Section two: the consumer outlook for 2024

The cost-of-living crisis has seen consumers adapt behaviours to counteract increased household costs – this will continue throughout 2024.

Shoppers have demonstrated increased savviness by cutting back, trading down and leveraging multi-channel propositions, all in attempts to manage budgets during an intense period of high inflation.

However, although inflation has passed its peak, the pressure on household finances continues due to rising borrowing costs. This impact will be felt unevenly with many battling higher mortgage repayments and rising rents, while others benefit from higher returns on savings.

Importantly, expectations and confidence play critical roles in determining the strength of consumer spending. Despite the cost of living falling sharply during 2023, our research shows that households expect ongoing erosion of spending power in 2024. Consumers expect inflation to persist above target at around 3.5% in the second half of 2024, and for earnings to moderate to around 3% in the period. This marks a fall from recent peaks of 11.1% for inflation in October 2022 and 7.8% for earnings in Q3 2023.

Competing middle and high income spenders

Expectations naturally differ across households. The more affluent expect higher earnings in 2024, while having expectations of lower inflation. Hence, they’re the least likely to expect a weakening in finances. This is critical because the most affluent 20% are responsible for over a third of consumer spending.

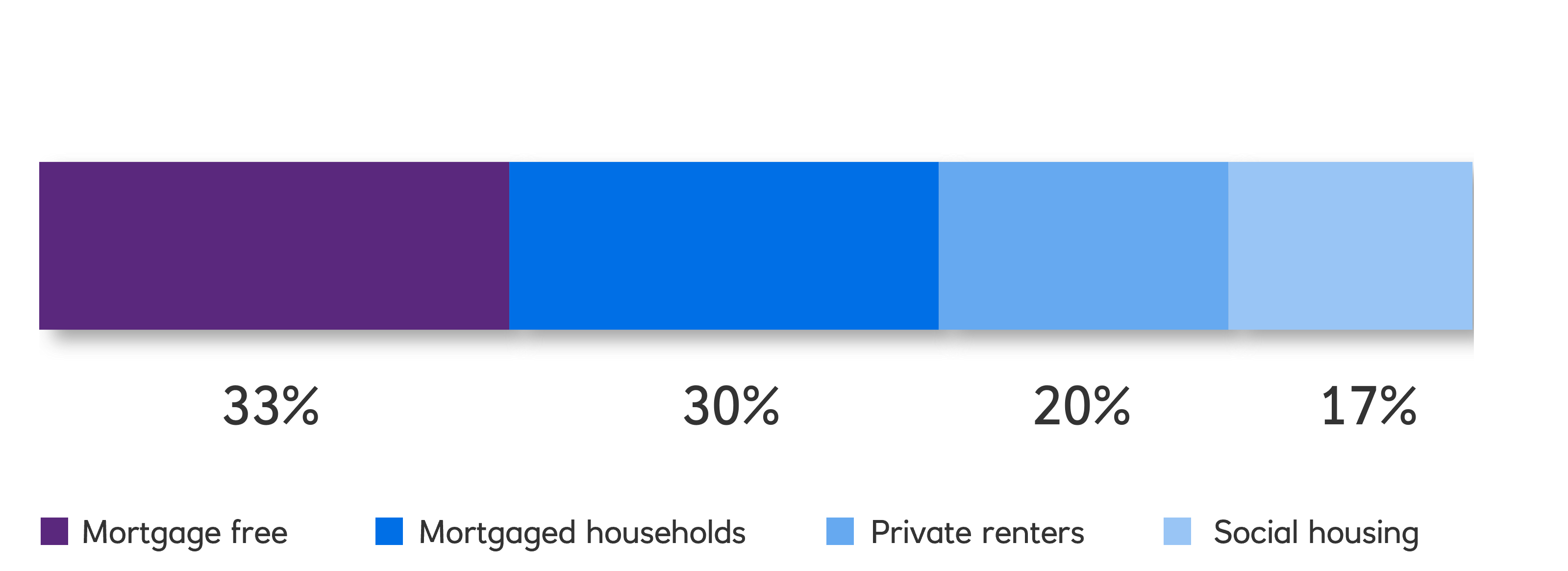

By comparison, mortgaged households and private renters (representing half of households) feel more downbeat about 2024 in general. They expect their personal finances to be weaker by the end of the year. A smaller cohort of households in social housing are extremely pessimistic, reflecting some of the most economically vulnerable individuals. Although consumers are generally less pessimistic than in 2023, it ultimately follows a weakening of finances over the past 12 months.

Fig 7: Household by type of tenure (proportion of consumers)

Source: Bank of England

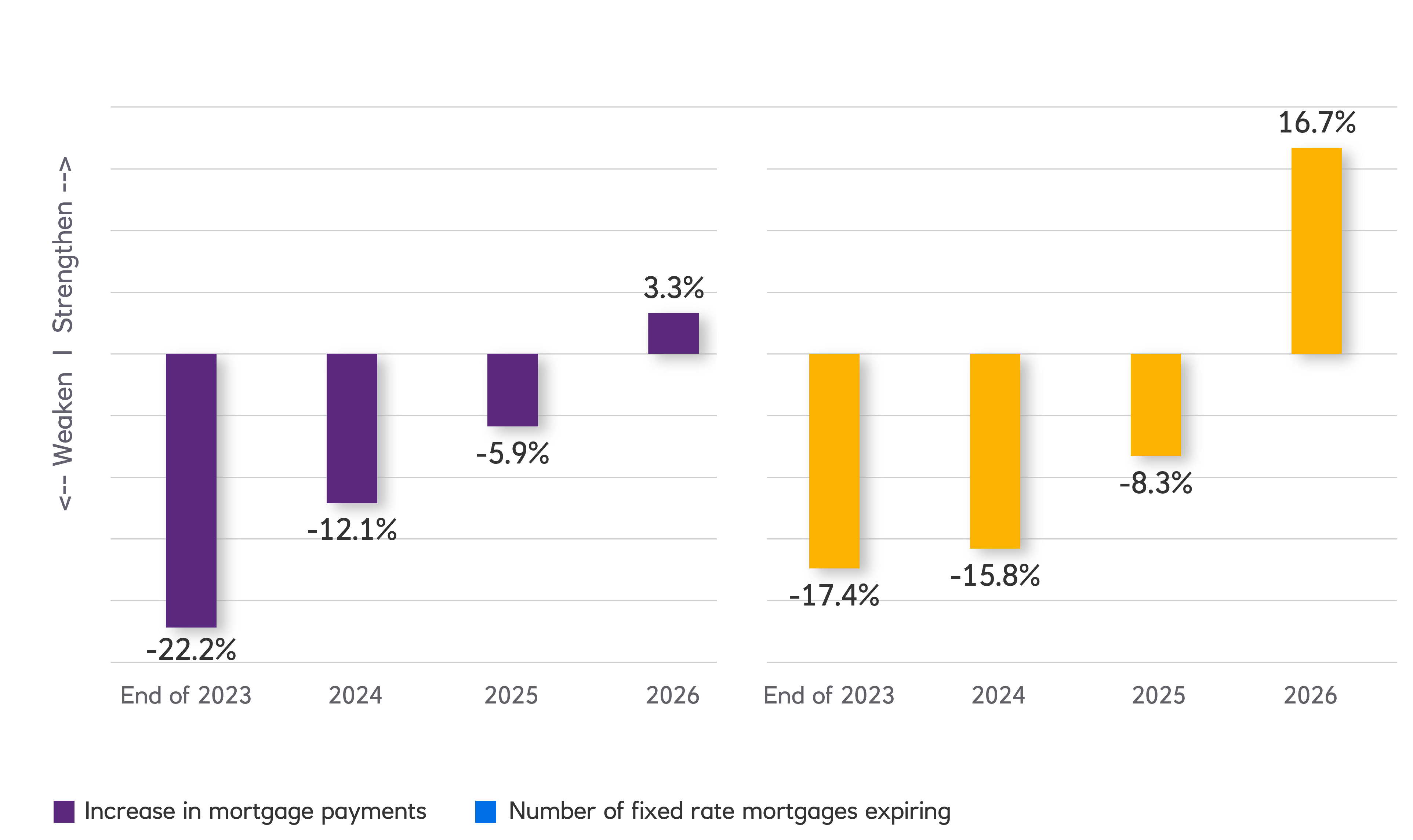

Those facing mortgage or rent renewals over the next year are particularly pessimistic, skewed towards younger, middle-income households. Although earnings are expected to increase among these groups in 2024, higher interest rates are likely to hit household consumption via higher mortgage and rental costs.

Our research also highlights a strong correlation between expectations of weaker finances and the length of time before mortgage and rent renewals. A net balance of around a quarter of consumers that remortgaged or renewed rental contracts at the end of 2023, expect their personal finances to weaken by the end of 2024, compared to the start of the year.

A third of those that faced mortgage renewals at the end of 2023 were typically middle income, while a quarter were lower-middle income who already spend a higher proportion on housing compared to more affluent groups. Meanwhile, half of those that faced rent renewals were middle-low income and around a quarter middle income.

Fig 10: Timing of mortgage and rent renewal shapes personal finance expectations in 2024

Source: Retail Economics

For those with mortgages trying to manage the interest burden, 69.6% have made (or expect to make) adjustments to their mortgage agreement. This could be in terms of length, payment values, or equity – often in opposing directions depending on individual circumstances.

Figure 11 shows recent mortgage agreement adjustments. Overall, households have taken proactive measures to reduce their mortgage burden. Three in every five changes to mortgages can be considered proactive, rather than acts of distress. Unsurprisingly, lower income households have been squeezed more than higher income homeowners.

The most affluent households are three times more likely to pay off a lump sum of their mortgage than middle income households. Instead, middle income mortgagors are twice as likely to have withdrawn equity compared to the most affluent, and are twice as likely to have increased their mortgage term.

Polarised spending

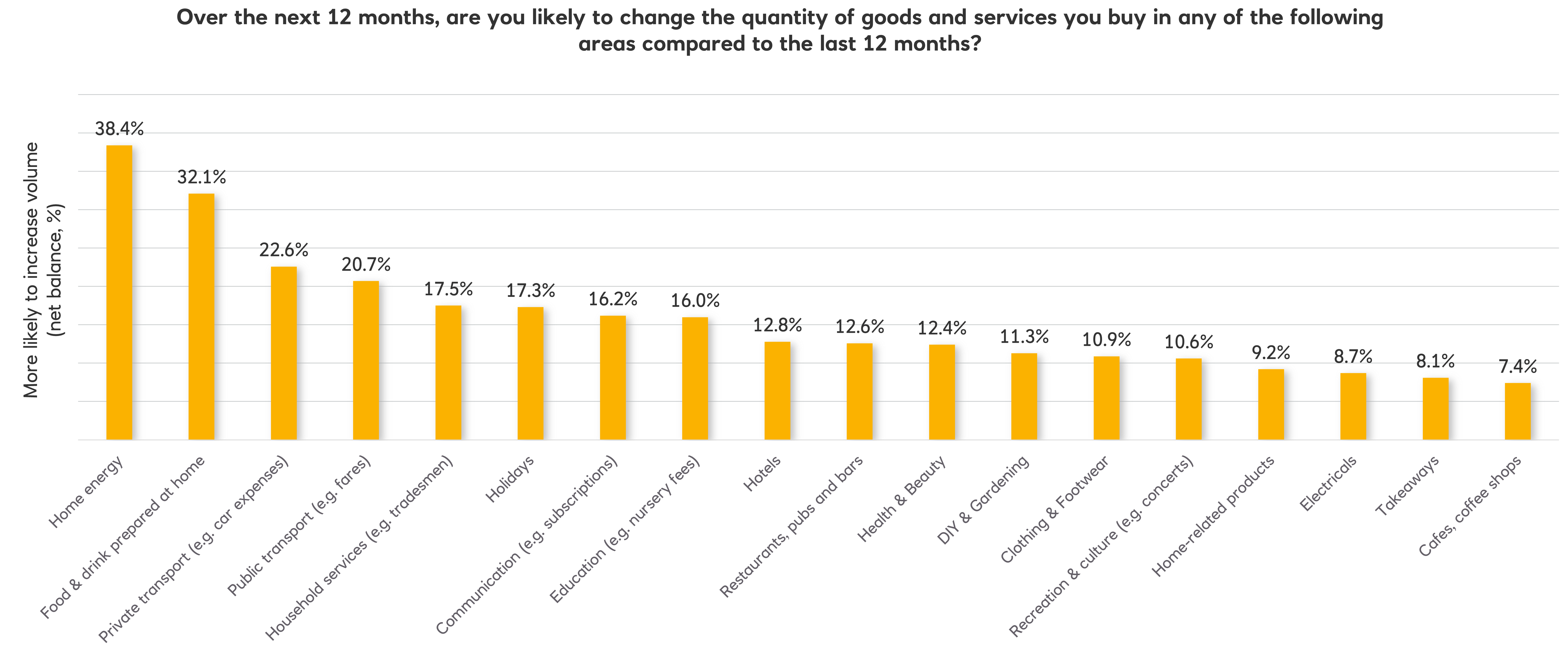

From the many challenges households face due to the cost-of-living crisis, there's a prevailing consumer sentiment that the toughest phase has passed. Granted, while differing fortunes are set to polarise spending across categories, our research shows a likely improvement in sales volumes across goods and services compared to recent lows. However, this is being driven by the most affluent, with low-middle- and middle-income households under greater pressure.

Relative to last year's subdued activity, households are poised to boost spending on essentials like energy, home-cooked food, and transport, as well as on holidays and tradesmen services which suffered pandemic-induced lockdowns and shortages. Conversely, sectors that thrived during the pandemic such as takeaways, electronics, and furniture, are shifting down the priority list.

“Relative to last year's subdued activity, households are poised to boost spending on essentials like energy, home-cooked food, and transport, as well as on holidays and tradesmen services.”

Fig 12: Households are priortising spending on essentials in 2024

Source: Retail Economics

There is also reduced intention to drive year-on-year spending volumes across non-essentials, with stark differences across affluence groups. Middle and low-middle income households who are most likely to be grappling greater housing expenses in 2024 are consequently the least likely to drive volume spending across non-food retail, leisure and hospitality.

Complete the form at the top of this page now to access the rest of Section 2

Section 3: Megatrends for 2024

The past four years have been defined by unprecedented challenges. Throughout 2024, retail, leisure and hospitality businesses must continue to recalibrate operations despite the weak economic backdrop, investing where necessary to remain relevant.

Our report identifies five key megatrends. These trends will demand attention from businesses striving to develop greater resilience in a more complex trading environment; they are:

-

Sustainability

-

AI and tech revolution

-

Omnichannel reality

-

Disruptive business models

-

Permacrisis

“Throughout 2024, retail, leisure and hospitality businesses must continue to recalibrate operations despite the weak economic backdrop.”

Megatrend 1: sustainability and ethical consumption

Key takeaways:

|

Consumers

|

Businesses

|

|

Personal responsibility: Younger consumers exhibit stronger personal responsibility to sustainable practices compared to their seniors.

|

Unification needed: Cross-sector investment is needed to tackle sustainability, but remains challenged by an uneven political backdrop.

|

|

Cost barrier: Across sectors, more than two-fifths of consumers say cost is the main barrier to sustainable alternatives.

|

Investor pressure: Green funds will necessitate sustainable practices if consumer businesses want access to preferential lending.

|

|

Essentials under pressure: Consumers express greater concern over sustainability across essentials (e.g. energy and waste) than retail products.

|

Market range of benefits: To drive spending towards sustainable alternatives, lower-order factors such as price, availability and convenience must be satisfied.

|

|

Willingness to pay: Generally, intentions to pay a premium for sustainable practices are low.

|

|

UK businesses are rapidly approaching a critical juncture where adapting to sustainability will no longer be an option, but a necessity. This requires a deep understanding of consumer values and expectations across different age groups and sectors to implement effective strategies at cost.

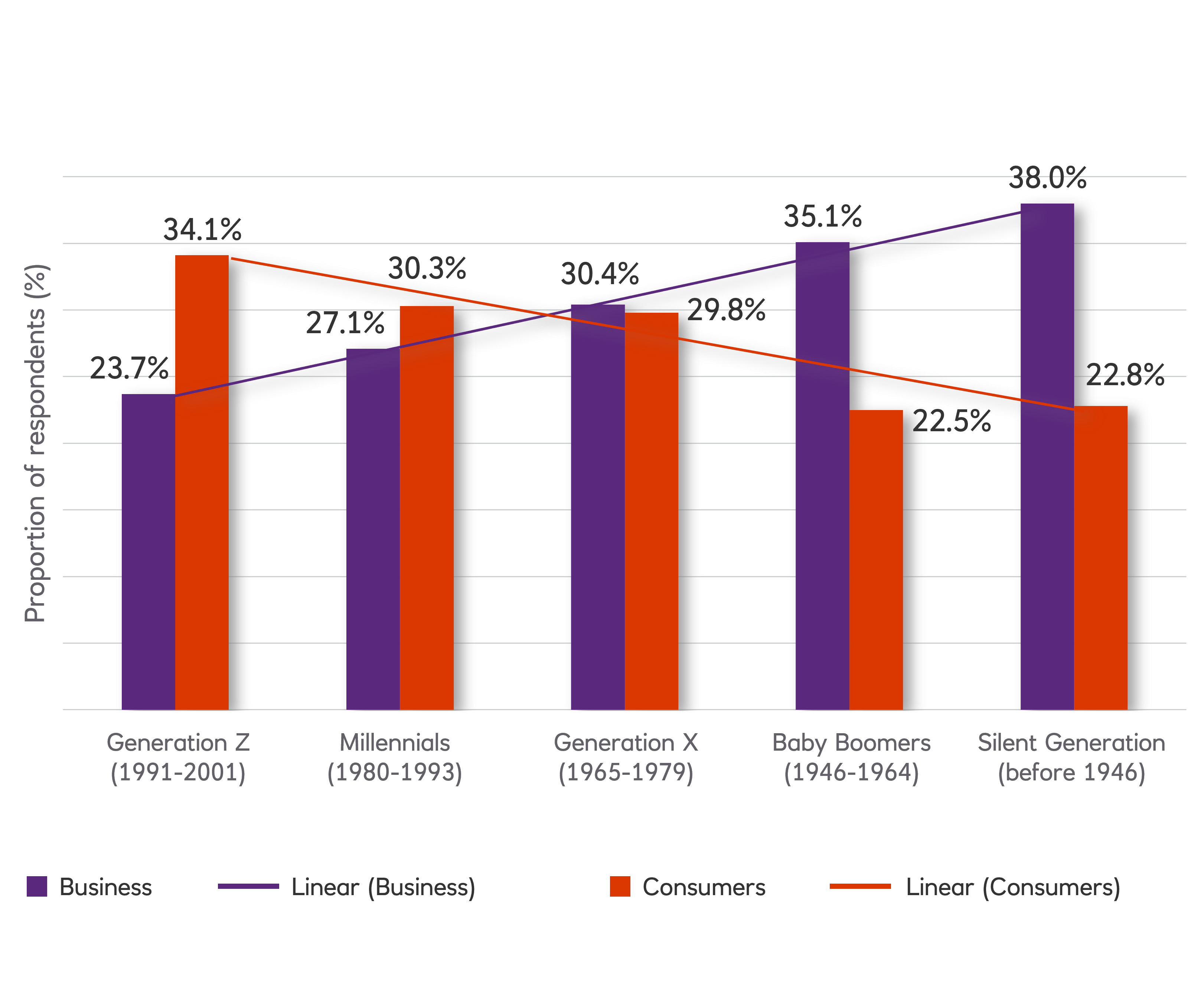

Notably, two-fifths of consumers hold the government most responsible for reducing emissions related to consumption. This is broadly consistent across age groups. However, there are clear generational divides concerning opinions on whether businesses or consumers are more responsible, with younger consumers suggesting greater personal commitment to sustainable practices, compared to their older counterparts. This is likely the result of greater awareness of environmental damage associated with business and global corporations.

Many younger consumers view implementing governmental and business net zero practices as key opportunities for individual action. Younger consumers also show greater intention to actively seek out brands that align with their values, including eco-friendly products and services. Nevertheless, there are still problematic issues around education and making informed decisions, versus cost and convenience.

Many businesses still remain far behind industry-leaders on their emission reduction targets. As a result, significant investment is required to seriously tackle sustainability. Key challenges lie with cost, incentives, and capacity to invest in low carbon alternatives or abatement measures. This is further exacerbated by an uneven political landscape with differing regulations across countries. Nonetheless, for UK businesses, the emergence of green funds will continue to rise in importance when accessing preferential terms with lenders.

Fig 17: Younger consumers have stronger personal responsibility to sustainable practices

Q: Which of the following groups do you believe has the greatest impact in reducing carbon emissions from the consumption of products and services? Ranked First

Source: Retail Economics

Complete the form at the top of this page now to access the rest of the report

About this report

This "Retail & Leisure Outlook Report 2024" is published by Retail Economics in partnership with NatWest.

The insight contained is critical for industry professionals operating in the retail and retail related industries for improving strategic planning, forecasts and to navigate the ongoing disruption and wider structural changes with the retail sector. Complete the form at the top of this page now to secure your free copy.

View All THOUGHT LEADERSHIP REPORTS