Omnichannel Communication & Solving Consumer Pain Across The Customer Journey

5 Minute Read

Our report, 'Omnichannel Communication & Solving Consumer Pain Across The Customer Journey', developed in partnership with Infobip, delivers critical insights into customer experience enhancements, digital transformation, and strategic responses to evolving consumer behaviours.

Below are some exerts from the report, download the full report to access even more insights and data.

Click here to explore working with Retail Economics for creating thought leadership papers like this.

What can you get from this report?

-

Explore innovative strategies for enhancing customer satisfaction and retention in the UK retail landscape for 2024.

-

Understand the critical pain points in the customer journey, from communication breakdowns to delivery and return issues.

-

Learn how advanced analytics and AI are transforming the retail experience, offering personalised interactions and efficient service.

-

Access strategic recommendations for navigating future retail challenges, focusing on customer-centric approaches and digital transformation.

-

Find out how different consumer personas—ranging from exacting to laid-back shoppers—affect shopping behaviours and preferences across channels.

Contents:

Introduction

We surveyed 2,000 consumers across the UK to gain fresh insights about what shoppers want from customer experience (CX).

Navigating the retail landscape in 2024 has become more complex with the changing channel mix, influenced by increasingly tech-savvy consumers and sophisticated retailer propositions.

As trading conditions become more challenging, retail brands are pressured to improve and maintain customer satisfaction and retention. Consumer budgets are severely affected by factors like inflation and rising interest rates, while the economic recovery remains uncertain due to high interest rates, geopolitical tensions, and unclear forecasts.

In this environment, shoppers are more careful during the buying journey, with pricing affecting their purchases and the customer experience. Any friction in the customer journey can lead to cart abandonment. This is why understanding consumer personas and behaviors is vital for enhancing sales and marketing strategies in omnichannel retail.

Today's customer journey involves consumers switching between multiple channels, including in-store, eCommerce, and social channels, while interacting across various digital channels and devices. Retailers are under pressure to be available anywhere, anytime, and to provide seamless, personalised customer journeys.

Section 1: The customer journey

Understanding how people interact with brands is crucial, from initial awareness and research to purchases and returns. By identifying typical consumer personas, retailers can tailor their strategies to better meet the needs and preferences of specific customer groups, ultimately providing more satisfying and effective customer journeys. From initial awareness to purchases and returns, every interaction shapes the customer experience.

The simplified five-stage customer journey

Customer personas

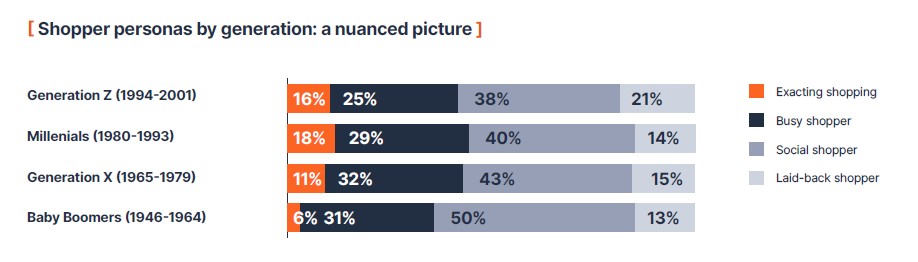

In our study, we established different buyer personas to gain a better understanding of potential friction points in their respective customer journeys:

-

The exacting shopper

-

The busy shopper

-

The social shopper

-

The laid-back shopper

Example persona:

(Download the full report for the rest of the personas)

Decoding consumer complexity: Looking beyond age and income

Our research has shown that making assumptions about shopper traits based on income and age would be wrong.

For example, while more tech-savvy consumers under 45 tend to fall under the exacting shopper persona, many of them could also be laid-back shoppers, especially those in Generation Z. This counters the stereotype of younger consumers consistently having elevated retail expectations.

The lines are also blurred between income groups: higher incomes don't always mean lower tolerance, nor do lower incomes guarantee greater leniency.

Affluent individuals show a similar proportion of laid-back shoppers as middle-income groups, challenging assumptions about financial status and retail expectations. Conversely, the least affluent have more exacting shoppers than middle-income brackets.

(Download the full report for the rest of this section)

Friction within the customer journey

Identifying friction areas is vital to improve touchpoints and solve problems in the journey. In doing so, retailers can enhance customer experience, loyalty, and business success.

Our research identifies several areas for enhancement across various stages of the customer journey:

-

Awareness and discovery

-

Research

-

Purchase

-

Fulfilment

-

Returns

Stage 1: Awareness and discovery

Creating brand awareness is a complex process, regardless of the maturity and size of a brand. The challenge intensifies in the digital space, saturated with advertising and promotions. Further learnings at this stage include:

-

Personalised communication helps to break through digital clutter, especially with exacting shoppers who appreciate individualised messaging.

-

Traditional channels remain essential for brand discovery, but retailers increasingly turn to data-driven marketing for precise targeting and improved ROI.

-

Physical stores are evolving into experiential destinations, bridging the gap between digital and physical realms – also known as phygital retail.

-

Social media, particularly short-form videos, is vital for brand discovery, especially for Gen Z and millennial consumers.

-

Crafting engaging content across demographics is key, underscoring the importance of a unique brand voice and genuine connections with consumers.

Source: Retail Economics, Infobip

Stage 2: Research

Digital channels are essential in reducing the frustration linked to purchase decisions – especially when expensive items are involved.

A significant 58% of consumers find it straightforward to research and locate product information online. However, there is a notable gap between digitally-savvy shoppers and more occasional store-first shoppers. This highlights a potential digital skills gap and underscores the need for accessible, user-friendly online platforms for all shoppers.

Source: Retail Economics, Infobip

(Download the full report for the rest of this section)

Section 2: Managing customer expectations and building trust

We identified five key areas where customers feel their expectations are unmet, which are critical points for retail brands to focus on to deliver significant improvement:

1. Paying for returns - Over a third of exacting and busy shoppers have stopped shopping with brands that expect customers to pay for returns. Confusing or unclear processes also lead to brand abandonment.

2. Stock availability - Directly impacts customer satisfaction, sales, repeat business, and retention rates. Nearly 25% of all shoppers ended relationships with retailers because of this.

3. Poor communication - When delays or issues arise is vital within the customer journey, as it helps maintain trust and transparency, mitigate dissatisfaction, and preserve customer relationships.

4. Lack of delivery options - Negatively impacts customer satisfaction and loyalty. 29% of exacting shoppers and 28% of social shoppers stopped shopping with retailers who don't offer different delivery choices.

5. Delivery tracking - Builds confidence and bolsters customer trust. Exacting shoppers will most likely stop shopping altogether with retailers that don't offer this (22%).

Source: Retail Economics, Infobip

Communication goes both ways

Communication is crucial in establishing trust and loyalty. Understanding consumer preferences in communication channels is essential for effective strategies.

While email remains the most popular across the board, there are a few notable trends between the buyer archetypes:

-

The time-sensitive exacting shoppers favor phone calls or talking to chatbots

-

Gen Z leans toward communication via text messages, phone calls, and social media

-

24% of consumers opt for phone calls, highlighting the enduring importance of human interaction for issue resolution

-

Between different age groups, digital channels like WhatsApp, social media, and online chat are still dominated by more conventional channels like phone calls, text messages, and email.

-

AI integration in customer service, including chatbots, garners mixed reactions. Only 27% of consumers are comfortable with AI-enhanced communications, indicating a need for cautious implementation.

-

Despite technological advancements, 40% of consumers desire more effortless access to human support. This preference for human interaction fosters trust and loyalty, outweighing the need for speedy resolution.

Source: Retail Economics, Infobip

(Download the full report for the rest of this section)