From Plastic to Pixels: Navigating Shifts in Consumer Payment Preferences

10 Minute Read

Our report 'From Plastic to Pixels' (produced in partnership with FreedomPay) analyses, quantifies and forecasts the trajectory for digital wallets across the UK retail, leisure and hospitality industries.

Below are some exerts from the report, download the full report to access even more insights and data.

Click here to explore working with Retail Economics for creating high level thought leadership papers like this.

What can you get from this report?

-

A better understanding of the driving forces behind digital wallets becoming popular

-

Strategies for implementing digital payments

-

5 trends to look out for in the coming years

-

A deeper look into the influences and barriers shaping the future of digital wallets

-

A breakdown of digital wallet adopters and non-adopters

-

Long term structural considerations for businesses

Contents:

-

Introduction

-

Section one: The Evolution of Payments Towards Digital

-

Section two: The Digital Wallet Tipping Point and the Technological Divide

-

Trend 1

-

Trend 2

-

Trend 3

-

Trend 4

-

Trend 5

-

Section three: Strategic Considerations for Adoption

-

Conclusion

Introduction

Amid the unfolding digital revoloution within financial serives, and imminent seismic shift is poised to reshape the very bedrock of consumer payment preferences. The time-honoured bastions of cash and debit cards are giving way to the allure of digital wallets as consumers look for more convenient ways to pay for goods and services.

Digital wallets enable consumers to effortlessly tap their smart devices to pay for goods, redeem discounts, and automatically collect loyalty points, among other functions.

In our digital age, they have become potent symbols of convenience, security and technological progress. As consumers navigate across channels, they are opting for more refined and seamless experiences that effortlessly merge digital and physical realms in a way that digital wallets can deiver. This technology essentially marks the inception of a new era in payment transactions.

Our research suggests that within the next decade, digital wallets will prevail as the payment method of choice for most consumers. This will mark the demise of cash, while accelerating the 'death of plastic' (debit and credit cards).

This report analyses, quantifies and forecasts the trajectory for digital wallets and other forms of payment across the UK retail, leisure and hospitality industries. It explores the importance of digital wallets in increasing competitive advantage, market share, and overall growth.

Section one: The Evolution of Payments Towards Digital

Payment systems constantly evolve, but the rise of digital wallets represents a notable shift. Spurred on by digital advances, this transformation sees the gradual waning in dominance of 'plastic' (debit and credit cards) and cash.

While debit and credit cards have been foundational, digital wallets are proving to be more efficient and adaptable for today's omnichannel consumers.

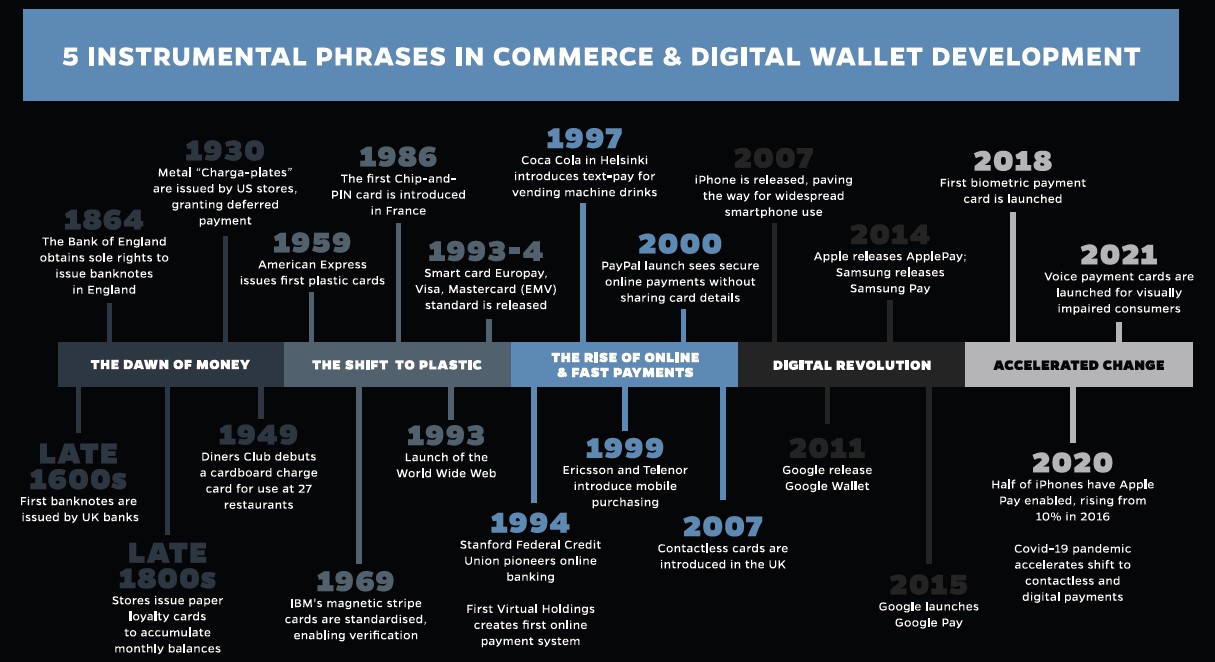

The future of transactions is unfolding. The figure below shows the evolutionary timeline of payments within retail, hospitality and leisure in five key phases as we enter a period of accelerated change.

The pandemic hastened a departure from conventional payment methods. Many consumers embraced digital wallets for the first time, while companies that reduced cash transactions quickly recognised numerous benefits. Now, with no legal mandate to accept cash, many establishments, including high street brands have opted for cashless operations, prioritising efficiency, cost savings and employee safety.

Meanwhile, with the surge in smartphone adoption, coupled with the availability of platforms like Apple Pay and Google Pay, has rendered traditional notes and coins less desirable for a significant proportion of consumers. Indeed smartphones are deeply engrained into today's retail customer journey, enabling consumers to discover, research, purchase products, and track online deliveries among other functionalities.

Mobile accounts for around 70% of all online retail traffic in the UK, representing significant growth over the last five years

There are also long-term, structural considerations for UK businesses. For example, governments and central banks across the world are discussing the concept of a Central Bank Digital Currency (CBDC). The Bank of England and the Treasury are exploring the potential od CBDC, leveraging the infrastructure offered by blockchain. This could pave the way for direct digital currency issuance to individuals or businesses, facilitating digital holdings on smartphones.

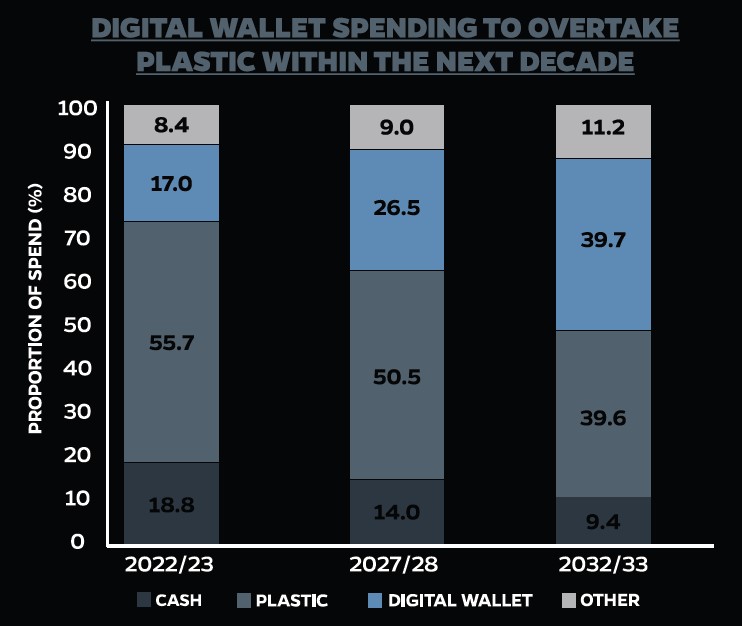

Simultaneously, there are clear strides towards a cashless society, marked by bank branch closures and caps on cash deposits and withdrawls. In fact, cash usage has plummeted from over half of all transations in 2010 to a mere 18.8% in 2022/23, according to our findings. Furthermore, our research shows that alongside the deline of cash, there is legitamate potential for the 'death of plastic', as accelerating digital wallet adoption takes hold over the next decade (explored in section 2).

Section two: The Digital Wallet Tipping Point and the Technological Divide

Retail, hospitality and leisure businesses need to prepare themselves for a fundamental shift in payments. For businesses and consumers alike, digital wallets unlock value-added benefits, including identification to enable relevant and personalised customer journeys across channels.

Businesses must underpin their value propositions with payment experiences that seamlessly elevate convenience and engagement to fulfill their customers' desire for frictionless transactions and personalised experiences.

Leaders are setting themselves apart by putting payment innovation at the heart of connected omnichannel experiences that anticipate consumers' emerging expectations.

In today's customer journeys, spanning from initial awareness to aftersales and repurchase, a single transaction can now have noth online and physical touchpoints. Here, digital wallets step in seamlessly to enhance convenience and supercharge omnichannel experiences.

Deeply understanding consumer needs across different demographics and categories will be critical during the digital wallet transition over the next decade. This section provides key insights, framed by the following five trends:

Trend 1 - The Demise of Plastic: Estimates the tipping point when digital wallet payments overtake spending on plastic and unpacks the consumer cohorts driving different rates of adoption

Trend 2 - Digital Wallet Adopters: Unravels the characteristics of digital wallet users, revealing three main consumer behavioural archetypes

Trend 3 - Consumers Demanding More From Technology: Adopters value the ease of digital wallet payments, but expectations are shifting to more integrated and harmonious experiences.

Trend 4 - Trust Barriers to Adoption: Key barriers to widespread adoption of digital wallets centre around limited acceptance, knowledge gaps, and trust in the technology, clearly showing a demographic at potential risk of financial exclusion.

Trend 5 - Pace of Adoption Varies by Category: The short-term shift to digital wallets will be uneven with categories across retail, hospitality and leisure displaying different market characteristics, oppurtunities and barriers to adoption.

Trend 1: The Demise of Plastic

The uptake of digital wallets is accelerating at a remarkable rate. Our research suggests that within the coming decade, this innovative mode of payment will eclipse 'plastic' as the favoured transaction method in the retail and hospitality sectors.

Over the past year alone, two-thirds of consumers (63.7%) have used a digital wallet either online or in a physical environment; while a fifth (19.6%) intend to use them in the near future. The uptake is primarily driven by acceptance across retail and hospitality outlets as consumers discover new levels of convenience offered.

Currently, around a fifth (17.0%) of retail, leisure and hospitality spending is conducted using digital wallets; compared with over half (55.7%) using plastic, and around a fifth (18.8%) using cash. Over the next 10 years, the share of digital wallet payments is set to more than double to 39.7%. This equates to £210bn of retail, leisure and hospitality spending using digital wallets in 2032/33, rising rapidly from the current £72.5bn, and predicted £127.7bn in 2027/28.

The velocity of adoption varies dramatically by demographic. Early adoption of digital wallets has been prominent among younger and more affluent consumers who embrace digital advancement. The vast majority of affluent consumers have used digital wallets in the past year and intended to continue to do so. However, there is a significant cohort of typically older and lower affluence consumers that show no intention to use digital wallets in the near future, slowing the overall pace of adoption.

For further information about this trend, download the full report for free at the top of the page

Trend 2: Digital Wallet Adopters

Digital wallet adopters are leveraging advances in technology to heighten the convenience, speed amd relevancy of their engagement with brands across channels.

The increasing pressure on retail, hospitality and leisure businesses to embrace technology that supports seamless and personalised experiences can often challenge merchants with legacy operating models. However, digital wallets unlock benefits for both consumers and merchants, and enable businesses to better engage younger, affluent consumers who are becoming more commercially significant.

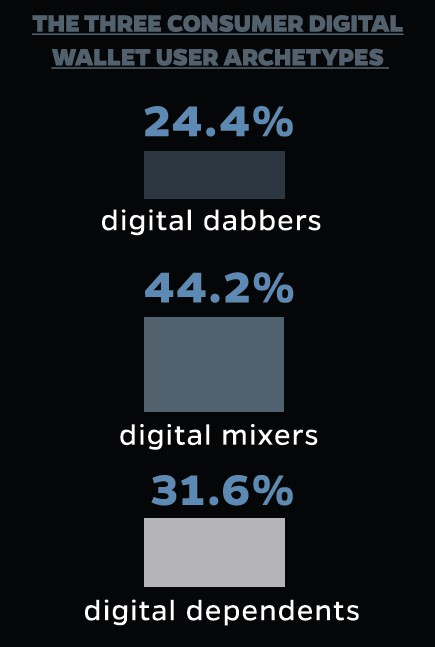

Analysing characteristics of digital wallet users in the UK reveals that the pace of adoption differs across three main consumer behavioural archetypes. This is primarily influenced by different levels of exposure to digital wallets, affluence and age.

'Digital Dependants' who account for around a third (31.6%) of digital wallet users, already make the majority of their payments through digital wallets. Their wallet adoption has been over a number of years they are typically younger and more affluent consumers.

By comparison, 'Digital Dabblers' who represent a quarter (24.2%) of digital wallet users are typically older, and relatively less affluent. They have started using digital wallets more recently, with three quarters (73.6%) using them for less than a year and with a penetration rate lower than one in four. Importantly, two thirds of this cohort expect their proportion of spending via digital wallets to increase over the next five years.

'Digital Mixers' typically capture a middle-income cohort, with their use of digital wallets less established than 'Digital Dependents', but accelerating as it becomes more habitual.

The digital wallet shift over the next five years is greatest among 'Digital Dabblers'(79.9% increase in digital wallet spending between 2023-2028), followed by 'Digital Mixers' (36.2% increase, 2023-28). Although these two groups currently have lower penetration rates, they show an increasing propensity to making most payments using digital wallets over the next decade.

The research emphasises that across these three archetypes, digital wallet use displaces plastic and cash, implying that after a period of normalisation, digital wallet use will gradually supersede traditional payment methods.

Trend 3: Consumers Demanding More from Technology

The rapid uptake of digital wallets reflects the democratisation of technology. As tools and platforms become universally accessible, consumer expectations will naturally evolve, driving a shift in trasaction methods. Digital wallets lend themselves to seamless and integrated customer journeys, with ease of payments being a cornerstone of digital wallet use.

The research shows that over the next five years, consumers have gorwing expectations of digital wallets. They desire features that enable end-to-end solutions for all payment-related functions. Furthermore, what 'convenience' means for consumers is changing as they embrace cross-channel shopping and personalisation.

The emerging connected consumer journey will expect frictionless omnichannel experiences and place increasing value on integrated loyalty schemes, BNPL options, and personalised offers over the next five years.

'Digital Dependents' place particular importance on the integration of loyalty points, and personalised offers, with almost a third (31.7%) wanting both these features in the future.

Nevertheless, ease of payment is fundamental to support the transition to new payment technologies for those who were not born in the digital afe. Ease of use will be the highest priority for the older Silent Generation. A significant 64.3% of those aged 77 and over want to see easier payments, compared with just 38.0% of Millennials, who were early adopters to the technology.

Trend 4: Trust is the Top Barrier of Widespread Adoption

Trend 5: Pace of Adoption Varies by Category

(download the report now to access Trend 4 and Trend 5)