Changing Consumer Values & Behaviour: Building a Competitive Proposition in Retail

5 minute read

If you're interested in teaming up with Retail Economics to create first-rate thought leadership research like this, click here.

Report highlights

This report produced by Retail Economics in partnership with Alvarez & Marsal looks at how consumer behaviour is changing in response to industry mega trends, disruption, and the cost of living crisis. It explores different shopper behavioural archetypes based on five key attributes, and highlights areas that retailers and brands need to focus on to improve business strategies to 'weather the storm'.

The report is divided into 5 main sections:

• Introduction

• Part 1: Defining value and the five consumer archetypes

• Part 2: Megatrends shaping change in consumer values

• Part 3: The evolution of consumer values and how retailers and consumer brands must urgently react

• Conclusion

Introduction

Understanding shifts in consumer values lies at the heart of survival for many retail and consumer brands.

Successive waves of disruption have permanently altered much of the landscape, with the rise of digital, the shift to online, a global pandemic, and geopolitical tensions all forcing changes in ways that were once unimaginable.

A combination of rising costs of global commodities (e.g. oil, natural gas, grain, paper), transport (e.g. shipping, containers), labour shortages and ongoing disruptions from the pandemic have caused significant cost pressures which continue to filter through the supply chain.

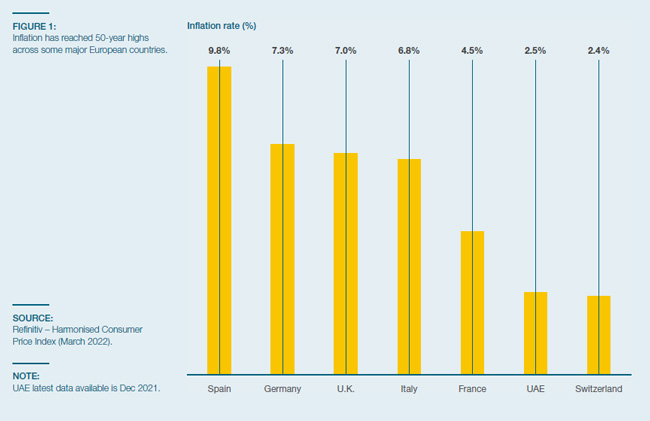

The speed and magnitude of these pressures differ widely by country and industry, based on factors such as the length and complexity of supply chains, hedging strategies, margins and supplier contracts. Nevertheless, consumer prices remain on an upward trajectory. Some forecasts predict double digit inflation by the end of 2022 for major economies across Europe, urging central banks to carefully balance tightening monetary policy with economic growth.

Figure 1. Inflation climbs to 40-year high driven by surging fuel, food and energy prices

Source: Refinitiv – Harmonised Consumer Price Index (March 2022)

Indeed, the Bank of England raised interest rates for the fourth consecutive time in May, reaching the highest level since the global financial crisis. Meanwhile, the European Central Bank (ECB) has confirmed it will end its net asset purchases, opening up the possibility of a rate hike which some policymakers hinted could come as early as July 2022.

Households are transitioning from an era characterised by a pandemic, towards one of economic uncertainty.

Against this backdrop, households are transitioning from an era characterised by a pandemic, towards one of economic uncertainty. Consumer values (and behaviours) are likely to be further remoulded to cope with a different set of challenges; values based on factors such as product type, channel, price point, sustainability and expectations within the customer journey.

As a result, retailers and brands will need to adapt their propositions to meet an increasing number of cost-conscious consumers with squeezed finances, whilst battling rising operating costs and ongoing supply chain disruption.

This will be tough for many.

Retailers and brands will need to adapt their propositions to meet an increasing number of cost-conscious consumers.

Consumer values are based on various attributes such as cost, quality and convenience, amongst others. The insights contained within this report are essential for businesses to better understand how consumer values are expected to evolve throughout 2022-23 (and beyond), and how retailers and other consumer-facing businesses can build their strategies and operating models to succeed in the current environment.

Section 1 of this report outlines a framework to measure consumer values. Section 2 explores megatrends shaping changes in consumer values; and the final section looks at strategies that businesses must embrace to adapt to current and future changes in consumer values.

The research contains data-driven insights developed from nationally representative consumer panel surveys comprising over 5,250 households across France, Germany, Italy, Spain, Switzerland, UAE and the U.K.

Part 1 - Defining value and the five consumer archetypes

Understanding consumer values is critical to building a strong and competitive value proposition. It forms the basis of securing customer loyalty as shoppers consider purchasing items that offer the highest perceived benefit for the lowest cost or effort.

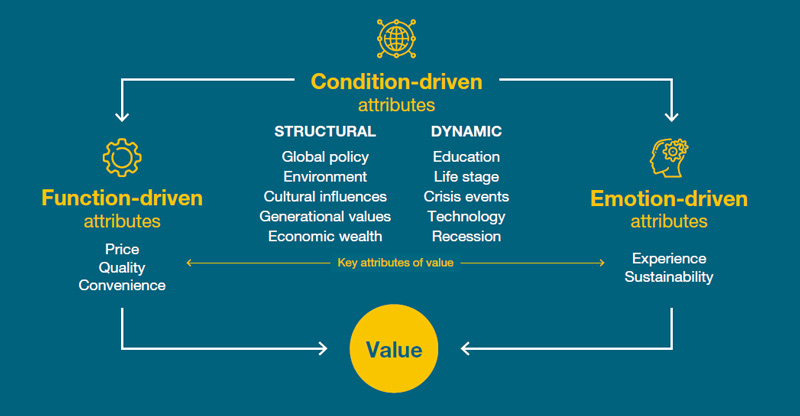

The consumer value framework (Fig. 2) encompasses factors such as economic development, life stage, income, education and many others. It is dynamic and evolves with time. Our research shows that the consumer path to purchase is influenced by perceived value which is derived by a continuous trade-off (benefits vs. sacrifices) between five key attributes:

1. Price

2. Quality

3. Convenience

4. Experience

5. Sustainability (ESG)

Figure 2: The consumer value framework

Source: Retail Economics, Alvarez & Marsal

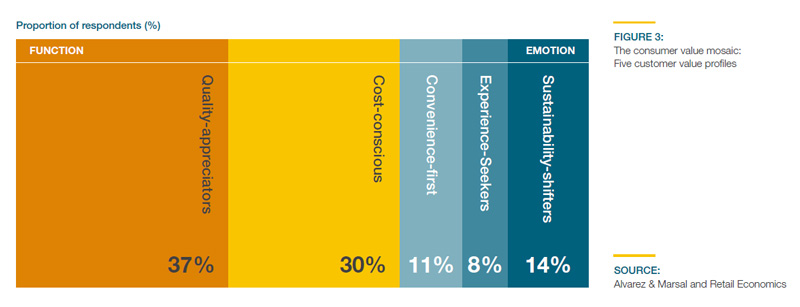

Our research reveals five consumer value archetypes (Fig. 3), based on how consumers across the seven countries perceive and rank the importance of the attributes when purchasing retail products and services.

Figure 3: The consumer value mosaic: Five customer value profiles

Source: Retail Economics, Alvarez & Marsal

1. Quality-appreciators are often aged 55 or older. Quality is perceived as the most important value when purchasing products, with consideration primarily placed on materials and brand, above low prices. From the countries analysed, these consumers are more likely to come from UAE and Switzerland, reflecting higher average incomes. Over half (55.0%) of Quality-appreciators value ease and access to product information, enabling judgement on product sourcing, materials and likely longevity.

2. Cost-conscious are more likely to be younger consumers, but ultimately the value captures a broad spectrum of ages. This cohort is primarily concerned with getting value for money from selected brands, retailers and products based predominantly on lower prices. These consumers look for pricing transparency and value access to product information to make informed choices. They are least likely to pay extra for sustainable products.

3. Convenience-first consumers reflect a broad mix of ages. This group often desires immediacy and frictionless customer journeys. They select retail brands based on how well they align with their behaviour, and are often willing to pay more for brands that ‘get it right’. Convenience for this group is less about finding promotions and deals, and more about understanding availability, simple payment and easy returns.

4. Experience-seekers are nearly twice as likely to be shoppers aged under 25 than over 55 years old. These shoppers are looking for meaningful interactions with retail brands, where entertainment, education, environment and escapism adds value to the overall transaction. This group is most likely to seek entertainment when shopping, and value inspiring environments both in-store and online.

5. Sustainability-shifters are typically Millennials and Gen Xs. These consumers increasingly embrace social causes, shopping with intent by seeking products and brands that align with their values. Six in ten consumers within this group would be willing to pay more for sustainable products, with over a quarter (26.2%) valuing sustainable sourcing as the most critical retail ethical practice.

Download this free report for all the insights > complete the form at top of page...

The consumer value proposition

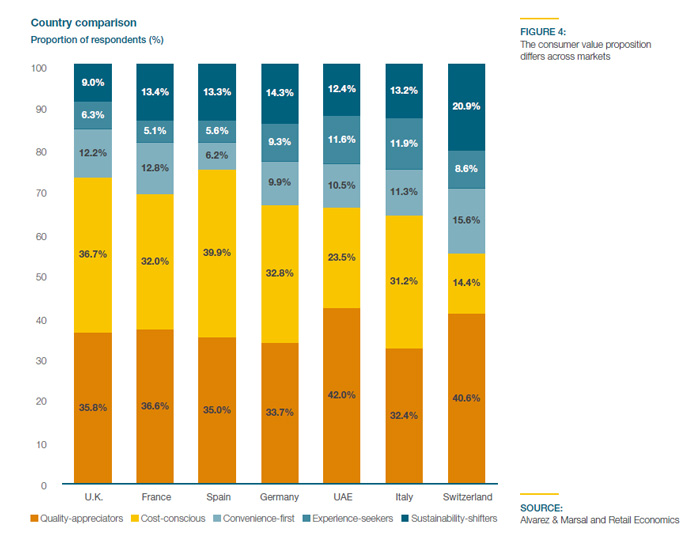

Despite notable international differences (e.g. market players, online infrastructure, competition), consumer values across the countries analysed remain remarkably consistent (Fig. 4). Price and quality comprise the main two constituents of the consumer value set across all markets (except for Switzerland where convenience is deemed marginally more important than price).

Interestingly, UAE and Switzerland have higher proportions of ‘Qualityappreciators’, and the lowest proportion of ‘Cost-conscious’ consumers. This finding is likely to reflect higher average incomes in these countries.

The U.K. ranked highest for consumers being more function-driven than any other country, followed by France and Spain. This is likely due to the U.K. having one of the most competitive, concentrated and digitally-developed markets across Europe. Arguably, this has created a more demanding consumer whose values are driven by low cost, high quality and seamless access to goods. With inflation hitting 9.8% in Spain in March 2022 (a near 40-year high), almost four in ten consumers are primarily driven by low-costs. This highlights the importance of ‘condition-driven’ influences (e.g. government policy, strength of regional economies, cultural influences) within the consumer value framework.

Figure 4: The consumer value mosaic: Five customer value profiles

Source: Retail Economics, Alvarez & Marsal

Part 1 - Defining value and the five consumer archetypes

Covid-19 changed the way people work, communicate and shop, and forced people to reassess their values which resulted in behavioural changes. For example, across Europe, 40% of consumers purchased a product online which they had only bought in-store pre-pandemic.

Now, consumer values are also being redefined. The exposure to new customer journeys and the disruption to everyday life have brought about a change in values for more than two thirds (68.8%) of consumers. Alongside the emergence of the cost-of-living crisis, price (15.7%), quality (15.0%), and convenience (15.6%) became more valuable factors when buying from a consumer-facing brand since the onset of the pandemic (Fig.5).

Figure 5: Consumers have become more demanding of price, quality and convenience since the pandemic

Since the onset of the pandemic, have any of the factors you view as being

important in what you look for when buying products from a consumer

facing brand become more valuable?

Proportion of respondents (%)

Source: Retail Economics, Alvarez & Marsal

Our research identifies three key trends that are currently shaping what consumers value:

Despite notable international differences (e.g. market players, online infrastructure, competition), consumer values across the countries analysed remain remarkably consistent (Fig. 4). Price and quality comprise the main two constituents of the consumer value set across all markets (except for Switzerland where convenience is deemed marginally more important than price).

Trend 1: Flight to value as cost-of-living crisis bites

Major economies across the world are facing tough economic headwinds as escalating inflation, slower growth and tightening monetary policy are set against a backdrop of heightened geopolitical tension. This means many households are ‘walking out of a pandemic’ into a cost-of-living crisis.

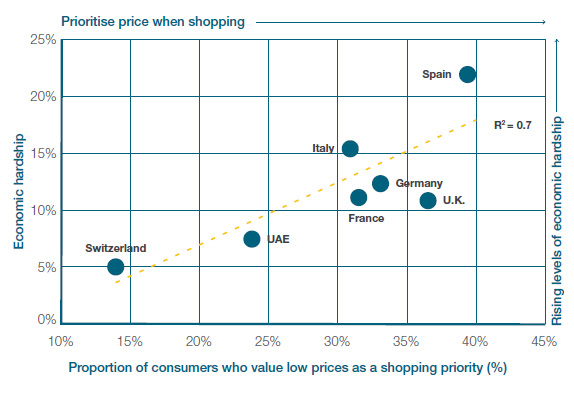

Our research shows a strong relationship between consumers who prioritise price (‘Cost-conscious’) as a core attribute of value, and those countries facing the toughest economic hardship. Figure 6 depicts this relationship, plotting a measure of economic hardship (calculated by combining inflation and unemployment into a single metric), with the proportion of ‘Cost-conscious’ consumers for each of the countries included in the research.

Figure 6: Countries feeling greater economic hardship have seen more cost-conscious consumers emerge.

Source: Retail Economics, Alvarez & Marsal

Spain emerges as the country with both the highest proportion of ‘Costconscious’ consumers, and the economy currently facing the greatest economic hardship. Arguably, it provides a clear indication for other countries as to how consumer values are likely to shift with deteriorating economic conditions.

Intuitively, the research confirms that countries that currently have a higher proportion of consumers that value price above other factors (e.g. Spain, U.K.) also have greater expectations that the rising cost of living will impact their values over the next 12 months.

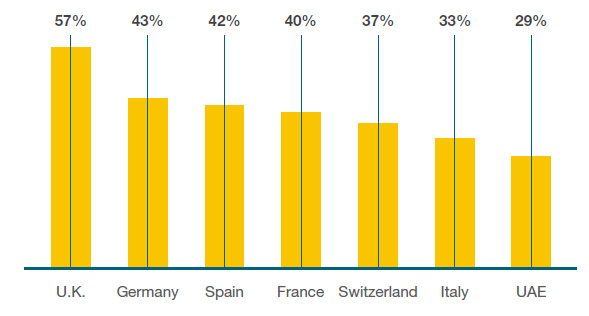

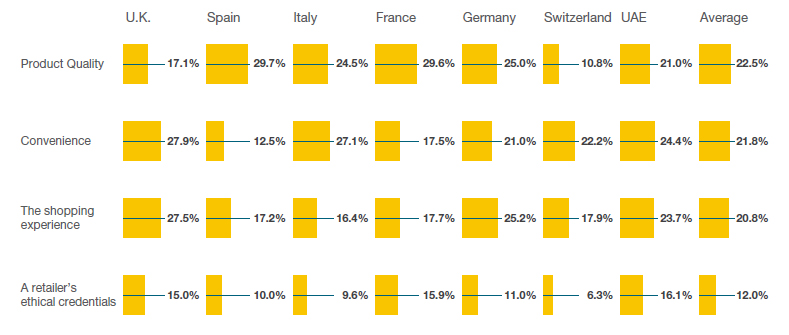

Across all countries, an average of 40% of consumers feel that the cost of living will have the biggest impact on their expectations of retail and consumer-facing brands over the coming 12 months – highest for the U.K. (57%), Germany (43%) and Spain (42%).Furthermore, as consumers focus on price, they are more likely to compromise on other value attributes. Almost a quarter of consumers (22.5%) would be willing to sacrifice quality in favour of lower prices. This is closely followed by convenience (21.8%) and the shopping experience (20.8%).

Figure 7: The cost of living will have the biggest impact on consumers' expectations of retailers in the coming 12 months.

Over the next 12 months, what factors do you think will have

the biggest impact on your expectations of retail brands?

Proportion of respondents who said the “cost of living” could have the biggest impact (%)

Source: Retail Economics, Alvarez & Marsal

Our research shows a strong relationship between consumers who prioritise price (‘Cost-conscious’) as a core attribute of value, and those countries facing the toughest economic hardship. Figure 6 depicts this relationship, plotting a measure of economic hardship (calculated by combining inflation and unemployment into a single metric), with the proportion of ‘Cost-conscious’ consumers for each of the countries included in the research.

Spain emerges as the country with both the highest proportion of ‘Costconscious’ consumers, and the economy currently facing the greatest economic hardship. Arguably, it provides a clear indication for other countries as to how consumer values are likely to shift with deteriorating economic conditions. Intuitively, the research confirms that countries that currently have a higher proportion of consumers that value price above other factors (e.g. Spain, U.K.) also have greater expectations that the rising cost of living will impact their values over the next 12 months.

Almost a quarter of consumers (22.5%) would be willing to sacrifice quality in favour of lower prices.

Across all countries, an average of 40% of consumers feel that the cost of living will have the biggest impact on their expectations of retail and consumerfacing brands over the coming 12 months – highest for the U.K. (57%), Germany (43%) and Spain (42%). Furthermore, as consumers focus on price, they are more likely to compromise on other value attributes. Almost a quarter of consumers (22.5%) would be willing to sacrifice quality in favour of lower prices. This is closely followed by convenience (21.8%)

and the shopping experience (20.8%).

As price becomes a more important factor in decision making, consumers are expected to trade down to private label and own-brand products, and even switch supermarkets to discounter operators. For example, in the U.K., the combined market share for the German discounters Lidl and Aldi has risen from 14.1% to 15.4% in the two months to March 2022.

However, considerable differences emerge across countries. On average, consumers in the U.K., Switzerland and UAE are less likely to compromise on product quality for lower prices, and more inclined to sacrifice convenience or the shopping experience.

This differs considerably for consumers in Spain, France and Italy who suggest they are more willing to sacrifice on product quality for lower prices.

German consumers suggest they are willing to sacrifice across a broader set of values in exchange for lower prices, more so than other countries.

Interestingly, shoppers are least willing to compromise on a consumer-facing brand’s ethical credentials such as policies around sustainability, inclusion and diversity, and fair wages (Fig. 8). This finding is consistent across all countries included in the research which deviates little by age – albeit with a slight tendency for younger consumers to be less willing to sacrifice on ethics than middle-aged consumers. It reflects the rising expectation that ethical credentials are a ‘must’ for consumer-facing brands, and not something that consumers should be expected to pay for or compromise over.

Figure 8: What shoppers are prepared to sacrifice for lower prices differs by markets.

Which of the following factors are you most willing to compromise on for lower prices?

Proportion of respondents (%)

Source: Retail Economics, Alvarez & Marsal

Retail and consumer brands will need to ensure they implement local market strategies that reflect a variety of consumer characteristics specific not only to the geography, but to channels and categories which is explored further in the next trend.

Download this free report for all the insights > complete the form at top of page...

Trend 2: Consumer values differ by category and channel

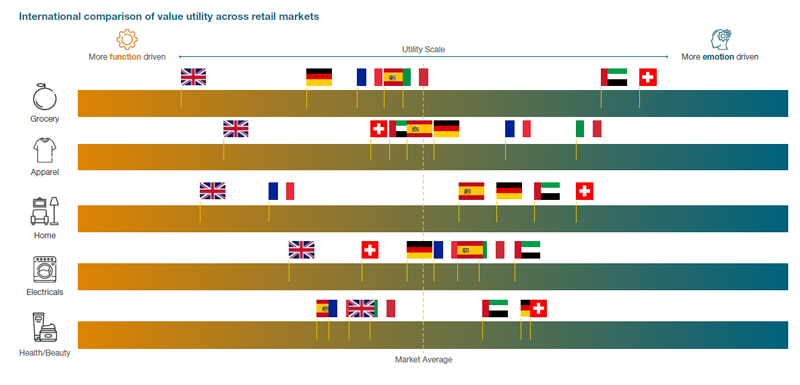

Consumer-facing brands need to deliver against consumer values which continuously change depending on the shopper mission, the product category and market. Our research shows that function-driven attributes of value (price, quality, convenience) are considered most important to consumers across all retail categories in the research.

That said, among all categories, fashion and food is where consumers tend to place more importance on emotion-driven value attributes (experience, sustainability) compared to other categories. This likely suggests that consumer sentiment regarding ethical practices within the apparel industry (e.g. sustainable sourcing) have become more important, or at least more so than other categories.

The research also suggests significant divergence between countries. For instance, consumer value is perceived most variedly across countries for the food category (Fig. 10) as shown by the picture below.

Figure 10: Consumer values differ by category and channel.

Consumer values differ widely across countries depending on retail category. Functional-driven includes price, quality and convenience. Emotion-driven includes sustainability and experiences)

Source: Retail Economics, Alvarez & Marsal

In general, consumers in the U.K. are more function-driven when thinking about value, compared with other countries, this being consistent across most categories. In comparison, consumers in UAE and Switzerland are more emotion-driven.

This is likely due to cultural differences, GDP per capita, market composition and inflation levels. Consumers in France however are more variable when it comes to value. They are more emotion driven in categories such as apparel and electricals, and more function-driven in grocery, home, and health and beauty.

Our research also found that... [download the full report for all the insights]

Trend 3: ESG and the conscious consumer

Societal values attached to the environmental impact of consumption are rapidly gaining traction as consumers, corporates and governments increasingly focus on carbon reduction strategies. Consequently, this accelerating shift makes it vital for retailers, consumer brands and suppliers to commit to environmentally friendly operations and ethical practices.

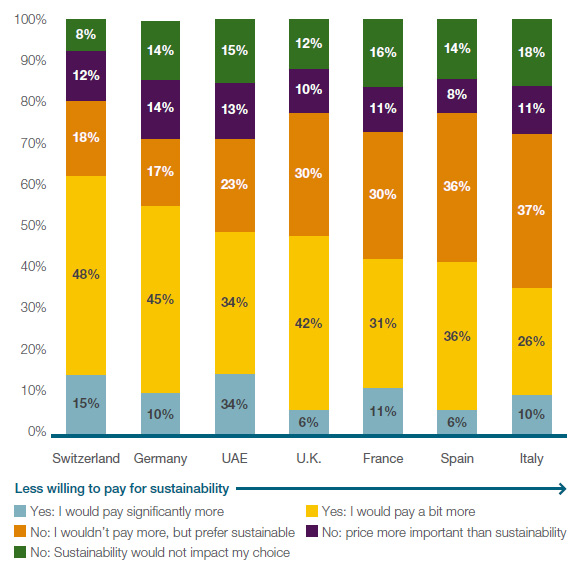

Yet there are differences across countries regarding how much consumers are willing to pay extra for sustainable products. Our research shows that almost half (47.7%) of consumers say they are willing to pay more for sustainable products (10.3% significantly more and 37.4% a little more).

However, consumers in Switzerland (62.7%) were considerably more likely to suggest they were willing to pay more than consumers in Italy (35.5%) (Fig. 14). In addition, more than a quarter of consumers in France, Germany, Italy and UAE suggested that price was more important than sustainability, or that sustainability concerns would not impact their choice.

Figure 14: Store-based visits depend on experience that can’t be replicated online.

Would you be willing to pay more for a sustainable product?

Proportion of respondents (%)

Source: Retail Economics, Alvarez & Marsal

Age was also an important factor. It appears that Gen X consumers, and more price sensitive buyers, are pushing the responsibility onto retailers, governments and suppliers more so than other age groups; whereas Millennials are more willing to pay for sustainable products themselves.

For Gen Zs, budget constraints and the expectation for retailers to simply offer sustainable products, mean that 14.3% of consumers...

Part 3 - The evolution of consumer values and how retailers and consumer

brands must urgently reacts

As consumer values continue to evolve rapidly, retailers and consumer-facing brands will need to adopt a laser-like focus on how to define their proposition while protecting their profitability against a backdrop of rising costs, ongoing supply chain disruption, squeezed household incomes, and fragile consumer demand. Structural shifts towards digital cannot be ignored if brands are to remain relevant.

Our research identifies five critical areas where consumer-facing businesses will need to urgently focus their resources to ensure they are able to navigate the challenges posed by the cost-of-living crisis.

Dicscover the five areas for retailers to focus on > complete the form at top of page...