Case Study: Refill

Refill is an award-winning behaviour change campaign to help people live with less waste. By providing a framework and platform for communities, businesses and consumers to take action, the campaign supports the transition towards reuse systems and tackles the global issue of plastic pollution by reducing waste, whilst empowering individuals, community groups, local authorities, and governments to drive lasting change in their communities by reducing single-use plastic. With the support of local volunteers, Refill Schemes, and International Delivery Partners, the campaign facilitates action at a grassroots level.

Across the United Kingdom, over 400 community and council-led schemes are committed to waste reduction in their local areas. Among these, 88 Refill Schemes are led by councils, demonstrating the campaign’s widespread impact and involvement. An astounding 89% of Refill Schemes report that their “involvement with Refill has helped deliver a positive environmental impact” within their communities.

The Refill campaign formed an integral part of the Turning the Tide project in Bournemouth, Christchurch and Poole. This partnership with the local council helped to transform 14 miles of coastline into a low-impact tourist destination by reducing single-use plastic on its beaches, and saw Refill working with MIW Water Cooler Experts to install new fountains to help residents and visitors stay hydrated and prevent plastic pollution caused by the millions of bottles of water bought every year. Free drinking water is now provided at over 150 locations, including 18 seafront kiosks, more than 130 existing beachfront taps, and 15 newly introduced “Hydration Stations”, with brightly coloured, fun and engaging signage directing people to refill at them.

All 150 water Refill Stations across the Bournemouth, Christchurch, and Poole (BCP) seafront have been added to the Refill app, bringing the total amount of Refill Stations in the BCP area to over 400. Encouraging visitors at the beach to remember their reusable bottles and refill at one of the now easy-to-find Refill Stations means less bottles of water are sold – and less empty bottles end up on the beaches, streets and in the sea. This partnership helped to stop 19,000 single use plastic bottles in July 2022 alone!

Section five: Calibrating the impact of advertising on UK bottle water sales today

As we have already highlighted in Section 2 of this report, promotional activity was pivotal to the establishment of bottled water as a distinct product category within Food and Drink. Today, the advertising activities of the major brands seem – at least on the surface – to be much more passive, protecting the category in the face of environmental headwinds as much as growing it further. Partly, the big brands themselves are at least somewhat conflicted in terms of bottled water growth since it might impinge on their higher-margin sales in other neighbouring categories (this is most obviously true with respect to CocaCola and Pepsi, but also applicable to Danone and Nestlé at least to a degree).

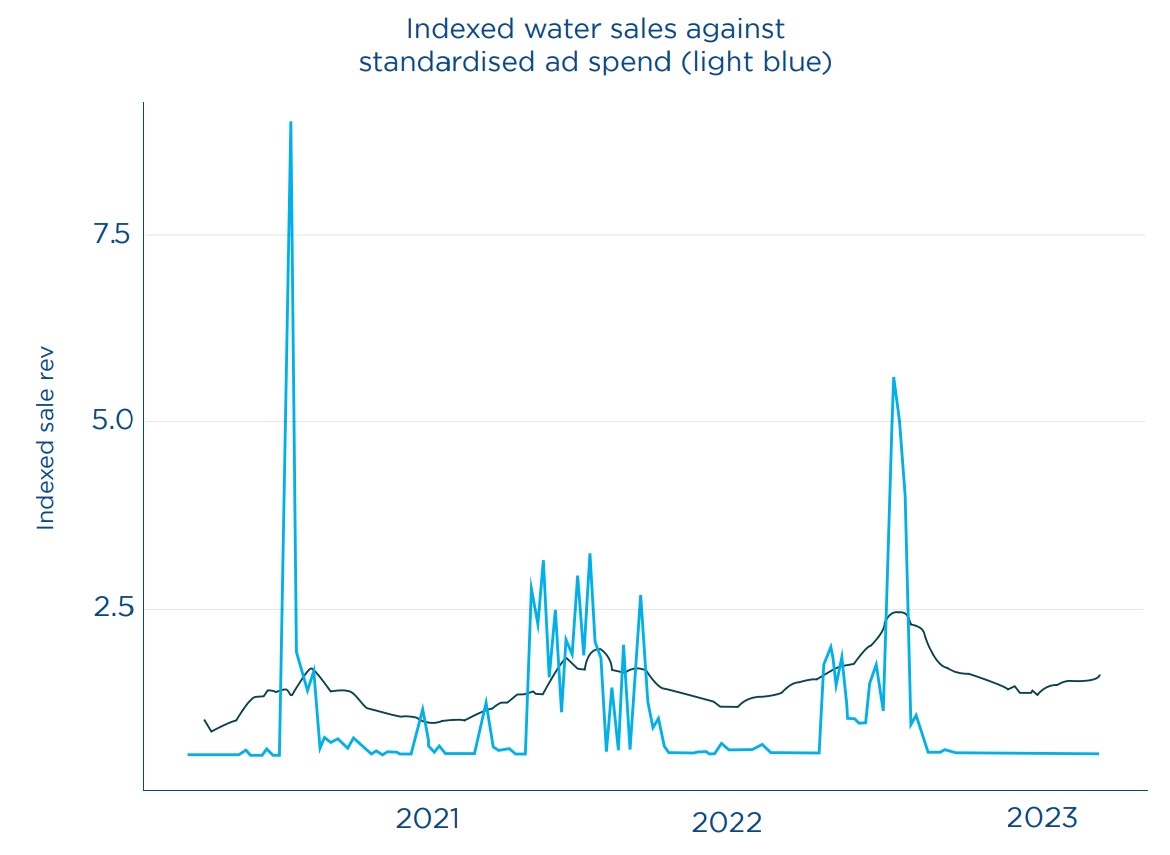

We examined recent weekly trends with respect to bottled water advertising and product sales using a Bayesian Marketing Mix Model (MMM) over the period March 2020 to December 2022 – almost three years. This model is a flexible statistical regression model which accounts for the historical relationship between marketing spend and sales; it then uses this information to estimate the contribution of each marketing channel to overall sales of bottled water. The regression analysis considers the spending levels of different advertising channels (e.g. TV, radio, digital), external factors such as seasonality (e.g. effect of holidays and time of year), as well as macroeconomic factors (e.g. COVID restrictions).

Initial research highlights a strong correlation between advertising and sales (Fig. 13), with the industry doing the majority of its advertising in the summer months as sales pick up with rising temperatures.

Figure 13: Indexed water sales against standardised ad spend

Source: Nielsen, Nielsen IQ

Advertising is likely to contribute to sales over 413 million bottles of branded water in just five years.

Including our forecast period and applying this from 2022 to 2026 (5-year period), advertising is likely to contribute to sales of over 413 million bottles of branded water in just five years.

Despite the plastic waste, bottle water still seems to position itself as ‘good for the environment’

Promotional activity around consumer products comprise various product claims and suggestions, which for bottled water are predominantly environmental in nature, including those on the face of the bottles themselves. To better understand these claims we looked more carefully at the messaging on bottle packaging designs from eight popular UK brands.

Despite the fact that these eight brands belong to just five parent companies, we failed to find a single, standardised point of similarity between them (other than the word ‘water’) in terms of how they are described – even the units used to describe bottle size. As such, there is practically no way for consumers to quickly and accurately assess the various product claims, never mind rank them in any meaningful way. And this remains true even when consumers are prepared to invest the time to research the brands further online.

Section 7: What is the solution?

In recent years, the UK Government has taken a range of policy measures to address perceived harms associated with specific products. Some initiatives have focused on safeguarding individuals from self-harm (e.g. smoking, drinking and gambling), while others have broadened their scope to encompass wider societal issues (e.g. financial strain on the NHS from obesity, child abuse resulting from alcohol misuse). In the past fifteen years, UK policymakers have increasingly ‘nudged’ consumers to take actions deemed beneficial, either for their own well-being or for the greater public interest.

It’s vital to acknowledge that in all these instances, consumer laws have been enacted to protect consumer rights and interests. These laws serve as a protective framework in a marketplace where the companies that individuals interact in, wield significantly more power. Furthermore, efforts have been made to enhance information disclosure during important transactions, ensuring greater transparency for all parties involved.

Examples of policy measures:

-

The traditional domains - tobacco and alcohol

-

Measures to help consumer awareness of their carbon footprint

-

Investment in refill stations

-

Present-day action - Calories, Carrier bags and Cotton buds

(These policies are explained in greater detail in the paper)

New guidance on environmental claims -

The Advertising Standards Authority and the Competition & Markets Authority have both recently promulgated new guidance regarding environmental claims that companies make about their product and services, explicit and implicit. Of particular concern to us are the following principles and advice:

-

‘Claims must not omit or hide important relevant information’ (CMA Guidance 2021)

-

‘Claims must consider the full life cycle of the product or service’ (CMA Guidance 2021)

-

‘Avoid using unqualified ‘carbon neutral’, ‘net zero’ or similar claims’ (CAP Guidance 2023)

What kind of policy strategy works? -

As we previously outlined in Section 1, there are significant and rising doubts regarding the ability of any single policy measure (tax-related or otherwise) to act as a ‘magic bullet’, allowing countries to hit their net-zero commitments. Instead, action is necessary on multiple fronts, with urgency being critical.

Evidence suggests that consumers alter their spending habits in response to clearer product labelling, partly because they otherwise seem to underestimate emissions associated with food and drink (Camilleri et. al., 2019). Traffic-light style environmental labelling successfully triggered more environmental product choices in a virtual reality setting at least (Arrazat et. al., 2023). Consumers also support labelling changes that allow them to make more informed buying choices according to our data.

Section eight: Key Policy Recommendations

We hereby set out our proposals for bottled water grouped under four broad headings:

Packaging Restrictions -

With 90% of the bottled water on our supermarket shelves being encased in plastic wrap (flexible, largely nonrecyclable, multi-pack associated), it is time to see this plastic wrap for what it really is – a carrier bag (some SKUs even come with handles).

As such, multi-pack plastic wrap should be taxed (at 10p per item) under suitable amendments to the Single Use Carrier Bags Charges Order 2015, or it should be banned under amendments to Environmental Protection (Plastic Straws, Cotton Buds & Stirrers) Regulations 2020. Of course, when it comes to carrier bags, consumers pay the tax when they purchase one, whereas with bottled water the item is automatically attached and non-removable prior to sale. Perhaps, like the Soft Drinks Industry Levy, the government might propose to tax the consumer at the point of sale unless the industry has reformulated the product (packaging in this case, rather than ingredients per the Soft Drinks Industry Levy) prior to the introduction of the levy

We also suggest that the industry be challenged to reduce the proportion of its sales accounted for by single-use bottles, especially with respect to non-sparkling water. Currently, we see no reason why the industry should be selling more than one-third of its product in 500 ml bottles in less than three years from now, especially considering what consumers indicated regarding their bottled water drinking habits when surveyed (mostly at home or at work).

Labelling Restrictions -

In his recent ‘Mission Zero’ Report, Chris Skidmore MP set out among his 129 recommendations, a goal for industrial product ecolabelling starting by 2025 (e.g. paper, glass), and that “government should continue to work with the industry” with respect to food ecolabelling. These are commendable and important goals, although the historical reality of food labelling systems (e.g. so-called trafficlight systems) suggests the road to final implementation will be long and arduous, certainly far beyond 2025 based on historical evidence.

Our own research also found that over two-thirds of consumers thought that there should be a label on single-use plastic bottled water to inform them of the environmental impact.

We see four main areas in which labelling will help support environmental objectives:

Environmental Awareness

Informed Consumer Choice

Encouraging Industry Accountability

Driving Market Transformation

(These four areas are explored in more detal in the paper)

Promotional Restrictions -

We propose that the Advertising Standards Authority (ASA) and Competition & Markets Authority undertake an immediate review of the explicit and implicit environmental claims and credentials proffered by bottled water manufacturers. This is in context of the negative environmental impact of their industry on society, and also in light of existing ASA rules in place regarding environment claims in particular.

After all, the whole of the bottled water industry is estimated to produce 4.0 billion bottles in 2022, with the majority either ending up in land fill or the incinerator. In addition, our research shows that advertising contributes directly to further the growth of the industry which causes further negative externalities.

The bottled water industry produced an estimated 4.0 billion bottles in 2022, with the majority ending up in land fill or the incinerator.

Accelerate Exisiting Commitments -

We strongly suggest that the UK government should accelerate the existing commitments to the Resources & Waste Strategy, Deposit Return & Extended producer responsibility schemes. In light of a series of delays, these commitments should be prioritised and legislation implemented as a matter of urgency to reflect the environmental cost of the industry on society.

We hope you found this article interesting. For more insights and industry analysis be sure to connect with us.

About this report

This policy paper: "An Economic and Environmental Case for Acting Against Bottled Water Packaging, Labelling and Marketing in the UK" is published by Retail Economics in partnership with Brita.

View All THOUGHT LEADERSHIP REPORTS