and most affluent when it comes to cutting back across retail, leisure, travel and hospitality sectors.

The most affluent are five times less likely to adopt cut back behaviours, with only around one in ten high income households dining out less often, cutting back on luxuries, or switching to own-label products, versus around 60% for the least affluent (Fig. 10).

This is significant because although the most affluent account for only one fifth of consumers, they are responsible for over 40% of total household spending.

Fig 10: Polarisation in cut back behaviours by household income

Since the start of the year, have you done any of the following in response to the increased cost of living?

Source: Retail Economics, Grant Thornton

Sector spending priorities:

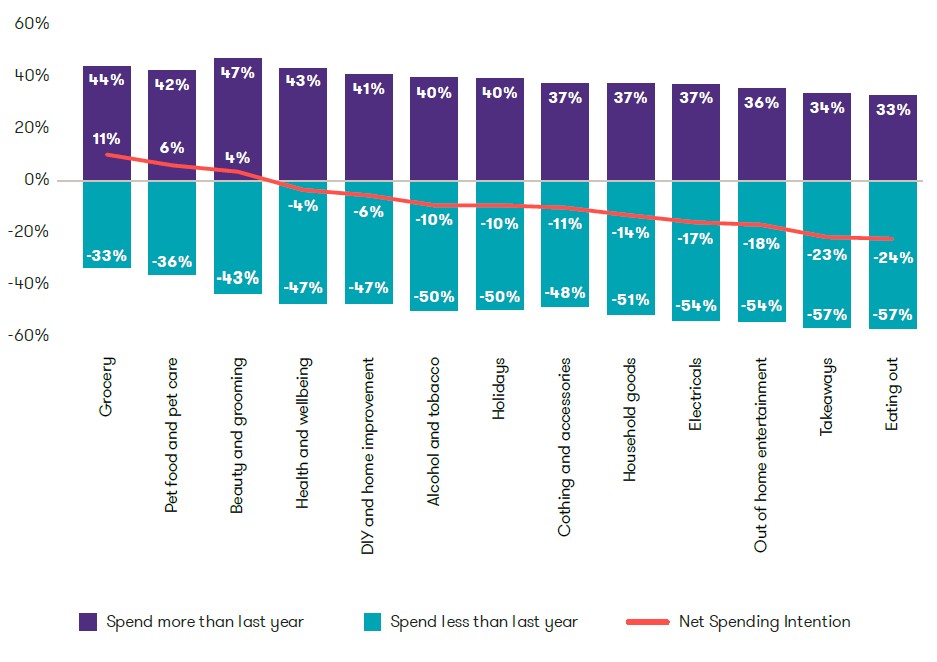

Looking ahead, Fig. 11 shows consumers’ spending priorities for the next 12 months across retail, leisure and hospitality based on their net spending intention for each category.

Fig 11: Consumer spending intentions by category

How do you intend to spend on the following categories over the next 12 months?

Source: Retail Economics, Grant Thornton

The research identifies three types of spending from the data:

• Resilient recession-proof: grocery, pets and personal care

• Challenged discretionary categories: eating out, takeaways, and out-of-home entertainment

• Experiences-first: holidays preferred over retail pleasures

Download the full report to delve deeper into these three types of spending.

Other areas of 'Understanding cut back behaviours and changing customer journeys' are:

• Shifting consumer values

• Consumer value cohorts

• Cost seen as barrier to sustainable values

• Blurring channels and creating unified customer journeys

• Online ‘blip’: Cost of living concerns dampen pandemic sales boost

• Online: increased competition and headwinds

• Investing in the right digital touchpoints: why understanding your customer behaviour is key

• A seamless customer journey: the route to success

Download the full report to access these areas of research.

Financial resilience and strategies for success

As retail, leisure, and hospitality businesses face continual challenges within the cut back economy, it’s crucial they adopt resilient, long-term strategies that go beyond the current economic climate.

In this final section, the research identifies five key themes that businesses need to focus on.

Cost management and efficient business models:

In the face of constantly evolving consumer behaviours and shifting market dynamics, businesses must evaluate their business models and consider comprehensive transformation to deliver true customercentricity.

This includes adopting flexible and agile approaches to accommodate shifting demand patterns, optimising supply chains to improve efficiency, and leveraging technology to

enhance customer experiences through a unified and seamless customer journey.

By transforming their operating models, businesses can respond effectively to market shifts and better meet customer needs while optimising costs and maximising value.

With margins under sustained pressure, effective cost management is crucial.

This requires identifying areas of inefficiency, optimising resource allocation, and implementing costsaving initiatives without compromising on quality or customer experience. By streamlining operations, negotiating favourable supplier contracts, and leveraging technology to automate processes, businesses can enhance their profitability and protect their bottom line.

The other four themes are:

• Digital skills and transformation

• M&A, strategic partnerships and investing in growth

• ESG, brand trust and reputation

• Enhancing value from internal audit

To access these, download the full report at the top of this page.