The Big Squeeze: Pressure on consumer finances, rising inflation & money management

10 Minute Read

If you're interested in collaborating with Retail Economics to produce exceptional thought leadership research similar to this, simply click here to explore the possibilities.

This report seeks to shine the spotlight on the complex issue of consumers' shifting attitudes, motivations and behaviours towards saving and spending. It looks at the challenges households face when striving to be more organised with money and explores the key differences between the four financial personas and their habits and attitudes towards money.

The report is divided into five main sections:

Section 1: Explores the emergence of a new inflationary environment alongside the complexity of financial relationships and social pressures that consumers face.

Section 2: Explores how budgeting tools can help consumers spend and save as they intend.

Section 3: Provides an analysis of saving and spending habits by generation and life stage.

Section 4: Identifies the four financial personas concerning saving, spending and organising money.

Section 5: Looks at consumers’ goals and saving intentions for 2022, and associated pressures

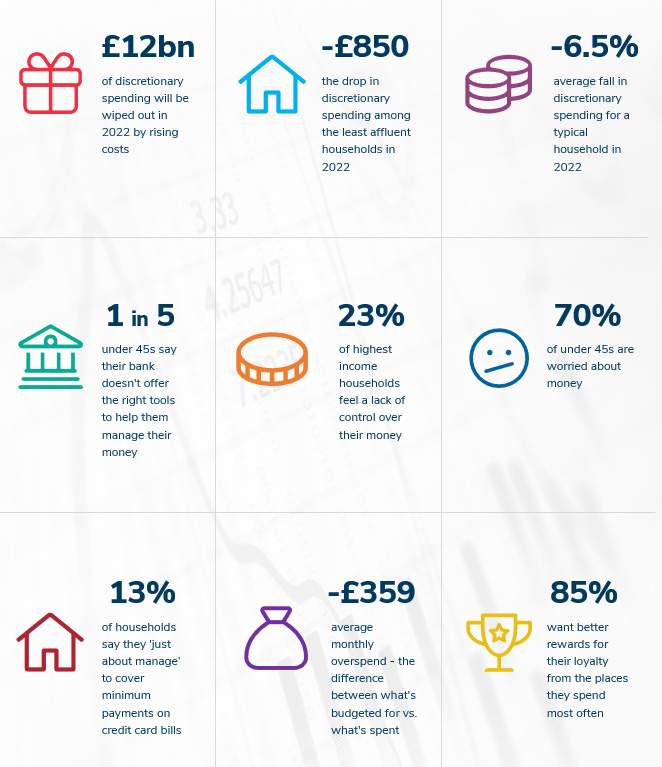

Headline stats

Introduction

UK households are entering an age of financial anxiety as economic uncertainty, higher inflation and rocketing energy prices drives the biggest cost of living crisis in 50 years. Alongside rising interest rates and higher national insurance contributions, energy bills are skyrocketing. The price of everyday staples such as food and fuel are also soaring.

The economic fallout from the tragic conflict in Ukraine is likely to add to this perfect storm of inflationary pressures. Taken together, these factors mean that UK households are set to experience the worst financial squeeze since the 1970s.

There is a growing consensus that inflation is here to stay, remaining significantly above pre-pandemic levels for the foreseeable future. This new era of financial pressure comes at a time when consumers are adopting more complex approaches to their saving and spending behaviours.

Of course, the impact will vary considerably by household. Those on lower incomes, or burdened with debt, will be most vulnerable to inflationary shocks. They are also much less likely to have accumulated a savings buffer compared to more affluent households.

With many households already living beyond their means, the inflationary shock will push them into the red, making it increasingly difficult to cover essentials and repay debt. Around 13% of households say that they currently ‘just about manage’ to cover minimum repayments on their credit card bills and 6% say that they are unable to.

Many consumers struggle to achieve their financial goals, but often this is not due to lack of effort. Most consumers (80%) set a monthly budget, shop around for price deals (83%) and try to put money aside for unexpected costs (79%). Despite best intentions, the typical UK household runs a monthly budget deficit of £359 due to spending more than they had planned for.

All these pressures impact most households, but their implications extend beyond just financial. They ignite emotional pressures too.

Even in ‘normal’ times, financial lives are complex. Despite best intentions, many consumers find it challenging to make informed decisions that balance both current and future financial needs.

The insights in this report are critical for retailers and brands who want to deeply understand how consumers' attitudes and behaviours concerning money are shaped by economics drivers and how consumer values change with age.

1 A new era of financial pressure

UK households are entering an age of financial stress as economic uncertainty, rising inflation and rocketing energy prices drives the biggest cost of living crisis in 50 years. This comes at a time when consumers are adopting more complex approaches to their financial planning and spending behaviours.

Inflation is rising at its fastest pace in decades due to the release of pent-up demand post-pandemic, widespread supply disruptions and surging commodity prices. While inflation was initially expected to be a transitory “reopening effect”, prices are rising at a faster and longer pace than anticipated, and Russia’s invasion of Ukraine only raises the likelihood of higher and more persistent inflation.

UK inflation is forecast to reach as high as 9.0% in Autumn 2022 and remain above target over 2023. Most consumers would not have experienced this kind of inflation during their working lives.

Some economists believe that the pandemic marks an inflection point between the deflationary forces of recent decades and a new inflation regime, where labour shortages and a push towards domestic production from impacted supply chains, leads to higher prices. A move to a sustained path of inflation, even at only moderately higher levels (e.g. 3.0-4.0%), would represent a significant change in economic realities and disposable incomes for many households.

Economic realities & squeezed incomes

Consumers are acutely aware of the prospect of a squeeze on incomes over 2022, with inflation seen as the biggest barrier to meeting their spending and saving goals.

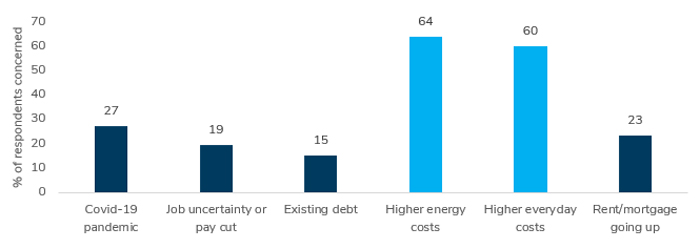

More than half of consumers expect their personal finances to weaken in 2022, rising to two-thirds for the least affluent households. Spiralling energy costs are the main concern, closely followed by higher food prices and everyday items (Fig 1). Increases in the energy price cap mean a typical energy bill went up 54% in April 2022, with bills projected to rise by a further 32% in October (Cornwall Insight).

As a result of the rising cost of living, Retail Economics projects that over £18 billion of non-essential spending will be wiped out across the UK economy in 2022.

Download this free report for all the insights > complete the form at top of page...

Figure 1. Inflation the top concern for household finances in 2022

Source: Retail Economics

The rising cost-of living will hit low-income families the hardest, given that they spend a disproportionate amount on essentials. Indeed, their share of income spent on energy bills is set to rise from 8.5% to 12% – three times as high as the share spent by the most affluent households.

To compound matters, these households are also much less likely to have accumulated savings throughout the Covid-19 crisis.

The Retail Economics-HyperJar Cost of Living Tracker shows the least affluent households will see their annual discretionary income (spare cash after paying for essentials) plunge by 19.5% - or almost £850 - in 2022 (Fig 2). While the typical household will see a 6.5% (£430) fall in discretionary spending power.

For many households, a lack of discretionary income adds to the complexity of managing personal finances, hindering their ability to save. People feel that they can only save if they have spare money left over after monthly outgoings, whether by default or careful budgeting.

After paying essential bills (e.g. mortgage/rent, council tax, utilities and any loan/debt repayments), a typical middle-income UK household has £1,057 left each month as discretionary income.

Against a backdrop of rising living costs, economic barriers are squeezing the ability of households to meet their financial goals, whether planning for a big purchase or putting money aside for a rainy day.

Complex financial lives

Digitalisation and the emergence of FinTech (financial technology) has disrupted the traditional bank-customer relationship, vastly expanding the number of interactions within the consumer financial services ecosystem.

While this has empowered consumers by providing greater choice, flexibility and convenience, paradoxically it can also make the task of managing money more difficult.

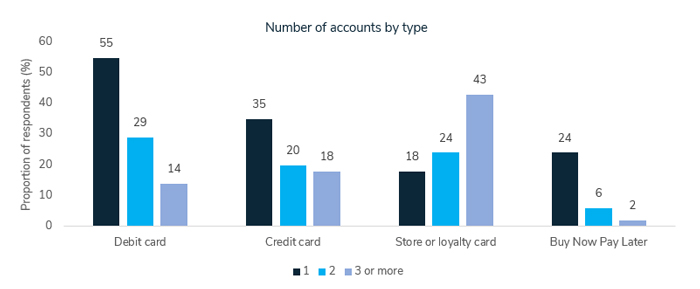

As the use and number of digital payment options have ballooned in recent years, financial relationships have become increasingly complex. Our research shows most consumers (64%) have more than five financial accounts to manage, spread across a variety of debit and credit cards, buy now pay later providers and store loyalty programmes.

More than a quarter (29%) have 8 or more financial relationships to manage. This is before accounting for additional shadow financial products such as mortgages, pensions, insurance, payday loans, cryptocurrencies, or investment/share portfolios.

Figure 3 – Financial complexities: consumers have multiple cards and accounts to manage

Source: Retail Economics

This increasingly fragmented picture has made keeping on top of personal finances trickier, with traditional banking services not fit for purpose in today’s digital payment world. Frustration is concentrated among younger generations, with one in four under 45s (or a third of Gen Z) finding it difficult to manage expenditure as their bank does not offer the appropriate tool for their needs.

Social & psychological toll of the 'spend now' economy

The complexities of managing money doesn't only affect financial health; it affects people’s mental and social wellbeing too. Our research shows almost two thirds (64%) of consumers regularly experience money worries.

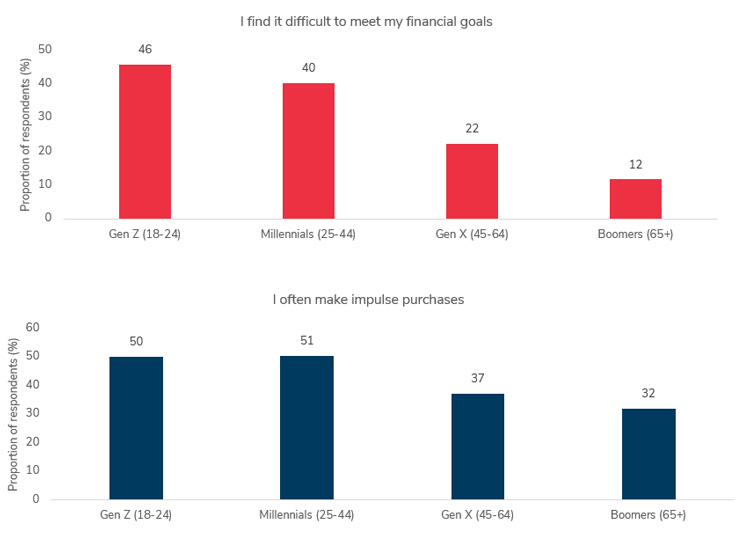

Money is a source of anxiety for all age groups, but younger generations in particular feel less confident and in control of their finances. Under 45s are twice as likely to find themselves struggling to meet their financial goals compared to older generations.

Heightened money worries among young adults can partly be explained by situational factors such as student debt, job insecurity, high rents and property prices. However, social pressures also weigh more heavily on younger generations.

Having grown up in a world of instant gratification, many Gen Z and Millennials have become acquainted with ‘spending without thinking’. Half of them often make impulse purchases, while one in four feel pressure to spend on the. latest fashion or technology.

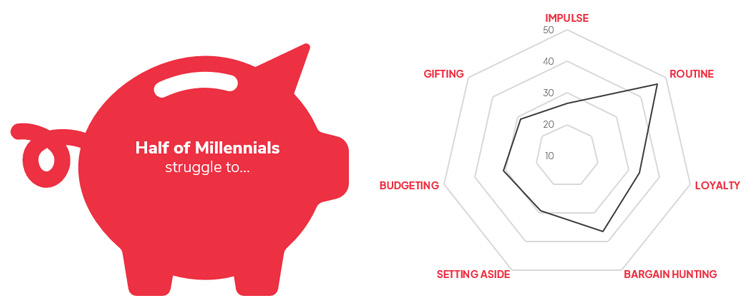

Figure 5 – Younger generations spend more impulsively and find it hard to meet their financial goals

Source: Retail Economics

Much of the pressure that Gen Z and Millennials feel to conform to the spending habits of their peers come from social media, where financial milestones or adventures can be posted for all to envy.

Social pressures and the FOMO effect (‘fear of missing out’) can encourage people to spend beyond their means, increasing reliance on credit and making it more difficult to meet financial goals.

2 Tackling the household budget deficit

When trying to meet saving and spending goals, consumers face a disconnect between knowing what they need to do, and achieving it in practice. This mismatch often results in overspending or misallocation of income, creating a monthly budget deficit for many households.

Mismatch between intention & action

While 75% of households have a budget in mind when shopping for everyday items, there is a significant shortfall between what they allow for versus how much is spent. Rising inflation is set to make this considerably worse.

Many consumers find it difficult to manage their money and achieve their saving goals, but this is not for want of trying. Most consumers (80%) set a monthly budget, shop around for the best deals (83%) and try to put money aside to cover emergencies or unexpected costs (79%).

Money struggles cannot simply be attributed to a lack of knowledge or financial literacy. Our research shows most consumers are aware of the risks involved in debt creation in terms of raising the cost of repayment, curbing saving power, and fuelling money worries.

Three quarters of consumers recognise that credit card debt, overdrafts, or Buy Now Pay Later schemes entail stress, leading to increased costs long term. Despite this, almost half (44%) of UK consumers fail to pay off their credit card debt in full each month.

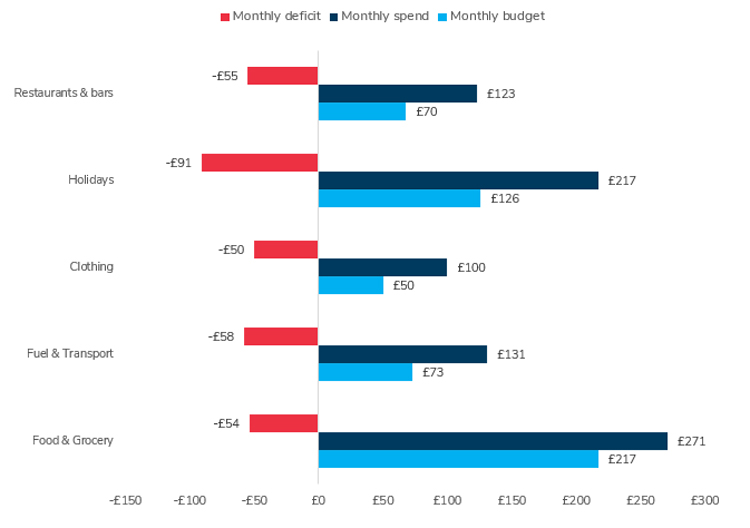

Figure 6 – Households regularly spend more than they budget fore

Source: Retail Economics

Consumers often try their best to behave responsibly with money, but there is a clear mismatch between intentions and action. This gap arises because any financial decision involves trade-offs between the present and the future; and consumers are prone to spending in ways that appear to provide short-term satisfaction, rather than long-term financial wellbeing.

Households regularly end up spending more than they originally budgeted for across key spending categories. The typical British household runs a monthly budget deficit of -£359 across routine expenditure (Fig 7). There are many reasons for this overspend, such as an impulse purchase, a lack of planning or unexpected costs.

Figure 7 – Households regularly spend more than they budget fore

Source: Retail Economics/ONS

Banks may not offer the right tools

While 75% of households have a budget in mind when shopping for everyday items, there is a significant shortfall between what they allow for versus how much is spent. Rising inflation is set to make this considerably worse.

Financial savviness requires more than desire and knowhow. Consumers need effective budgeting tools that give them greater confidence and self-control in managing their spending habits.

However, there is a perceived lack of budgeting tools available. Only a third of UK consumers regularly use financial apps or spreadsheets to help record and manage their money.

Frustration is concentrated among younger generations, with one in four under 45s (or a third of Gen Z) finding it difficult to manage expenditure as their bank does not offer the appropriate tool for their needs.

Rather than relying on traditional banks, many under 45s (41%) turn to offline DIY methods of budgeting, such as spreadsheets, while nearly half have no determined method of budgeting.

However, there are clear incentives for those that do. Across all income groups, consumers that regularly use a budgeting tool have more money left over each month (Fig 8). On average, budgeting tools help households save an extra £56 per month to put towards meeting their financial goals.

Bridging the gap with next generation apps

Digital budgeting tools make it easier for consumers to build up savings, explore new and convenient ways to manage their money, and gain greater control over spending habits.

The survey results indicate consumers’ growing preference for a new generation of digital money tools to help plan and organise their personal finances. Interest in digital budgeting tools is high among all age groups, but most notably under 45s.

These digital native generations are more receptive to experimenting with FinTech compared to older generations that require more education and encouragement to engage with digital money tools.

Super apps are apps that provide multiple services with payment and financial transaction processing. They make it easier for consumers to maintain multiple financial relationships with a single digital interface. This next generation of money management tools are less about banking products, and more about building customer-centric solutions to manage a broad range of financial situations.

For example, super apps can:

- Manage transactions for current and savings accounts

- Provide information & analytics for investments

- Process store payments

- Set budget limits on accounts and alerts for balances

- Remind users of payment dates (e.g. utility bill, mobile, subscription renewals)

- Sent alerts when stores have offers

- Provide analytics to show where users spend and how much

- Assist with achieving loyalty rewards for discounts with retailers

In contrast, many banking ecosystems only provide mobile or online access to the same services available in branches, and point users to external third-party providers without fully integrating the experience. The emergence of super apps reflects the reality that consumers want seamless integration of financial services within their lives across multiple providers.

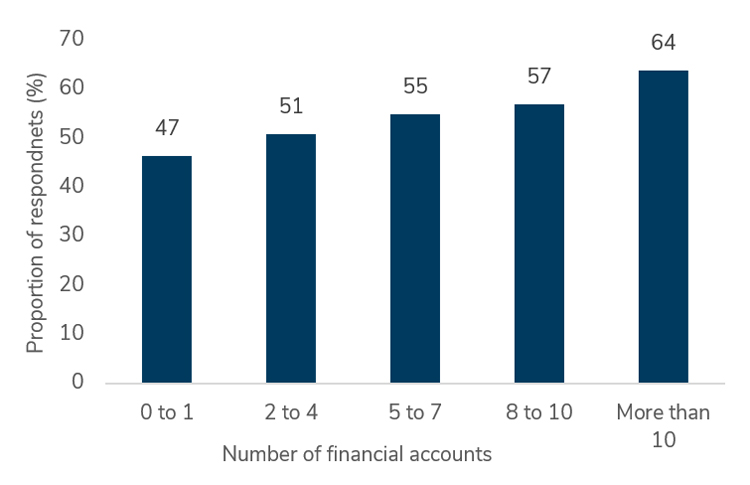

Our research shows a positive correlation between interest in digital budgeting tools and the number of financial relationships consumers have – in other words, the more complex consumers’ financial lives become, the greater their need for super apps (Fig 9).

Figure 9 – Interest in digital budgeting tools higher amongst those with multiple financial accounts

Source: Retail Economics

The use of big data and analytics allows super apps to provide hyper-personalised recommendations for every action taken within any part of the financial ecosystem. For example, this could include sending alerts to customers when they’ve reached their monthly budget limit due to overspending or an unplanned cost.

Helping reluctant consumers to budget better and become more efficient in their use of money opens the door to a long-term savings journey in a relatively low-friction way – straight from their current account. It gives consumers ‘real-time advice’ on things like who to pay, when, how to split payments, and where to find the best deals. All these little recommendations result in large financial wellness benefits.

3 The generational divide

When trying to meet saving and spending goals, consumers face a disconnect between knowing what they need to do, and achieving it in practice. This mismatch often results in overspending or misallocation of income, creating a monthly budget deficit for many households.

Significant variations in spending patterns by life stage

Different life circumstances clearly play a role in shaping consumer behaviour. These include such things as: progressing through education, forging careers, making more responsible choices about where to spend, buying a first home, and settling down with a partner or experiencing parenthood.

Younger generations (e.g. Gen Z & Millennials) are almost twice as likely to be motivated by planning for a big event/future goal; and over a third manage money for investment purposes, compared to just 18% for older age groups.

Conversely, older generations (e.g. Gen X & Boomers) are more risk-averse. Their motivations to save and organise money are driven by financial security needs and avoiding debt. Two-thirds (67%) of boomers are primarily motivated by having a safety net for an emergency.

While some of these motivations reflect pivotal moments within life stages, each generation also has their own unique traits and circumstances. For example, student debt, inflated property prices, and familiarity with technology are symptomatic of Gen Z and Millennial experiences that will have lasting effects on their financial behaviours in later life.

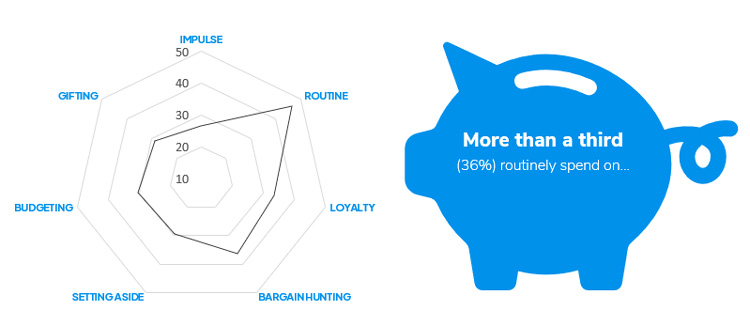

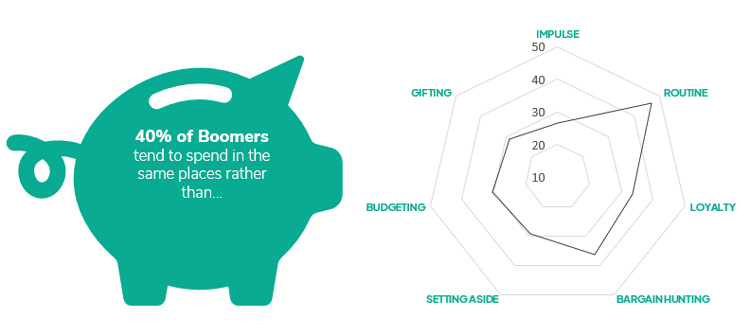

Spending and saving behavioural definitions:

Routine: I regularly spend as part of a weekly or monthly routine

Setting aside: I regularly put money aside in case I need it Impulse I spend impulsively without too much though

Budgeting: I regularly budget and usually stick to it

Gifting: I often spend on gifts or treats for friends and family

Loyalty: I tend to spend in the same places rather than shop around

Bargain hunting: I often look for the best deal or a discount before deciding where I spend

Gen Z: Young, wild & free (18-24 year olds)

- Over a third (36%) of Gen Z’s struggle with willpower and find it too easy to spend

- 55% of Gen Z’s use Buy Now Pay Later accounts to make purchases

This generation are unaware of life before the internet – many are ‘app-driven technoholics’ with high expectations and strong entrepreneurial characteristics.

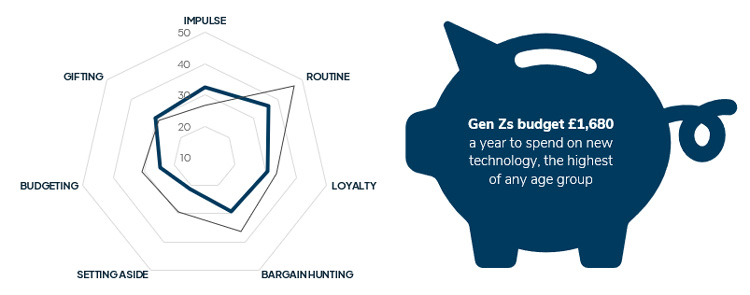

Figure 11 – Gen Z spending behaviour is more impulse driven (Blue line=Gen Z behaviour, black line=typical consumer)

Source: Retail Economics/Hyperjar

Gen Zs are driven more by impulse than routine. With fewer family commitments and domestic responsibilities, their spending habits are more varied compared to those of older generations. This reflects a diverse range of hobbies and interests, from fitness and fashion, to travel and technology.

Gen Zs are social trendsetters and health-conscious; this is the only generational life stage where Clothing and Health & Beauty (e.g. gym memberships, skincare) appear in the top five saving categories.

For recent graduates or school leavers starting a career path, earning and having significant disposable income is a novelty for most. Resultantly, spending money overrides saving it, with actual saving intentions motivated more by risk-taking than risk aversion. This doesn’t mean Gen Zs are not financially savvy. Determined to build a healthy financial foundation, and with time on their side, they are prepared to capitalise on the power of compound interest. Also to their advantage is their familiarity with digital banking and alternative payment and investment options (e.g. buy now pay later, cryptocurrencies).

Millenials: Settling down in search of domestic bliss (25-44 year olds)

- Putting aside £306 a month on average towards a deposit on a property (taking approximately 15 years to achieve a typical deposit

- About a third of Millenials find it difficult to... [download full report for more details]

The financial crisis of 2008 shaped the attitudes and behaviours of millennials.

The recession arrived just as they were leaving school, graduating from university, or venturing into the workplace. Job insecurity, student debt, higher relative living costs, poor pension provisions and difficulties stepping onto the housing ladder are all influencing factors.

Saving intentions are high at this life stage, driven by desires to have a safety net as well as...

Download this free report for all the insights > complete the form at top of page...

Gen X: Empty nesters seeking value & satisfaction (45-64 year olds)

- 40% of Gen X look for the best deal or a discount before spending

- 30% of Gen X have... [dowload the full report for more insights]

For the fortunate in this generation, financial pressures are easing and spending involves less guilt. Many Gen Xs have made inroads into paying off mortgages and are contemplating downsizing as children start to flee the nest.

This frees up disposable income to spend on ‘guilty pleasures’ such as wine, pedigree pets and overdue home improvement projects. However, financial planning is still important for this age group, as they look towards retirement plans, with the desire to budget and...

Download this free report for all the insights > complete the form at top of page...

Boomers: Retirement years driven by security & loyalty (65+ year olds)

- 67% of Boomers are motivated by the need to have a safety net

- Boomers save up to £1600 a year on average for... [donload the full report for more insights]

Having spent years accumulating savings and perfecting budgeting skills, Boomers generally have fewer money worries than younger generations.

Furthermore, this generation was raised just after the Second World War, so frugal attitudes remain in their blood, passed on by a generation affected by the hardship of world wars.

But they also enjoy...

Download this free report for all the insights > complete the form at top of page...

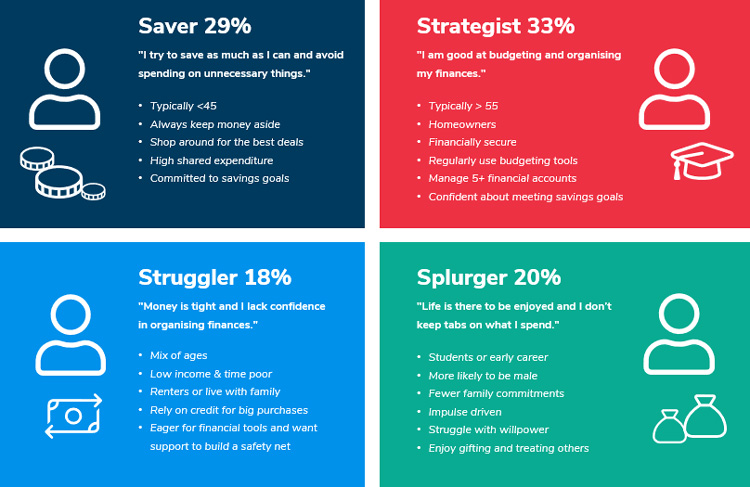

4 Financial personas

The research identifies four archetypal financial personas which define characteristics reflecting consumer goals, attitudes, motivations and mindsets regarding money management.

The four financial personas... which type are you?

Broad demographic features such as age, income or gender provide only limited insight about consumers’ approach to money. Consumers’ saving and spending habits are best understood through the lens of individual personas or mindsets. These archetypes are not one-size-fits-all and some consumers will have overlapping characteristics. Consumers can also transition from one persona to another, based on life stage, changes to their financial situation, and the support of effective budgeting tools. Our research shows that UK consumers are aligned to one of the four financial personas.

The "Saver" persona

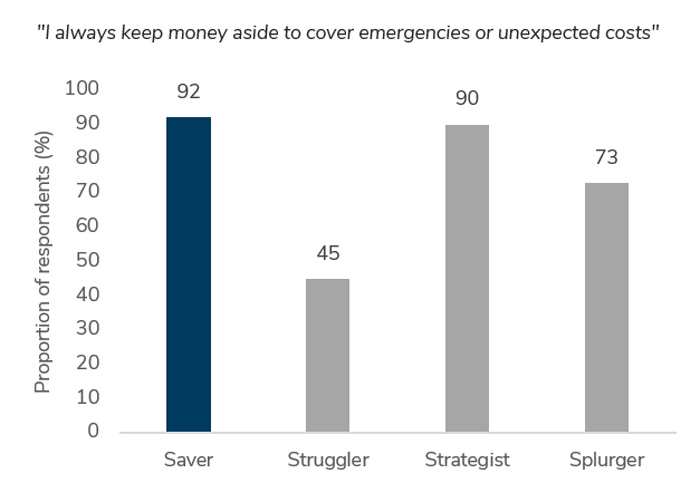

Broad demographic features such as age, income or gender provide only limited insight about consumers’ approach to money. Consumers’ saving and spending habits are best understood through the Savers take great pride in squirreling money away, and always set aside money for a rainy day. 92% of Savers say they always keep money aside to cover emergencies or unexpected costs, compared to just 45% of Strugglers.

Cost-cutters by nature, they seek ways to reduce monthly expenses and shop around to find the best prices.

Savers try to avoid impulse purchases and indulging in the latest trends; they get more satisfaction from bargain-hunting or negotiating a good deal. 86% of Savers will often look for the best deal or a discount before deciding where to spend.

Splitting bills and expenses with others is seen as an important way for Savers to keep control of costs and meet their saving commitments. Typically under 45, Savers are busy and socially-active: shared costs with family, friends or flatmates are a big proportion of their monthly expenditure.

Savers therefore place great value on digital banking or budgeting apps that enable them to quickly and easily share expenditure with friends and family. Almost three quarters (73%) of Savers regularly share expenditure with family and friends.

Savers usually have clear long-term goals in mind when managing money and take great interest in planning their personal finances to fulfil these aspirations.

Planning for a future event or goal is a primary motivation for saving for this cohort. This may include saving up for a wedding, mortgage deposit, children’s education, or making shrewd pension choices in preparation for retirement, even if it’s still many years away.

By organising money, cost-cutting and regular saving, most Savers feel confident and in control of their personal finances (Figs 15).

Download this free report for all the insights > complete the form at top of page...

Figure 15 – Interest in digital budgeting tools higher amongst those with multiple financial accounts

Source: Retail Economics

The "Struggler" persona

Splurgers gain great emotional satisfaction from spending money.

Splurgers encompass different types of people. Some are ‘bury your head’ types who don't want to face economic realities, preferring to ignore their personal finances and even taking risks through debt creation. Others don’t keep tabs on what they spend simply because they are...

Download this free report for all the insights > complete the form at top of page...

The "Strategist" persona

Strategists are characterised by strong budgeting skills, low debt, and a desire to proactively control their personal finances by monitoring spending activity, setting goals and reaching them.

They are committed to financial stability, preferring to take a considered approach to spending rather than act impulsively. Major purchasing decisions involve...

Download this free report for all the insights > complete the form at top of page...

The "Splurger" persona

Splurgers gain great emotional satisfaction from spending money.

Splurgers encompass different types of people. Some are ‘bury your head’ types who don't want to face economic realities, preferring to ignore their personal finances and even taking risks through debt creation. Others don’t keep tabs on what they spend simply because they are financially comfortable and...

Download this free report for all the insights > complete the form at top of page...