UK Omnichannel Retail 2023: Understanding Consumer Segmentation for In-store & Online Markets

5 minute read

Click here for more information on working with Retail Economics to publish world class thought leadership research like this.

What you can learn from this report

- We surveyed 2,000+ UK households to better understand what shopping channels consumers are spending in.

- We then distilled the key insights and reported them very succinctly.

- It will give you in-depth analysis of consumer channel behaviours and priorities to understand the fast-evolving omnichannel retail landscape.

- Get retail category-specific insight on shifting channel behaviours and the impact of demographic variables such as: age, income and place of work. However, members can get many more data splits for deeper insights.

- Retail brands, agencies and the like can use these insights to make better data-driven decisions to support strategic objectives.

Report insights can help provide answers to questions such as:

-

What shopping channels do female Millennials prefer to spend in for clothing & footwear?

-

What retail categories does the online channel significantly rival in-store?

-

How does household income impact shopping channel preference within the food and grocery sector?

What you need to know about omnichannel

Our UK Omnichannel Retail report reveals a prevailing trend towards physical channels, with 61% of consumers favouring in-store shopping, while 39% shop mostly online. However, the report delves deeper into the complexities of channel behaviour and identifies key demographic factors that drive variations in consumer preference, including:

Age: Almost one in two (45%) Millennials shop mostly online – the highest of any age group. In contrast, 69% of Boomers shop primarily in-store.

Income: Nearly two thirds (63%) of low-income households shop mostly in-store, while higher-income households have a stronger inclination towards online.

Place of work: Around half (48%) of work-from-home consumers shop primarily online, compared to 38% of commuters.

Retail sector: Electricals and Fashion are the only sectors where a majority of consumers shop online. Food & Grocery (77%) and DIY & Gardening (69%) have the highest proportion of in-store shoppers.

We've got so many ways to 'split the data' for deeper insights

Our UK Omnichannel Retail report provides a unique analysis of the social and demographic factors that influence channel preference, making it an invaluable resource for businesses looking to understand changes in consumer behaviour and the impact on online and in-store market trends.

This report helps businesses gain a deeper insight into which channels are most popular among different retail sectors and consumer segments, allowing them to tailor their strategy to reach their target customers more effectively.

The report only provides a snapshot of the data and insights available.

All Retail Economics members can access comprehensive datasets for this report, with channel behaviour trends split by:

- Age

- Gender

- UK region

- Household

- Income

- Employment

- Status

- Living arrangements

- Work environment

- Consumer sentiment

- Sustainability credentials

Example insights

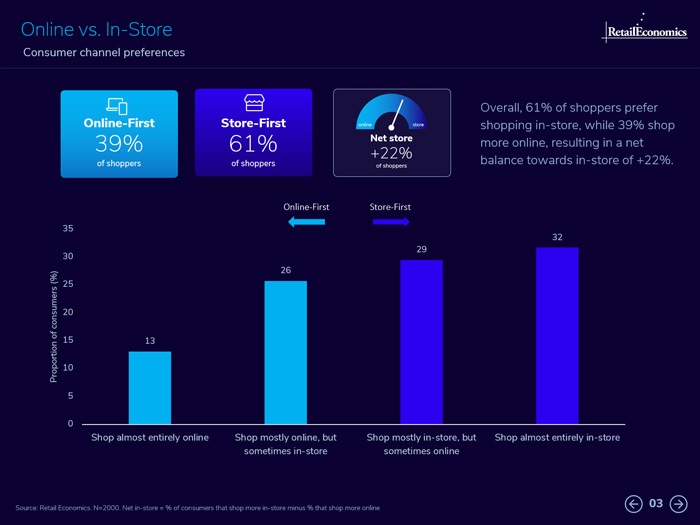

Overall: online vs. in-store

Overall, 61% of shoppers prefer shopping in-store, while 39% shop more online, resulting in a net balance towards in-store of +22%. This is depicted by our 'swingometer' as shown below for the overall sector. The report also includes channel prefernces by retail category as detailed later on (e.g. food, clothing, homewares etc.).

Factors impacting channel preference

There are several significant factors that determine shopping channel preferences. Here we look at just three of them: age; place of work, and income. However, as a Retail Economics member, you'll have full access to the reserach data where you'll be able to see data splits by region, employment status and many other metrics.

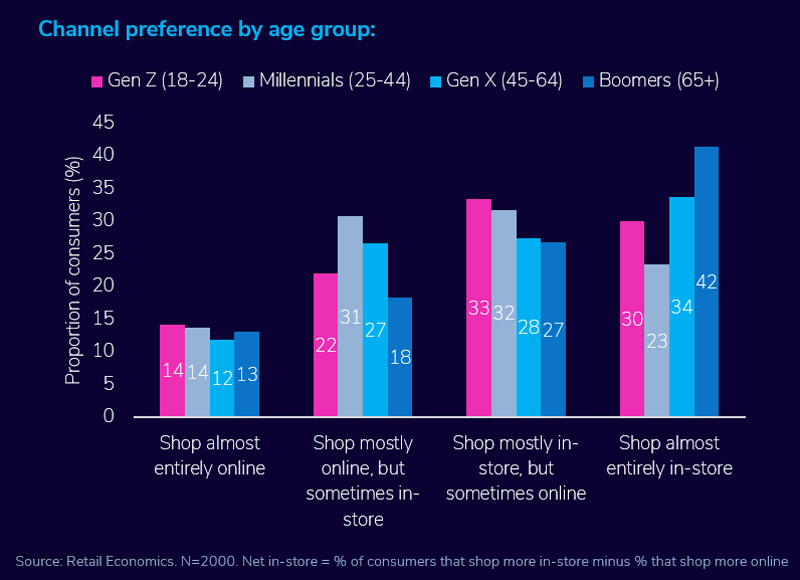

1. Generational differences

Age and generational values significantly impact shopping channel preferences as might be expected. Here, we look at the three key generations and see how age averagely impacts consumer behaviour in this context.

Gen Z (18-24 yrs) favour in-store over online: Despite being the youngest cohort of consumers and digital-natives, Gen Z’s value the instant gratification offered in-store, as well as the opportunity for socializing and shopping trips with friends. However, Gen Z are omnichannel shoppers, adept at switching between digital and physical channels regularly along the customer journey.

Millennials (25-44 yrs) most likely to be ‘Online-First’ shoppers: Valuing convenience and comfort with technology. Their busy lifestyles, which often involve work and family responsibilities, drive this preference, as online shopping provides a wider range of products, customizable experiences, and the option for delivery.

Boomers (65+ yrs) show clear preference for in-store: They value the touch and feel of products, the social aspect of shopping and the personalized support offered by sales associates. They may also have limited experience and comfort with technology, making in-store shopping a more familiar option for them.

Channel preference by age group

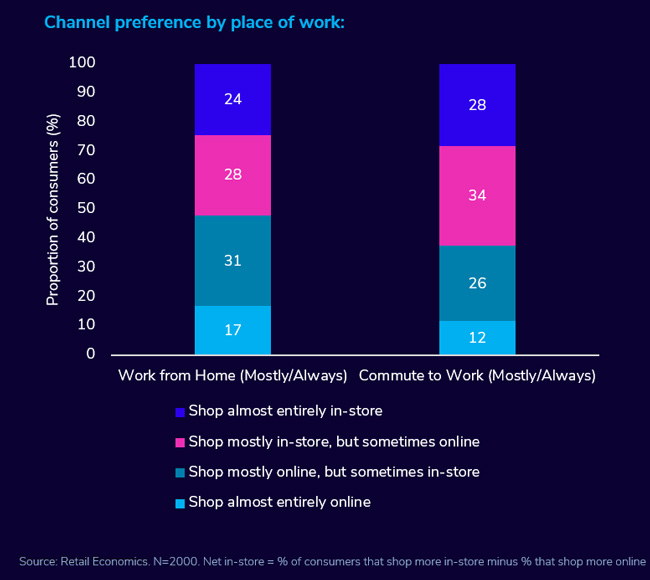

2. Place of work

Working from home can impact shopping behaviour, as evidenced by the higher propensity for online shopping among work-from-home consumers.

48% of Work-from-home consumers primarily shop online, compared to 38% of commuters.

The extra free time from less commuting, heightened availability for package delivery, and higher disposable income contribute to the appeal of online shopping for work-from-home consumers.

Conversely, over a quarter (28%) of commuters shop almost entirely in-store. Those who commute to their place of work spend more time outside of their home and have greater exposure to physical storefronts, which can drive their preference for in-person shopping. The convenience of being able to pop into stores on their way home from work is also a factor in their choice.

Work environment affects channel preferences, but not exclusively. As this report shows, other factors such as age, income, personal preference, and convenience play a role in shaping consumer behaviour, with the appeal of online shopping not limited to one's work environment.